Withholding Tax Penalty Form – There are a variety of reasons someone might choose to fill out a withholding form. This includes documentation requirements, withholding exemptions, and the amount of withholding allowances. However, if a person chooses to file the form it is important to remember a few things to keep in mind.

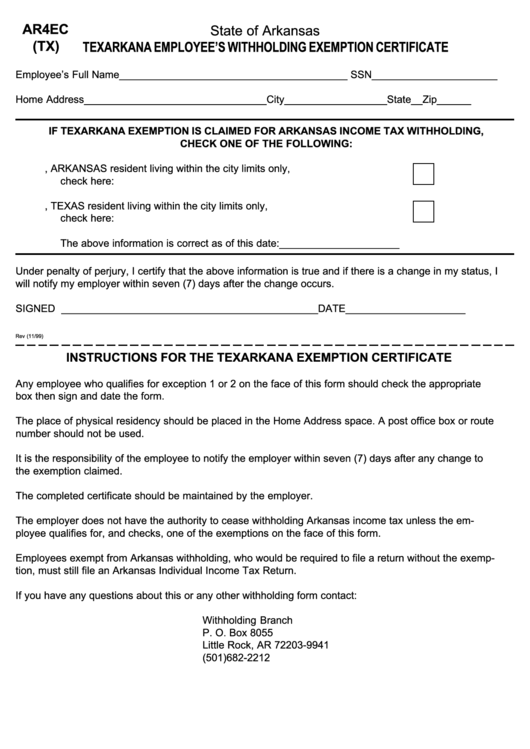

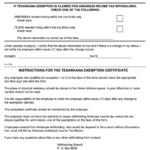

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. It is possible to file an exemption form from withholding in the event that you meet all conditions. This page lists the exclusions.

To submit Form 1040-NR, the first step is attaching Form 1042S. To report federal income tax purposes, this form provides the withholding process of the tax agency that handles withholding. Complete the form in a timely manner. A person could be treated differently if this information is not supplied.

Non-resident aliens have to pay 30 percent withholding. A nonresident alien may be qualified for an exemption. This applies when your tax burden is lower than 30 percent. There are several different exclusions available. Some are specifically for spouses, or dependents, for example, children.

In general, refunds are offered for the chapter 4 withholding. In accordance with Section 1471 through 1474, refunds are granted. The person who is the withholding agent, or the person who is responsible for withholding the tax at source, is the one responsible for distributing these refunds.

Relational status

A marriage certificate and withholding form can help your spouse and you both get the most out of your time. Furthermore, the amount of money that you can deposit at the bank can be awestruck. It isn’t easy to determine which one of many choices is the most appealing. There are certain that you shouldn’t do. There will be a significant cost if you make a wrong choice. But, if the directions are adhered to and you are attentive, you should not have any issues. If you’re fortunate you could even meet some new friends while traveling. Today is your anniversary. I hope you will use it against them to locate that perfect wedding ring. It will be a complicated job that requires the experience of an accountant. The tiny amount is worthwhile for the lifetime of wealth. You can find tons of details online. TaxSlayer is among the most trusted and respected tax preparation firms.

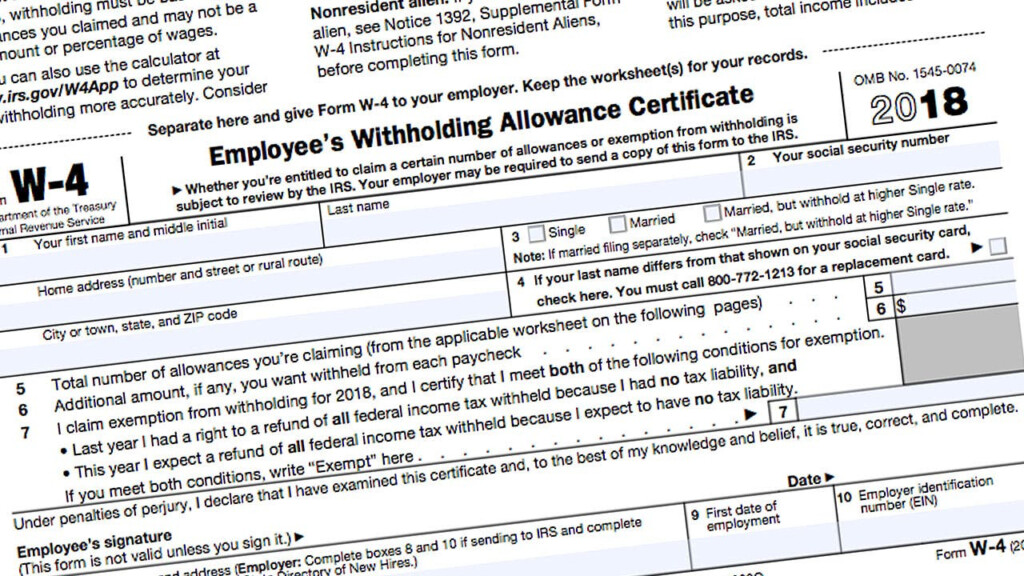

the number of claims for withholding allowances

It is important to specify the amount of withholding allowances which you would like to claim on the Form W-4. This is crucial because the tax amount you are able to deduct from your paycheck will be affected by the you withhold.

