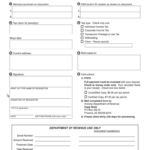

Www.azdor.gov Forms Withholding.aspx Et-13 – There are numerous reasons an individual could submit an application for withholding. Withholding exemptions, documentation requirements as well as the quantity of allowances for withholding demanded are all elements. No matter why the person decides to fill out the form there are some aspects to consider.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. If you satisfy the requirements, you may be eligible for an exemption to withholding. The following page lists all exclusions.

To submit Form 1040-NR, the first step is to attach Form 1042S. The form is used to record the federal income tax. It outlines the withholding by the withholding agent. Make sure that you fill in the right information when you complete the form. It is possible that you will have to treat a single person if you don’t provide this information.

The 30% non-resident alien tax withholding tax rate is 30 percent. If your tax burden is lower than 30 percent of your withholding you may qualify to receive an exemption from withholding. There are a variety of exemptions. Certain are only for spouses or dependents, for example, children.

Generallyspeaking, withholding in Chapter 4 allows you to claim a return. Refunds are granted according to Sections 1471-1474. The refunds are given by the agent who withholds tax (the person who withholds tax at the source).

relationship status

An official marriage status withholding form can help your spouse and you both make the most of your time. Furthermore, the amount of money that you can deposit at the bank can surprise you. The challenge is choosing the right option from the multitude of choices. There are certain that you shouldn’t do. Making the wrong choice could result in a significant cost. If the rules are followed and you pay attention, you should not have any problems. If you’re lucky enough to meet some new friends while driving. Today marks the anniversary. I’m hoping you’ll be able to utilize it against them to locate that perfect ring. To complete the task correctly, you will need to seek the assistance of a certified tax expert. This tiny amount is worth the lifetime of wealth. Fortunately, you can find many sources of information online. TaxSlayer and other trusted tax preparation companies are some of the most reliable.

The number of withholding allowances claimed

When filling out the form W-4 you file, you should declare the amount of withholding allowances you seeking. This is essential as the tax withheld will impact the amount of tax taken from your paychecks.

You could be eligible to claim an exemption for your head of household when you’re married. Your income level will also influence how many allowances your are entitled to. You could be eligible to claim more allowances if make a lot of money.

Tax deductions that are appropriate for you could aid you in avoiding large tax payments. If you file your annual income tax return, you might even get a refund. However, you must be aware of your choices.

Like every financial decision, you must conduct your own research. To figure out the amount of tax withholding allowances that need to be claimed, you can use calculators. An alternative is to speak with a specialist.

Submission of specifications

Employers are required to take withholding tax from their employees and then report the amount. Some of these taxes can be submitted to the IRS through the submission of paperwork. It is possible that you will require additional documents, such as the reconciliation of your withholding tax or a quarterly return. Here is some information on the different tax forms for withholding categories and the deadlines for the submission of these forms.

In order to be eligible for reimbursement of tax withholding on salary, bonus, commissions or other revenue earned by your employees, you may need to file a tax return for withholding. Additionally, if your employees are paid on time, you may be eligible for tax refunds for withheld taxes. Remember that these taxes may be considered as county taxes. There are also specific withholding techniques which can be utilized in specific situations.

You have to submit electronically withholding forms in accordance with IRS regulations. You must include your Federal Employer ID Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.