Work Withholding Form – There are numerous reasons that a person may decide to submit a withholding application. These factors include the document requirements, exclusions from withholding and withholding allowances. It doesn’t matter what motive someone has to fill out an Application There are a few aspects to keep in mind.

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once every year. If you meet these requirements, you may be eligible for exemptions from the withholding form. This page lists all exclusions.

For submitting Form 1040-NR include Form 1042-S. For federal income tax reporting reasons, this form details the withholding made by the withholding agency. Fill out the form correctly. The information you provide may not be given and result in one individual being treated differently.

Non-resident aliens are subject to 30 percent withholding. Nonresident aliens could be eligible for an exemption. This applies the case if your tax burden less than 30 percent. There are a variety of exemptions. Some of them apply to spouses or dependents like children.

Generallyspeaking, withholding in Chapter 4 gives you the right to a return. Refunds are available under Sections 1401, 1474, and 1475. Refunds are given to the agent who withholds tax the person who withholds the tax at the source.

Status of relationships

A valid marital status and withholding forms can simplify the work of you and your spouse. You’ll be amazed at how much money you could make a deposit to the bank. Knowing which of the several possibilities you’re most likely to pick is the tough part. Certain issues should be avoided. Making a mistake can have costly results. It’s not a problem when you follow the directions and pay attention. If you’re lucky you may even meet some new friends on your travels. Today marks the anniversary. I’m sure you’ll be in a position to leverage this against them in order to acquire the elusive wedding ring. If you want to get it right you’ll need the help of a certified accountant. This small payment is well enough to last the life of your wealth. There are a myriad of online resources that provide details. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

The number of withholding allowances claimed

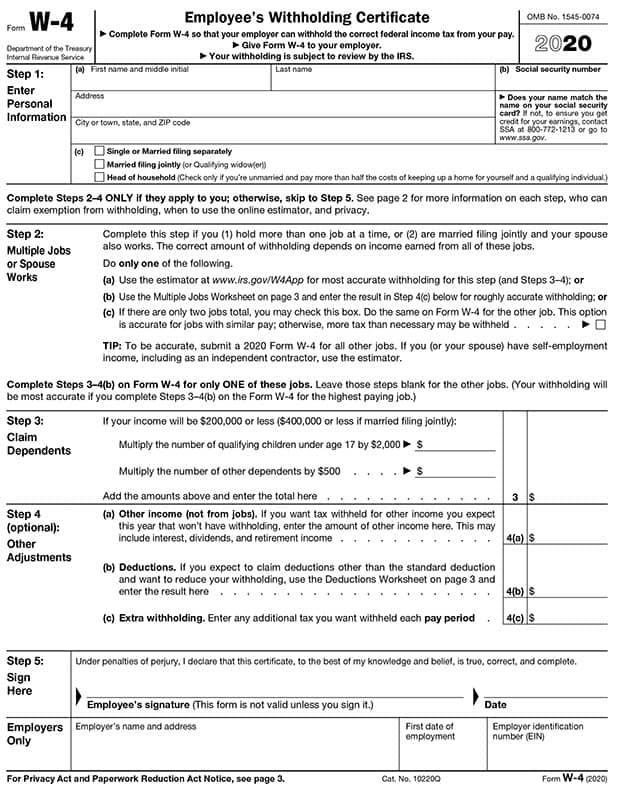

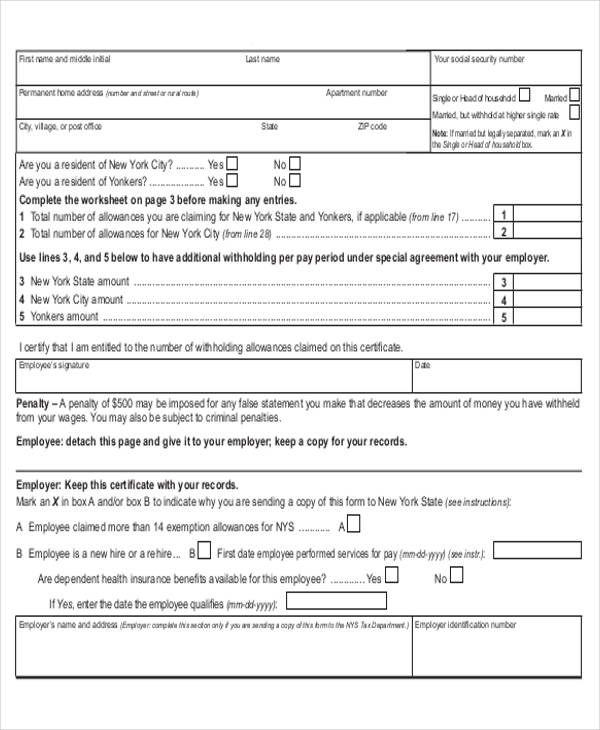

In submitting Form W-4 you should specify the number of withholdings allowances you would like to claim. This is critical as your paychecks may be affected by the amount of tax that you pay.

The amount of allowances that you receive will depend on the various aspects. For instance when you’re married, you could be entitled to a head or household exemption. You may also be eligible for higher allowances based on the amount you earn. If you earn a higher income, you can request an increased allowance.

A proper amount of tax deductions could aid you in avoiding a substantial tax charge. If you complete your yearly income tax return, you could even get a refund. Be sure to select the right method.

You must do your homework as you would for any financial choice. Calculators are a great tool to determine the amount of withholding allowances you should claim. Alternative options include speaking with an expert.

Formulating specifications

If you are an employer, you must pay and report withholding tax on your employees. If you are taxed on a specific amount, you may submit paperwork to IRS. Other documents you might require to submit includes an withholding tax reconciliation, quarterly tax returns, as well as the annual tax return. Here are some information regarding the various forms of tax withholding forms and the filing deadlines.

The bonuses, salary, commissions, and other earnings you earn from your employees could require you to file withholding tax returns. If you also pay your employees on-time, you might be eligible for reimbursement for any taxes that were not withheld. It is crucial to remember that not all of these taxes are local taxes. There are specific tax withholding strategies that could be suitable in certain circumstances.

In accordance with IRS rules, you must electronically submit withholding forms. You must provide your Federal Employer Identification Number when you point to your tax return for national income. If you don’t, you risk facing consequences.