Wv Individual Withholding Form – There are many reasons why an individual might want to complete a withholding form. Withholding exemptions, documentation requirements and the amount of withholding allowances demanded are all elements. Whatever the reason the person decides to fill out a form, there are a few points to be aware of.

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR once per year. If you satisfy these requirements, you could be eligible for exemptions from the withholding form. The following page lists all exclusions.

The first step for submitting Form 1040 – NR is to attach the Form 1042 S. The form contains information on the withholding done by the withholding agency for federal tax reporting to be used for reporting purposes. Make sure you fill out the form correctly. It is possible for one individual to be treated in a manner that is not correct if the information is not given.

The rate of withholding for non-resident aliens is 30%. It is possible to receive an exemption from withholding tax if your tax burden is higher than 30 percent. There are many exemptions. Certain of them apply to spouses, dependents, or children.

In general, chapter 4 withholding allows you to receive an amount of money. As per Sections 1471 to 1474, refunds are given. The person who is the withholding agent, or the person who withholds the tax at source, is responsible for making these refunds.

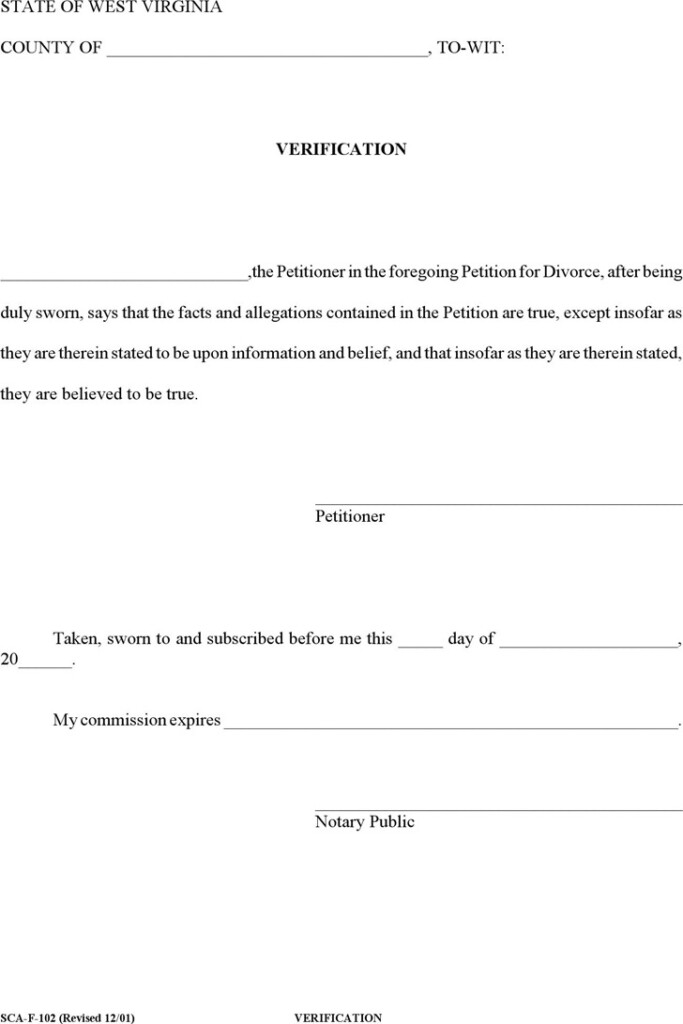

Relational status

The marital withholding form is an excellent way to make your life easier and assist your spouse. The bank may be surprised by the amount you’ve deposited. It is difficult to decide which of the many options you’ll choose. Certain aspects should be avoided. False decisions can lead to expensive consequences. If you adhere to the guidelines and adhere to them, there won’t be any issues. If you’re lucky you’ll make new friends while traveling. Today is the anniversary. I’m sure you’ll take advantage of it to search for that one-of-a-kind wedding ring. It will be a complicated job that requires the knowledge of a tax professional. A lifetime of wealth is worth the small amount. You can get a lot of details online. TaxSlayer is a well-known tax preparation firm, is one of the most useful.

