Withholding Form For Pensions – There are a variety of reasons someone might choose to complete a form for withholding form. This includes the need for documentation, withholding exemptions and the amount of the required withholding allowances. No matter the reason for an individual to file an application it is important to remember certain points to keep in mind.

Withholding exemptions

Non-resident aliens are required to submit Form 1040 NR at least once every year. However, if you satisfy the criteria, you may be eligible for an exemption form from withholding. The following page lists all exclusions.

The attachment of Form 1042-S is the first step to file Form 1040-NR. The form contains information on the withholding done by the tax agency that handles withholding to report federal income tax purposes. It is important to enter exact information when you fill out the form. One individual may be treated differently if this information is not entered.

The non-resident alien tax withholding rate is 30 percent. If the tax you pay is less than 30 percent of your withholding you could be eligible to receive an exemption from withholding. There are a variety of exclusions. Some of them are for spouses, dependents, or children.

Generally, a refund is accessible for Chapter 4 withholding. According to Sections 1471 through 1474, refunds are granted. The person who is the withholding agent, or the person who withholds the tax at source, is the one responsible for distributing these refunds.

relationship status

The correct marital status as well as withholding forms can simplify your work and that of your spouse. You’ll be amazed at how much you can deposit at the bank. The challenge is in deciding what option to choose. There are certain things to be aware of. There are a lot of costs in the event of a poor decision. If you stick to the instructions and follow them, there shouldn’t be any issues. It is possible to make new acquaintances if you’re lucky. Today is the anniversary date of your wedding. I’m hoping you’ll apply it against them to secure the elusive diamond. To complete the task correctly you must obtain the assistance of a tax professional who is certified. A little amount can create a lifetime of wealth. There are numerous online resources that can provide you with details. TaxSlayer is a well-known tax preparation firm is among the most useful.

