Wisconsin Partnership Withholding Form – There are many explanations why somebody could decide to fill out a tax form. This includes the documentation requirements, withholding exclusions and withholding allowances. No matter why one chooses to submit the form there are some aspects to consider.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. If you meet the criteria, you could be qualified for exemption from withholding. This page you’ll discover the exemptions available to you.

For submitting Form 1040-NR add Form 1042-S. The form outlines the withholdings that the agency makes. It is essential to fill in the correct information when filling out the form. A person could be treated if the information is not entered.

Non-resident aliens are subject to the 30% tax withholding rate. Exemption from withholding could be granted if you have a an income tax burden of less than 30 percent. There are a variety of exemptions. Some are only for spouses or dependents like children.

Generallyspeaking, withholding in Chapter 4 allows you to claim the right to a refund. Refunds are available according to sections 1401, 1474 and 1475. These refunds are provided by the withholding agent (the person who collects tax at source).

Relational status

A valid marital status and withholding forms can simplify the work of you and your spouse. You will be pleasantly surprised at how much money you can transfer to the bank. It is difficult to decide which one of the options you’ll choose. There are certain things that you should not do. You will pay a lot if you make a wrong choice. If you stick to the guidelines and adhere to them, there won’t be any problems. If you’re lucky, you could be able to make new friends during your journey. Today marks the anniversary. I’m hoping they can turn it against you in order to assist you in getting the elusive engagement ring. You’ll need the help of a certified tax expert to finish it properly. This small payment is well worth the lifetime of wealth. Online information is readily available. TaxSlayer is a trusted tax preparation firm.

There are many withholding allowances being requested

When filling out the form W-4 you submit, you must declare how many withholding allowances are you asking for. This is essential since the tax amount you are able to deduct from your paychecks will be affected by how much you withhold.

The amount of allowances that you get will be contingent on a variety of factors. For instance If you’re married, you could be eligible for an exemption for your household or head. Your income will determine how many allowances you can receive. If you earn a high amount you may be eligible to receive a higher allowance.

Making the right choice of tax deductions can save you from a large tax bill. If you file your annual tax returns You could be eligible for a refund. You need to be careful when it comes to preparing this.

It is essential to do your homework the same way you would for any financial choice. Calculators will help you determine how many withholding amounts should be requested. Alternate options include speaking to a specialist.

Formulating specifications

Employers are required to report any withholding taxes being paid by employees. You can submit paperwork to the IRS for some of these taxes. An annual tax return and quarterly tax returns as well as tax withholding reconciliations are just a few examples of paperwork you might need. Here’s a brief overview of the various tax forms and the time when they should be submitted.

Withholding tax returns may be required for certain incomes such as salary, bonuses and commissions, as well as other income. If you paid your employees promptly, you could be eligible to receive reimbursement for taxes that you withheld. Be aware that some of these taxes may be county taxes. There are also specific withholding methods which can be utilized in specific situations.

Electronic submission of forms for withholding is required according to IRS regulations. The Federal Employer Identification Number needs to be listed on your tax return for national revenue. If you don’t, you risk facing consequences.

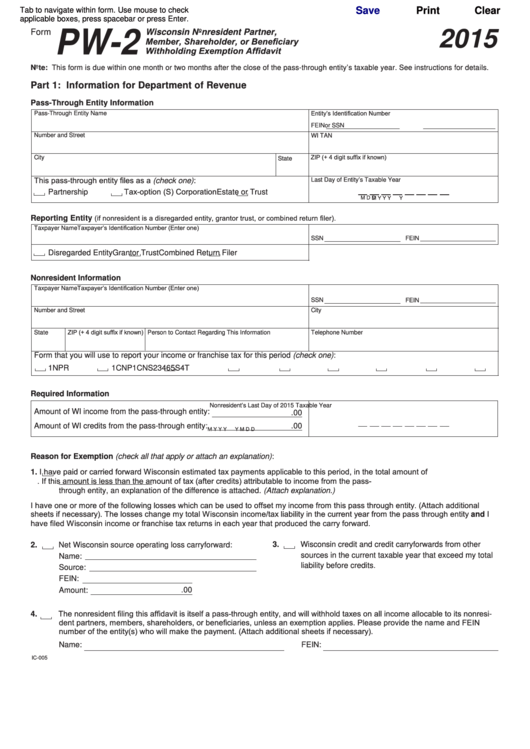

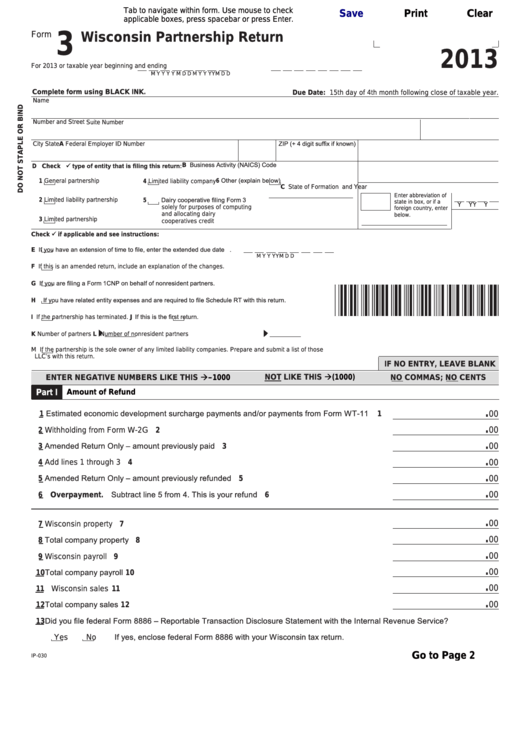

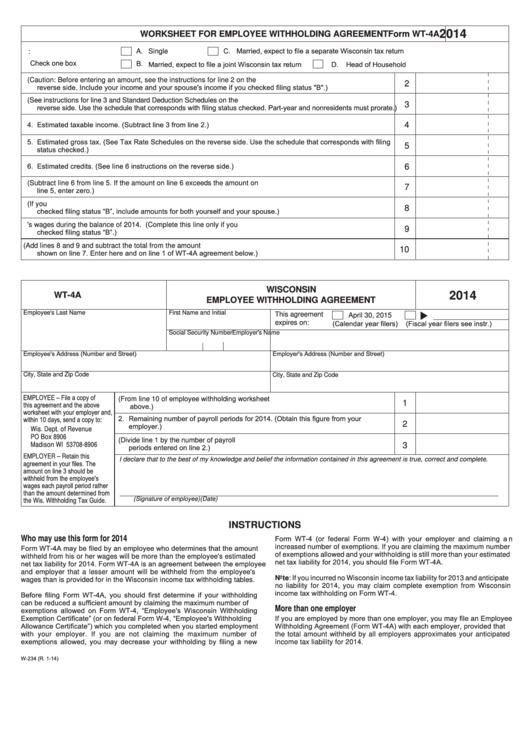

Gallery of Wisconsin Partnership Withholding Form

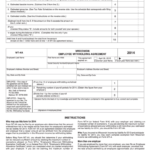

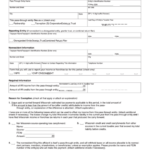

Form Wt 4a Wisconsin Employee Withholding Agreement Printable Pdf Download