The amount of withholding allowances claimed

You need to indicate how many withholding allowances to be able to claim on the form W-4 you submit. This is important as your paychecks may depend on the tax amount you have to pay.

There are many factors that affect the amount of allowances you are able to claim. If you’re married you might be qualified for an exemption for head of household. Your income will determine how many allowances you can receive. If you have a higher income you may be eligible to receive a higher allowance.

Choosing the proper amount of tax deductions can help you avoid a hefty tax payment. If you file your annual income tax return, you might even receive a refund. However, you must choose the right method.

It is essential to do your homework as you would with any other financial option. Calculators are useful to determine the amount of withholding allowances that are required to be claimed. Other options include talking to a specialist.

Submitting specifications

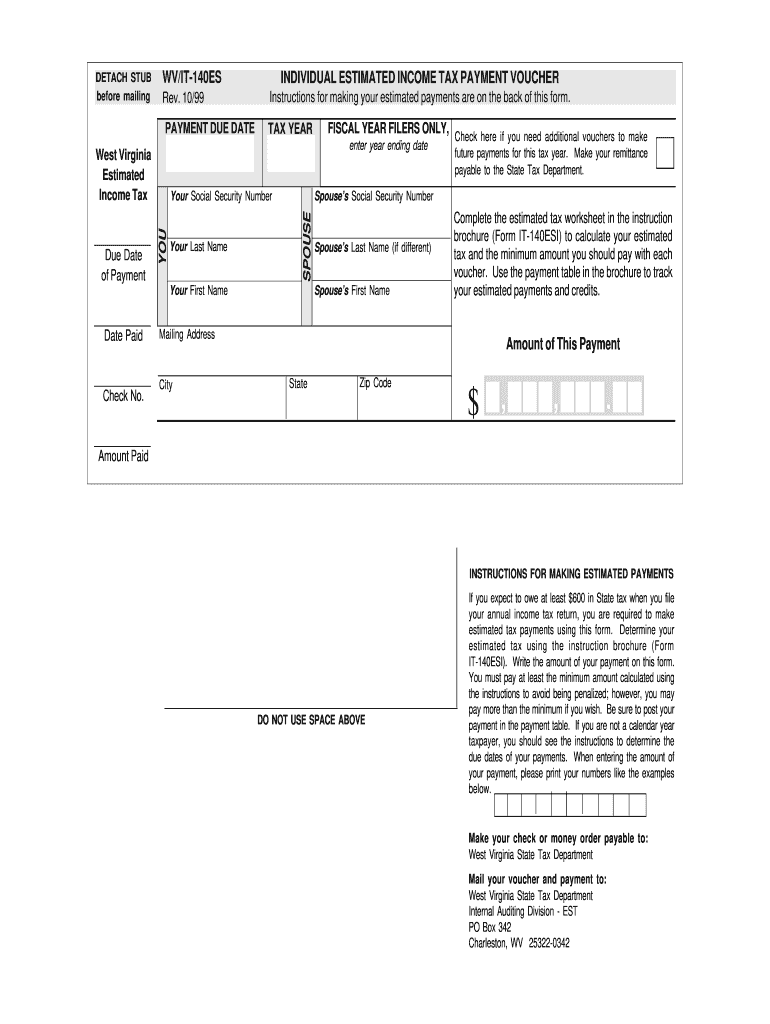

Employers must report the employer who withholds taxes from their employees. The IRS will accept documents for certain taxes. Additional documents that you could need to submit include a withholding tax reconciliation, quarterly tax returns, as well as an annual tax return. Below are information on the different tax forms that you can use for withholding as well as the deadlines for each.

The compensation, bonuses commissions, bonuses, and other income that you receive from employees might require you to file tax returns withholding. In addition, if you pay your employees on-time it could be possible to qualify to be reimbursed for any taxes not withheld. It is important to note that certain taxes are also county taxes ought to also be noted. You may also find unique withholding procedures that can be applied in particular circumstances.

As per IRS regulations the IRS regulations, electronic filings of tax withholding forms are required. When you file your tax returns for national revenue make sure you provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.