There are many withholding allowances being claimed

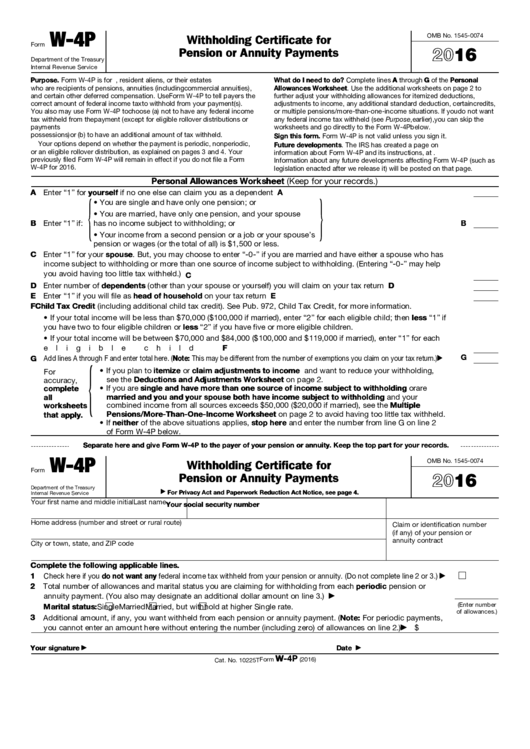

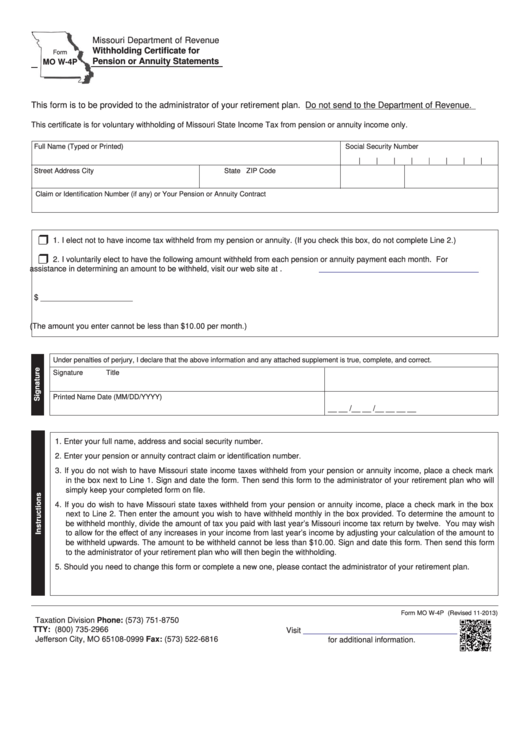

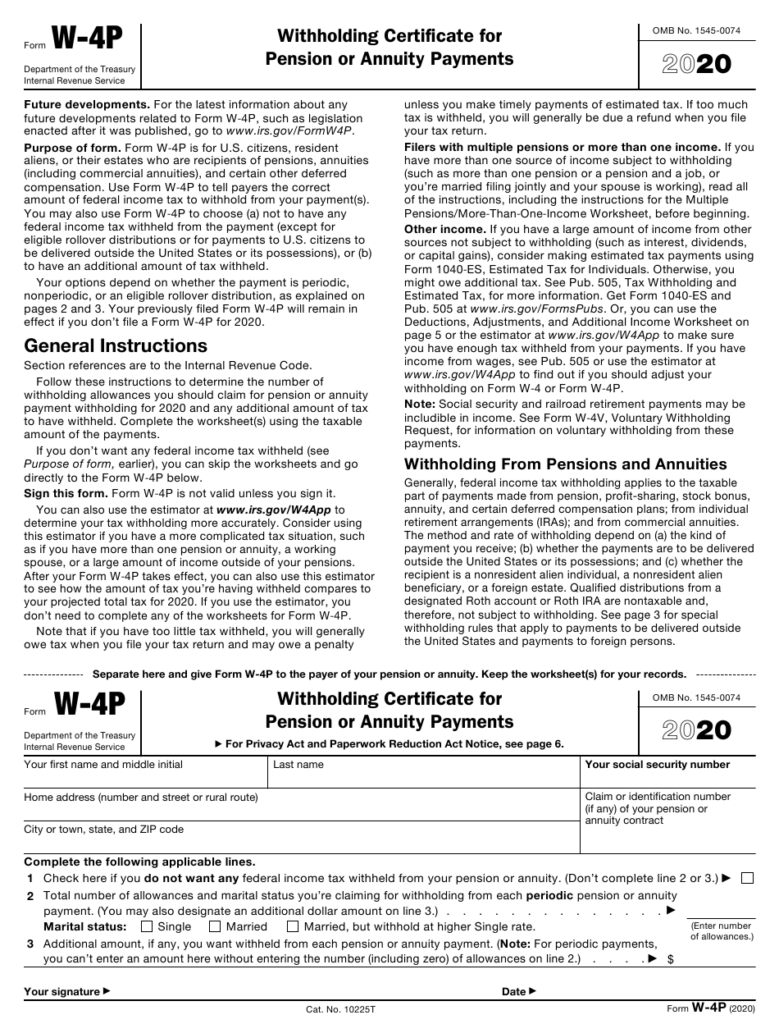

When you fill out Form W-4, you need to specify how many withholdings allowances you would like to claim. This is essential since the withholdings can have an effect on the amount of tax that is taken from your paychecks.

There are a variety of factors that affect the allowances requested.If you’re married as an example, you might be eligible for an exemption for the head of household. Your income will affect the amount of allowances you are entitled to. A higher allowance may be granted if you make lots of money.

It could save you lots of money by choosing the correct amount of tax deductions. In addition, you could even receive a tax refund if your tax return for income is filed. But be sure to choose your method carefully.

Do your research as you would with any other financial option. Calculators can assist you in determining the number of withholdings that need to be demanded. As an alternative, you may speak with a specialist.

Specifications that must be filed

Employers must report any withholding taxes being taken from employees. You may submit documentation to the IRS for some of these taxes. You may also need additional forms that you might need, such as an annual tax return, or a withholding reconciliation. Here’s some details about the different tax forms and when they must be submitted.

In order to be eligible for reimbursement of tax withholding on pay, bonuses, commissions or other revenue received from your employees it is possible to file a tax return for withholding. Additionally, if your employees are paid in time, you could be eligible to get the tax deductions you withheld. It is important to note that certain taxes are also county taxes ought to be taken into consideration. There are also unique withholding techniques which can be utilized in specific situations.

You have to submit electronically withholding forms in accordance with IRS regulations. The Federal Employer identification number should be noted when you file your national tax return. If you don’t, you risk facing consequences.