Withholding Form 2024 – There are a variety of reasons why one could fill out an application for withholding. These factors include documentation requirements as well as exemptions from withholding, as well as the quantity of requested withholding allowances. There are certain things you should remember regardless of the reason the person fills out the form.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If the requirements are met, you may be eligible for an exemption from withholding. This page lists all exemptions.

When you submit Form1040-NR, attach Form 1042S. The form lists the amount that is withheld by the tax withholding authorities for federal tax reporting purposes. Complete the form in a timely manner. This information might not be provided and could result in one individual being treated differently.

The non-resident alien tax withholding tax rate is 30 percent. You could be eligible to get an exemption from withholding if the tax burden is greater than 30%. There are a variety of exemptions available. Certain exclusions are only applicable to spouses and dependents like children.

In general, chapter 4 withholding entitles you to a refund. Refunds are made under Sections 471 through 474. These refunds must be made by the agents who withhold taxes that is, the person who withholds taxes at source.

Relational status

The proper marital status and withholding forms will ease your work and that of your spouse. You’ll be amazed at the amount you can deposit to the bank. Knowing which of the several possibilities you’re likely decide is the biggest challenge. There are some things to be aware of. Unwise decisions could lead to expensive results. However, if the instructions are followed and you pay attention you shouldn’t face any issues. If you’re lucky, you might even meet new friends while you travel. Today is the anniversary of your wedding. I’m hoping they reverse the tide to help you get that elusive engagement ring. To do it right you’ll need the assistance of a certified accountant. The little amount is worth it for a life-long wealth. You can get a lot of information on the internet. Trustworthy tax preparation companies like TaxSlayer are among the most efficient.

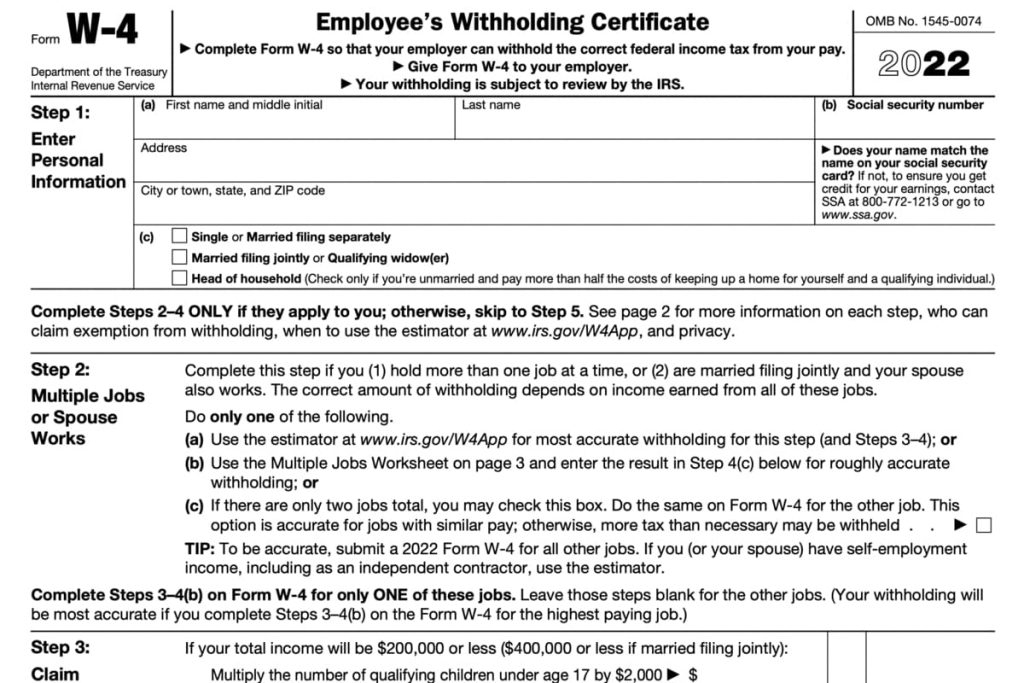

Number of withholding allowances claimed

It is essential to state the amount of withholding allowances which you would like to claim on the Form W-4. This is critical as your paychecks may depend on the tax amount you have to pay.

A number of factors can determine the amount that you can claim for allowances. The amount you’re eligible to claim will depend on the income you earn. If you earn a significant amount of money, you could be eligible for a higher allowance.

You could save a lot of money by determining the right amount of tax deductions. A refund could be possible if you submit your income tax return for the current year. But , you have to choose the right method.

As with any financial decision, you should conduct your homework. To figure out the amount of withholding allowances to be claimed, you can utilize calculators. An alternative is to speak to a professional.

Submission of specifications

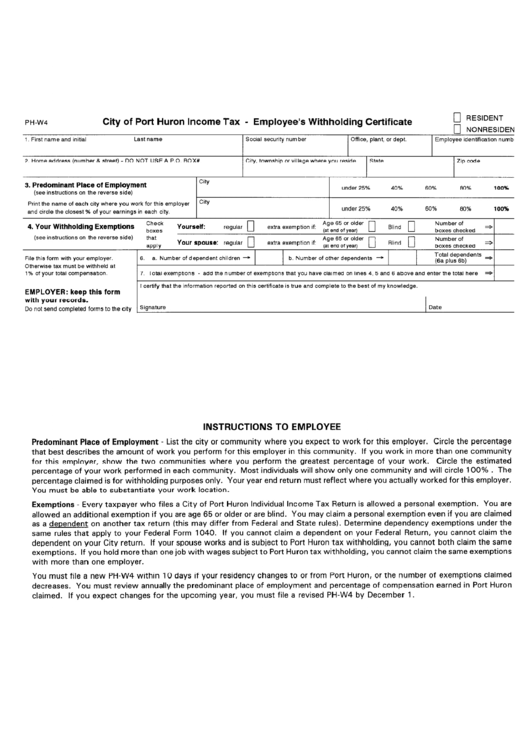

Employers should report the employer who withholds taxes from their employees. For certain taxes you might need to submit documentation to the IRS. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly return. Here’s some information about the different tax forms and the time when they should be submitted.

Withholding tax returns may be required to prove income like bonuses, salary and commissions, as well as other income. Additionally, if you paid your employees on time, you could be eligible to receive reimbursement for taxes withheld. Be aware that certain taxes are taxation by county is important. In certain situations the rules for withholding can be different.

In accordance with IRS regulations, you must electronically submit forms for withholding. It is mandatory to provide your Federal Employer Identification Number when you point your national income tax return. If you don’t, you risk facing consequences.