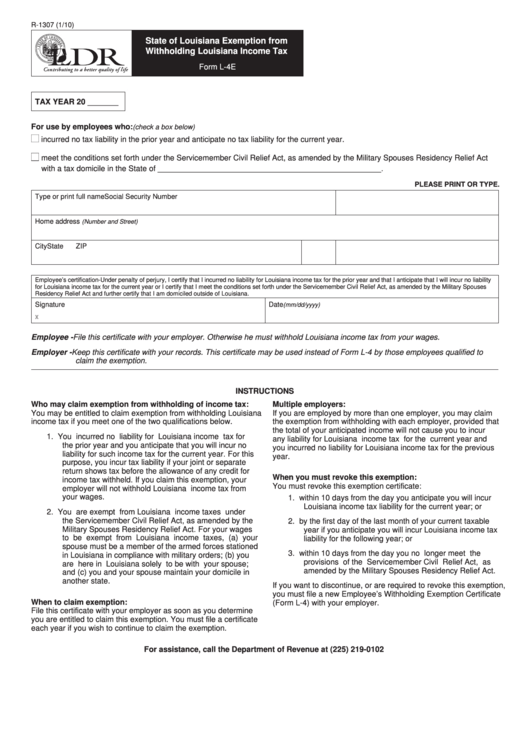

Withholding Form Type R-1307 – There are a variety of reasons why a person could choose to submit an application for withholding. This includes the need for documentation, exemptions from withholding and also the amount of required withholding allowances. It is important to be aware of these aspects regardless of why you choose to fill out a form.

Withholding exemptions

Non-resident aliens have to file Form 1040-NR at least once a year. If you satisfy these requirements, you could be eligible for an exemption from the withholding form. The exclusions are that you can access on this page.

The first step in filling out Form 1040-NR is attaching the Form 1042 S. The form is used to record federal income tax. It outlines the withholding by the withholding agent. Please ensure you are entering the right information when filling out this form. It is possible for one person to be treated differently if the correct information is not provided.

The non-resident alien withholding tax is 30 percent. A tax exemption may be possible if you’ve got a a tax burden that is less than 30 percent. There are numerous exemptions. Some are for spouses or dependents like children.

Generally, a refund is available for chapter 4 withholding. Refunds can be made in accordance with Sections 471 to 474. These refunds must be made by the agents who withhold taxes who is the person who withholds taxes at source.

Relational status

The work of your spouse and you will be made easy by a proper marriage status withholding form. You’ll be surprised by how much you can deposit to the bank. It is difficult to decide what option you will choose. There are certain things you should avoid. You will pay a lot in the event of a poor decision. If you stick to the directions and be alert for any potential pitfalls You won’t face any issues. If you’re lucky, you may even make new acquaintances while you travel. Today marks the anniversary of your wedding. I’m hoping you’re capable of using this against them to obtain that wedding ring you’ve been looking for. It’s a difficult job that requires the knowledge of an accountant. The small amount is well enough for a life-long wealth. There are numerous websites that offer details. TaxSlayer is one of the most trusted and respected tax preparation companies.

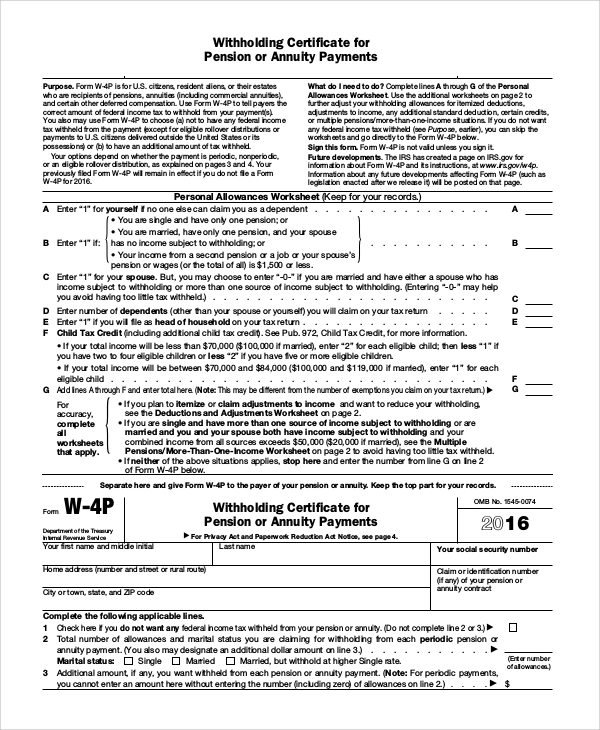

The number of withholding allowances that were requested

The W-4 form must be completed with the amount of withholding allowances you wish to take advantage of. This is crucial since it will affect the amount of tax you get from your paychecks.

You could be eligible to claim an exemption for your spouse if you are married. Your income level can also affect the number of allowances available to you. If you have high income, you might be eligible to receive a higher allowance.

Tax deductions that are suitable for you can aid you in avoiding large tax payments. Even better, you might even receive a tax refund if your annual income tax return has been completed. But , you have to choose your strategy carefully.

Similar to any financial decision, it is important that you should do your homework. To figure out the amount of tax withholding allowances that need to be claimed, make use of calculators. Alternate options include speaking to a specialist.

Formulating specifications

Employers must report the employer who withholds tax from employees. Some of these taxes may be reported to the IRS through the submission of paperwork. There are other forms you could require like a quarterly tax return or withholding reconciliation. Here are some specifics about the various types of withholding tax forms along with the deadlines for filing.

Tax returns withholding may be required to prove income like bonuses, salary, commissions and other income. In addition, if you pay your employees on-time you may be eligible to be reimbursed for any taxes that were not withheld. Noting that certain of these taxes may be taxation by county is crucial. In certain situations there are rules regarding withholding that can be unique.

As per IRS regulations Electronic submissions of withholding forms are required. You must provide your Federal Employer ID Number when you submit to your tax return for national income. If you don’t, you risk facing consequences.