Withholding Forms For New Employees – There are numerous reasons that a person may decide to submit an application for withholding. This is due to the requirement for documentation, exemptions from withholding and also the amount of required withholding allowances. There are some important things to keep in mind regardless of why a person files a form.

Exemptions from withholding

Non-resident aliens are required to file Form 1040–NR once a calendar year. It is possible to file an exemption form for withholding tax when you meet the criteria. The exemptions you will find on this page are yours.

To submit Form 1040-NR, include Form 1042-S. For federal income tax reporting reasons, this form details the withholding process of the agency responsible for withholding. Complete the form in a timely manner. A person could be treated if the information is not provided.

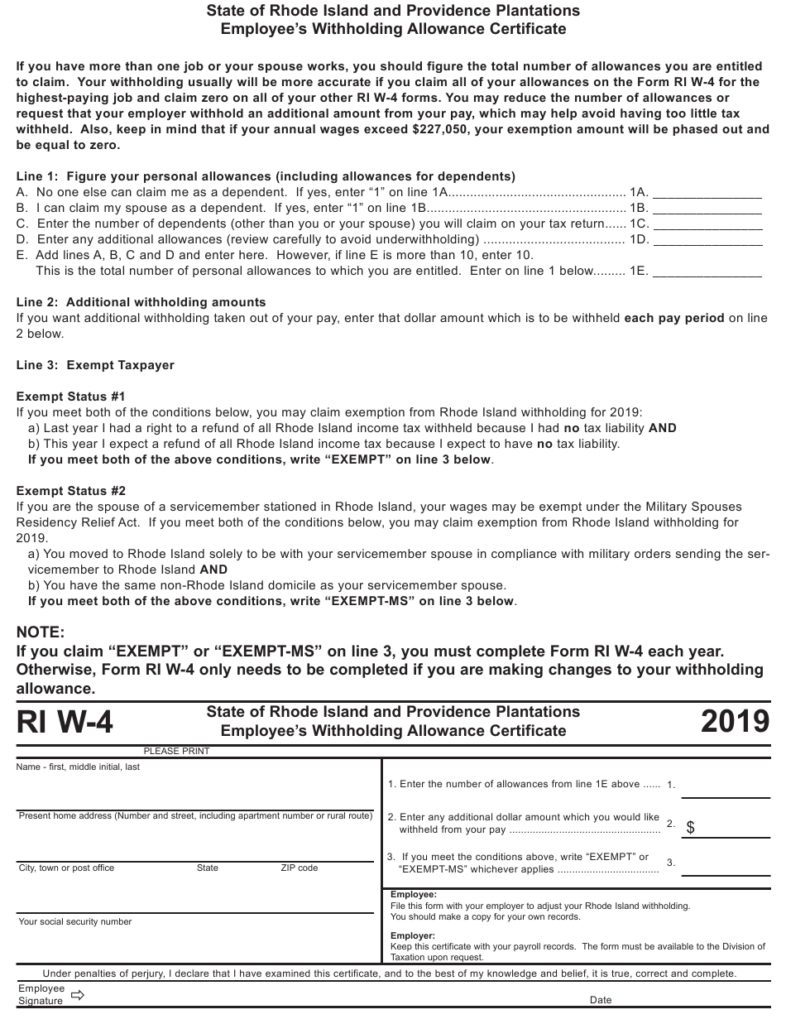

Non-resident aliens are subject to a 30% withholding tax. You may be eligible to receive an exemption from withholding if the tax burden is higher than 30 percent. There are many exemptions. Certain exclusions are only applicable to spouses and dependents such as children.

In general, the chapter 4 withholding gives you the right to a refund. Refunds may be granted according to Sections 1400 through 1474. Refunds are given to the withholding agent the person who withholds the tax from the source.

Relationship status

Your and your spouse’s job will be made easy by the proper marital status withholding form. You’ll be amazed at the amount that you can deposit at the bank. It isn’t always easy to determine which one of many choices is most appealing. There are certain things that you shouldn’t do. It’s expensive to make the wrong decision. If you follow the instructions and adhere to them, there won’t be any problems. If you’re lucky enough, you could be able to make new friends as traveling. Today is the anniversary. I hope you will take advantage of it to locate that perfect engagement ring. If you want to get it right you’ll need the aid of a qualified accountant. A lifetime of wealth is worth the small amount. There is a wealth of details online. Reputable tax preparation firms like TaxSlayer are one of the most useful.

