Withholding Tax Voucher Form Wh-1 Indiana 2024 – There are many reasons that someone could complete an application for withholding. Withholding exemptions, documentation requirements as well as the quantity of withholding allowances requested are all factors. It doesn’t matter what reason someone chooses to file an Application there are some things to remember.

Withholding exemptions

Non-resident aliens must submit Form 1040 NR once per year. If you meet these conditions, you could be eligible to receive an exemption from the form for withholding. This page you will discover the exemptions that you can avail.

To submit Form 1040-NR, add Form 1042-S. For federal income tax reporting purposes, this form details the withholdings made by the withholding agency. It is important to enter correct information when you complete the form. It is possible for a person to be treated if the information is not given.

Nonresident aliens pay the option of paying a 30% tax on withholding. A tax exemption may be granted if you have a the tax burden less than 30%. There are many exemptions. Some of them are intended for spouses, while others are meant for use by dependents such as children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds are granted according to Sections 1400 through 1474. The withholding agent or the person who withholds the tax at source is responsible for the refunds.

Status of relationships

An official marriage status withholding form will help both of you get the most out of your time. You’ll be amazed at the amount you can deposit at the bank. It is difficult to decide which one of the options you’ll choose. Certain issues should be avoided. Making the wrong choice could result in a significant cost. If the rules are followed and you pay attention, you should not have any problems. If you’re lucky enough, you could even meet new friends while traveling. Today is the anniversary. I hope you are able to use this to get that wedding ring you’ve been looking for. To complete the task correctly it is necessary to get the help from a qualified tax professional. This small payment is well enough to last the life of your wealth. You can get plenty of information on the internet. TaxSlayer is a well-known tax preparation company is among the most effective.

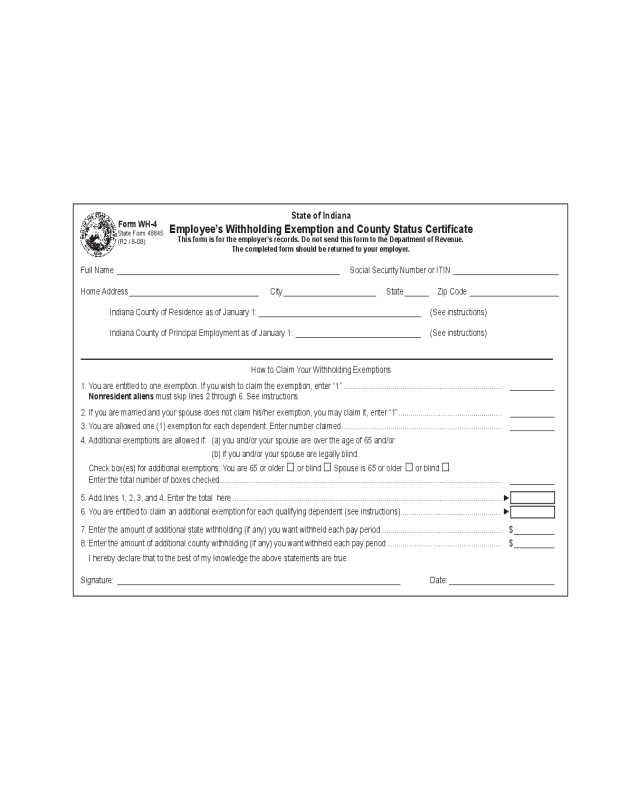

The amount of withholding allowances claimed

The W-4 form must be filled out with the number of withholding allowances that you wish to be able to claim. This is vital since it will affect how much tax you will receive from your pay checks.

A number of factors can influence the amount you qualify for allowances. The amount you earn can impact how many allowances are available to you. If you have high income, you might be eligible to receive a higher allowance.

A proper amount of tax deductions can save you from a large tax bill. A refund could be possible if you file your income tax return for the previous year. Be sure to select your method carefully.

As with any financial decision it is crucial to do your homework. Calculators can assist you in determining how much withholding allowances you can claim. If you prefer contact an expert.

Formulating specifications

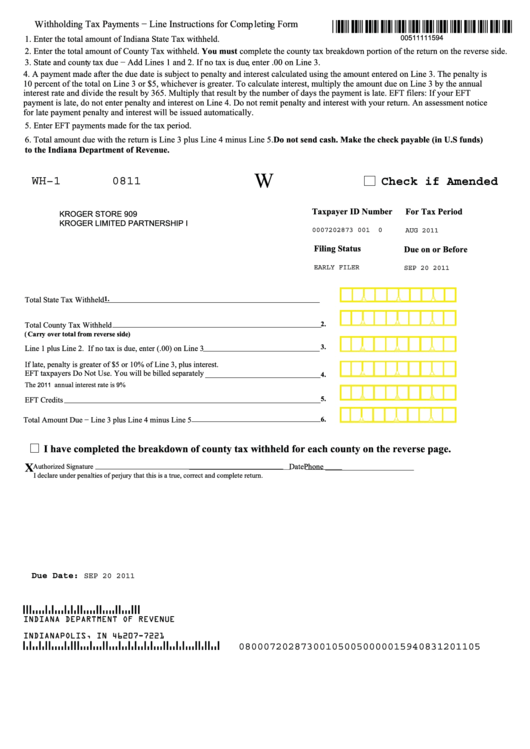

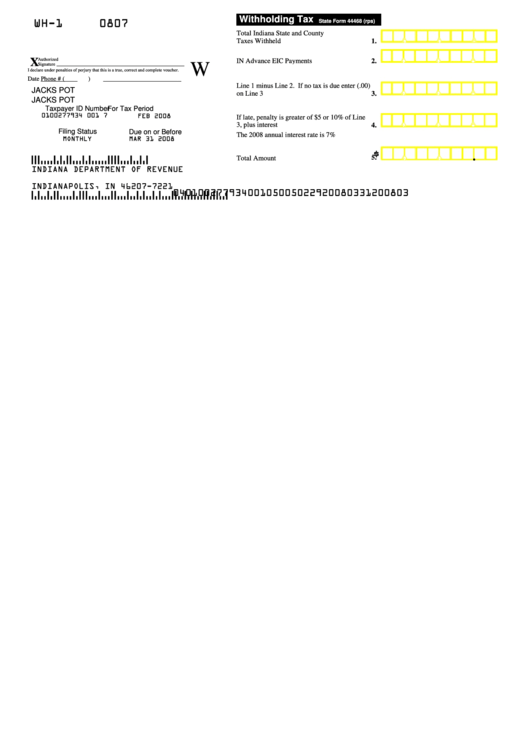

Employers are required to collect withholding taxes from their employees and then report the amount. The IRS may accept forms for some of these taxes. Additional paperwork that you may be required to file include a withholding tax reconciliation as well as quarterly tax returns as well as an annual tax return. Here are some information about the various types of withholding tax forms and the deadlines for filing.

The compensation, bonuses, commissions, and other income you get from your employees may require you to submit withholding tax returns. Additionally, if your employees are paid punctually, you might be eligible for the tax deductions you withheld. It is crucial to remember that not all of these taxes are local taxes. Additionally, you can find specific withholding rules that can be utilized in certain situations.

Electronic submission of forms for withholding is mandatory according to IRS regulations. When you file your tax returns for the national income tax, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.