Many factors determine the amount that you can claim for allowances. The amount you are eligible for will be contingent on the income you earn. If you have a higher income, you might be eligible to receive more allowances.

The right amount of tax deductions could aid you in avoiding a substantial tax charge. Additionally, you may even get a refund if your tax return for income is completed. However, you must choose the right method.

As with any financial decision, you must do your research. Calculators are a great tool to determine how many withholding allowances are required to be claimed. Alternative options include speaking with an expert.

Formulating specifications

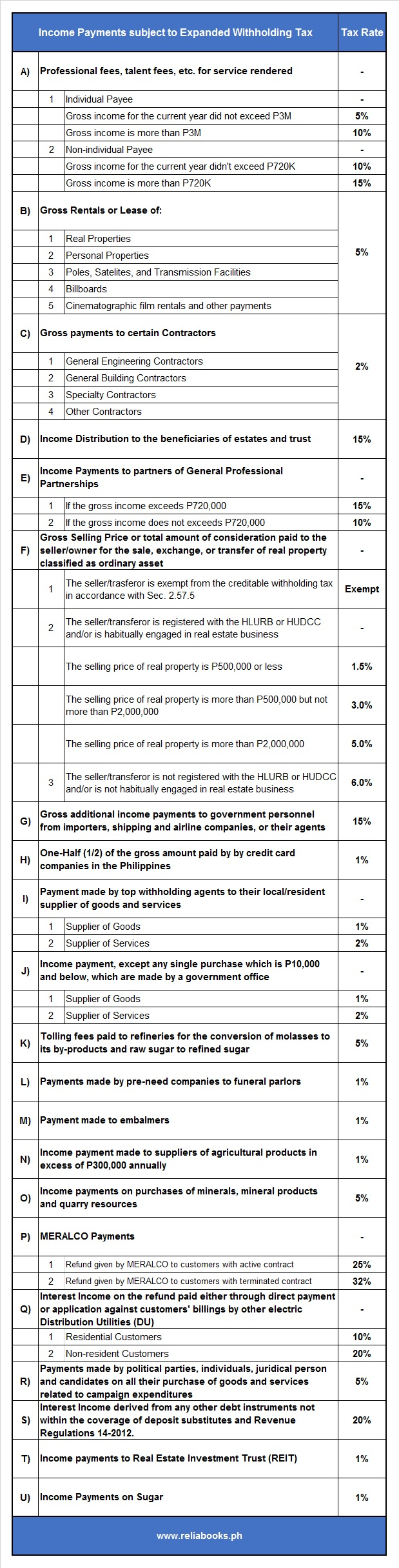

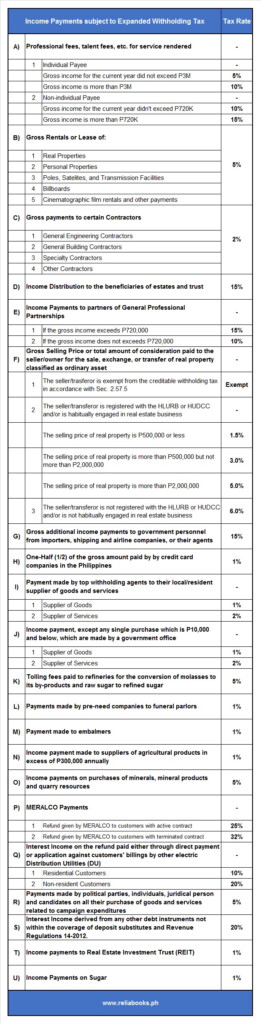

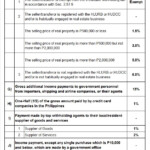

Employers must collect withholding taxes from their employees and then report the tax. It is possible to submit documents to the IRS to collect a portion of these taxation. Other documents you might be required to file include a withholding tax reconciliation as well as quarterly tax returns as well as the annual tax return. Below are information on the different withholding tax forms and the deadlines for each.

The compensation, bonuses commissions, bonuses, and other earnings you earn from employees might necessitate you to file withholding tax returns. If you also pay your employees on time you may be eligible to receive reimbursement for taxes taken out of your paycheck. Noting that certain of these taxes could be considered to be taxes imposed by the county, is crucial. Additionally, you can find specific withholding procedures that can be used in specific situations.

In accordance with IRS regulations, you have to electronically submit forms for withholding. The Federal Employer Identification number must be noted when you file at your national tax return. If you don’t, you risk facing consequences.