Wisconsin Pension Withholding Form – There are many reasons someone may decide to submit an application for withholding. Withholding exemptions, documentation requirements and the amount of allowances for withholding requested are all factors. Whatever the reason one chooses to submit the form it is important to remember a few points to be aware of.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040-NR at least once per year. However, if you satisfy the requirements, you might be eligible to submit an exemption from withholding form. There are exemptions that you can access on this page.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The document is required to report the federal income tax. It outlines the withholding of the withholding agent. When you fill out the form, ensure that you provide the accurate details. This information might not be given and cause one person to be treated differently.

Nonresident aliens have a 30% withholding tax. You may be eligible to receive an exemption from withholding tax if your tax burden exceeds 30%. There are several different exclusions that are available. Some of them are for spouses or dependents like children.

You are entitled to refunds if you have violated the provisions of chapter 4. Refunds can be made in accordance with Sections 1400 through 1474. The person who is the withholding agent, or the person who is responsible for withholding the tax at source is responsible for the refunds.

relationship status

An official marriage status withholding form can help both of you get the most out of your time. Furthermore, the amount of money you may deposit at the bank can delight you. It isn’t always easy to determine which one of many choices is most appealing. You must be cautious in when you make a decision. It’s costly to make the wrong choice. If you stick to it and follow the instructions, you won’t have any issues. If you’re fortunate, you might even make acquaintances when you travel. Today is your birthday. I’m sure you’ll be able to leverage it to secure that dream wedding ring. If you want to do this properly, you’ll require assistance of a qualified Tax Expert. The accumulation of wealth over time is more than the modest payment. You can get a ton of information online. TaxSlayer is a trusted tax preparation company.

The amount of withholding allowances claimed

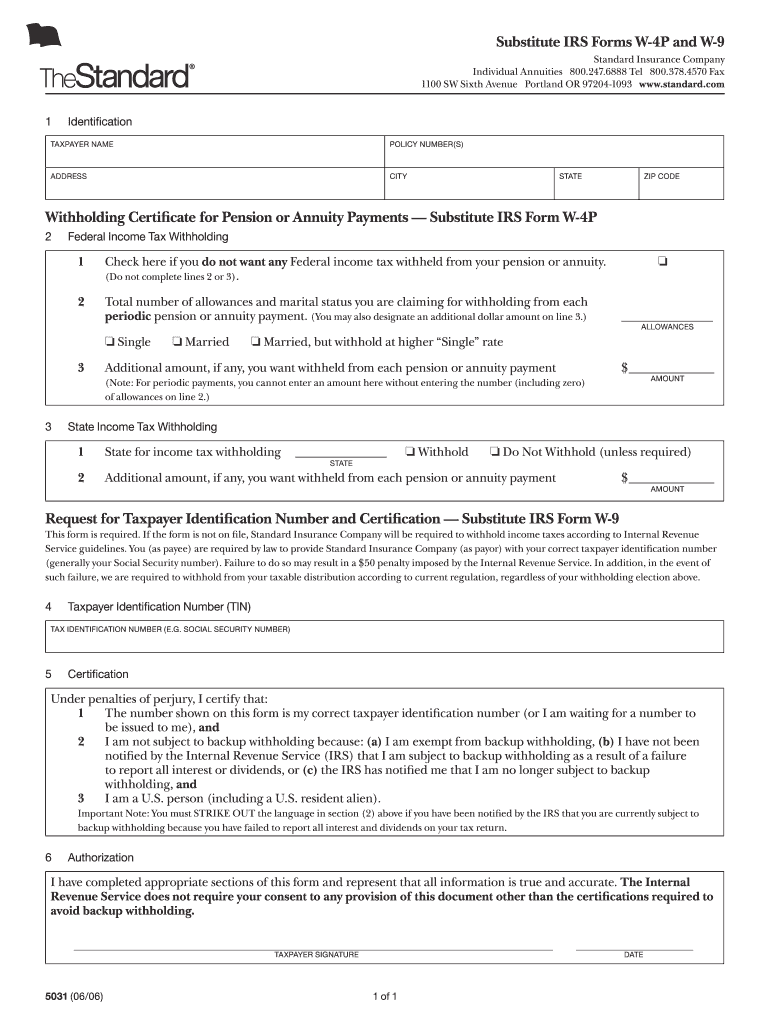

On the Form W-4 that you submit, you must indicate how many withholding allowances are you asking for. This is important as your paychecks may depend on the tax amount you have to pay.

You could be eligible to request an exemption for the head of your household in the event that you are married. Your income can impact how many allowances are offered to you. If you earn a higher income, you can request an increase in your allowance.

It could save you thousands of dollars by choosing the correct amount of tax deductions. In fact, if you submit your annual income tax return, you may even be eligible for a tax refund. However, you must be careful about how you approach the tax return.

Just like with any financial decision it is essential to do your homework. Calculators are a great tool to figure out how many withholding allowances should be claimed. You may also talk to a specialist.

Formulating specifications

Employers are required to report any withholding tax that is being collected from employees. For a limited number of these taxes, you can submit paperwork to IRS. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly tax return. Here are the details on various tax forms for withholding and their deadlines.

To be eligible to receive reimbursement for withholding tax on the compensation, bonuses, salary or other income that your employees receive it is possible to submit withholding tax return. If you pay your employees on time, you could be eligible for reimbursement of any withheld taxes. Be aware that some of these taxes could be considered to be local taxes. In certain situations there are rules regarding withholding that can be unique.

As per IRS regulations, electronic filing of forms for withholding are required. When you file your tax return for national revenue make sure you include your Federal Employer Identification number. If you don’t, you risk facing consequences.