The number of withholding allowances made

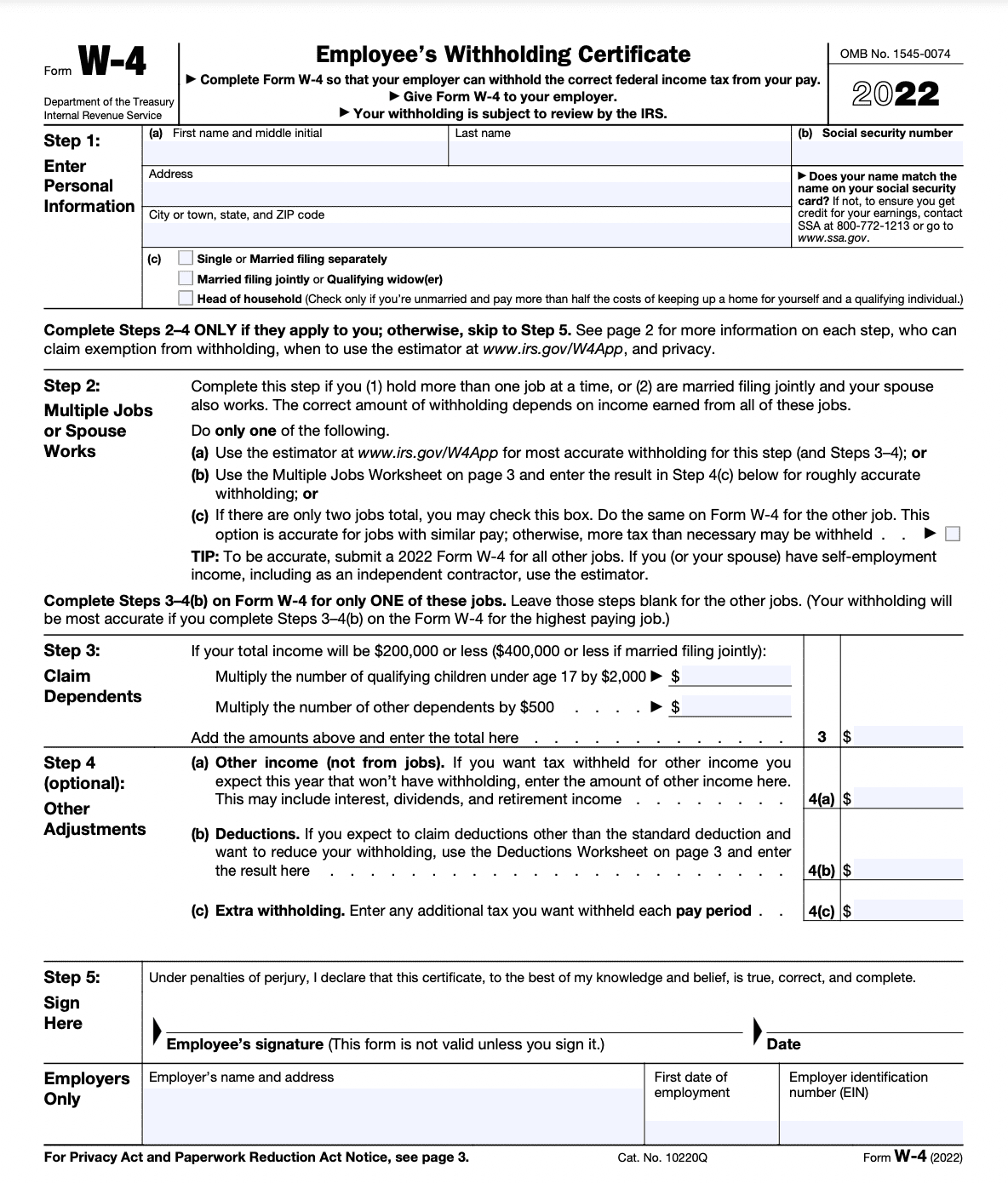

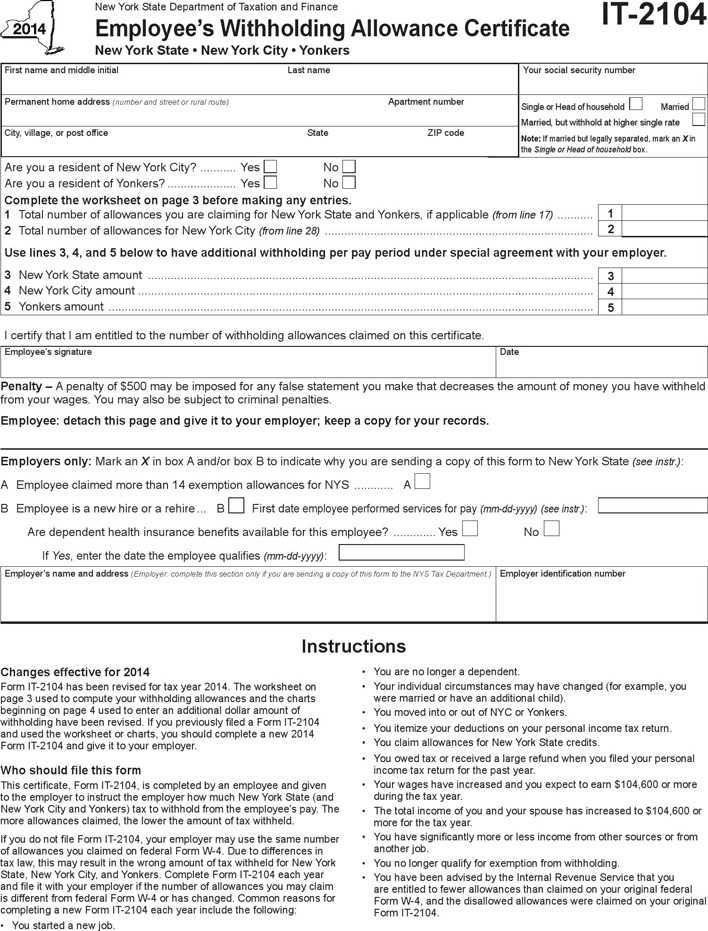

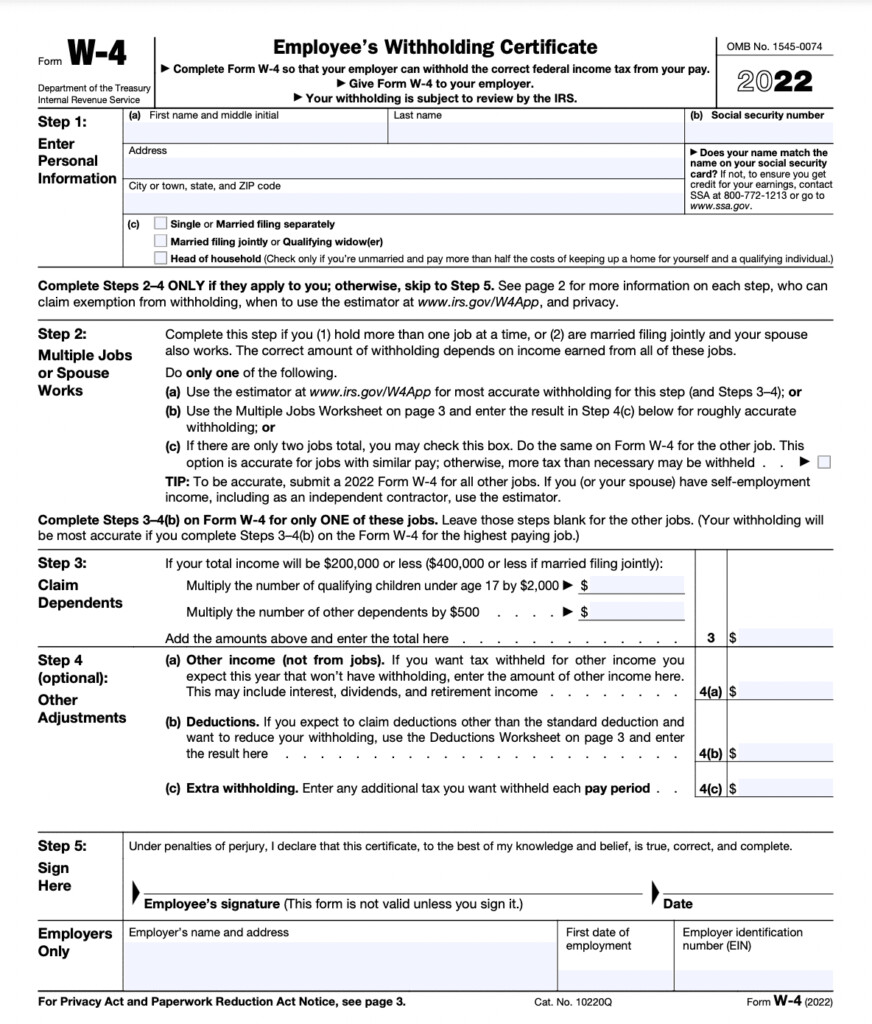

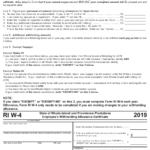

It is important to specify the amount of withholding allowances which you wish to claim on the Form W-4. This is important as your paychecks may depend on the tax amount that you pay.

You could be eligible to apply for an exemption on behalf of your head of household if you are married. The amount you earn can determine the amount of allowances offered to you. If you earn a significant amount of money, you could be eligible for a larger allowance.

A tax deduction suitable for you can aid you in avoiding large tax bills. A refund could be possible if you submit your tax return on income for the previous year. But it is important to pick the right method.

As with any financial decision, it is important that you must do your research. Calculators can be utilized to figure out how many withholding allowances are required to be made. Alternate options include speaking to an expert.

filing specifications

If you are an employer, you have to pay and report withholding tax from your employees. A few of these taxes may be submitted to the IRS by submitting forms. There are other forms you might need, such as the quarterly tax return or withholding reconciliation. Here’s some details about the various tax forms and when they must be filed.

In order to be eligible to receive reimbursement for withholding tax on the salary, bonus, commissions or any other earnings earned by your employees it is possible to submit withholding tax return. You could also be eligible to be reimbursed for tax withholding if your employees received their wages on time. Noting that certain of these taxes may be county taxes, is also important. You may also find unique withholding rules that can be used in specific situations.

Electronic submission of forms for withholding is required according to IRS regulations. If you are filing your tax returns for the national income tax ensure that you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.