Wisconsin Tax Withholding Form For Employees – There are a variety of reasons why a person could choose to submit a withholding application. This includes documentation requirements and exemptions for withholding. It is important to be aware of these aspects regardless of why you choose to fill out a form.

Withholding exemptions

Nonresident aliens are required once every year to file Form1040-NR. If you meet these requirements, you may be able to claim exemptions from the withholding forms. This page lists all exclusions.

Attaching Form 1042-S is the first step to submit Form 1040-NR. The form outlines the withholdings that the agency makes. Make sure you enter the right information when filling out this form. If the information you provide is not supplied, one person may be taken into custody.

The tax withholding rate for non-resident aliens is 30. The tax burden of your business must not exceed 30% to be exempt from withholding. There are numerous exemptions. Some are only for spouses or dependents like children.

In general, the chapter 4 withholding allows you to receive a refund. According to Sections 1471 through 1474, refunds can be made. The refunds are made by the tax agent. This is the individual accountable for tax withholding at the source.

Status of the relationship

A valid marital status and withholding forms can simplify your work and that of your spouse. You’ll be amazed by the amount you can deposit at the bank. It isn’t easy to determine which of the many options you’ll pick. Undoubtedly, there are some that you shouldn’t do. You will pay a lot in the event of a poor decision. There’s no problem If you simply adhere to the instructions and be attentive. If you’re lucky, you may make new acquaintances on your trip. Today is your birthday. I’m hoping that you can apply it against them to secure that elusive diamond. It’s a difficult job that requires the knowledge of an expert in taxation. It’s worth it to build wealth over the course of your life. Information on the internet is easily accessible. TaxSlayer, a reputable tax preparation business is among the most effective.

In the amount of withholding allowances requested

The form W-4 should be completed with the amount of withholding allowances you wish to claim. This is crucial because the amount of tax you are able to deduct from your paychecks will be affected by the you withhold.

Many factors affect the amount you are eligible for allowances. Your income level can also impact how many allowances are accessible to you. You could be eligible to claim more allowances if have a large amount of income.

Choosing the proper amount of tax deductions might help you avoid a hefty tax bill. In reality, if you complete your yearly income tax return, you could even be eligible for a tax refund. It is important to be cautious regarding how you go about this.

Like every financial decision, you must do your research. Calculators can help determine how many withholding amounts should be demanded. An expert may be an alternative.

Submitting specifications

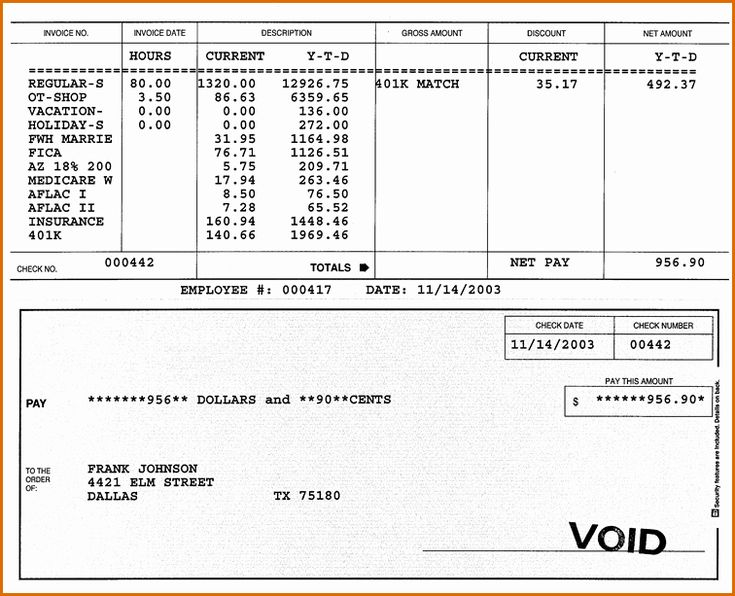

Employers must report the employer who withholds taxes from employees. Some of these taxes may be reported to the IRS through the submission of paperwork. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few kinds of documentation you may need. Here’s some details about the different tax forms and the time when they should be filed.

To be qualified for reimbursement of withholding tax on the compensation, bonuses, salary or other income that your employees receive, you may need to file a tax return for withholding. It is also possible to receive reimbursement for tax withholding if your employees received their wages in time. It is important to note that some of these taxes could be considered to be county taxes, is also vital. Furthermore, there are special methods of withholding that are used in certain conditions.

Electronic filing of withholding forms is required under IRS regulations. Your Federal Employer Identification number must be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.