Where To.mail Tax Form Withholding Forms For Social Security – There stand a digit of reasons why someone might choose to fill out a tax form. This includes documentation requirements and exemptions for withholding. Whatever the reason behind an individual to file a document there are certain aspects you must keep in mind.

Withholding exemptions

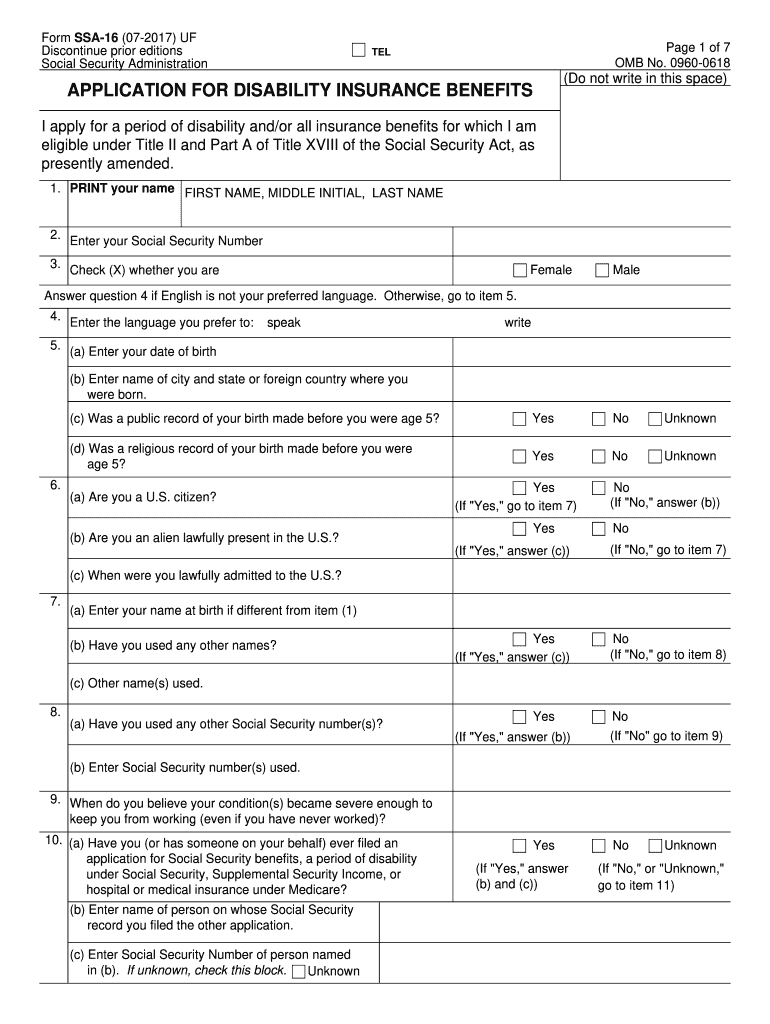

Nonresident aliens are required once every year to file Form1040-NR. If you meet these requirements, you could be able to claim an exemption from the withholding form. This page lists all exemptions.

For submitting Form 1040-NR include Form 1042-S. This document is required to record the federal income tax. It outlines the amount of withholding that is imposed by the tax withholding agent. It is important to enter the correct information when filling out the form. You may have to treat one person for not providing this information.

The rate of withholding for non-resident aliens is 30%. If the tax you pay is less than 30 percent of your withholding you could be eligible to receive an exemption from withholding. There are many different exemptions. Certain of them are designed for spouses, whereas others are meant for use by dependents like children.

Generally, withholding under Chapter 4 allows you to claim the right to a refund. Refunds are available according to sections 1401, 1474 and 1475. Refunds are given to the agent who withholds tax that is the person who collects the tax from the source.

Status of relationships

The work of your spouse and you is made simpler by a proper marital status withholding form. The bank could be shocked by the amount you’ve deposited. The problem is deciding which one of the many options to choose. There are some things you should avoid doing. The wrong decision can cost you dearly. It’s not a problem If you simply adhere to the instructions and be attentive. If you’re lucky you’ll make new acquaintances while driving. Today is the anniversary of your wedding. I hope you are able to use this to get that elusive wedding ring. For a successful approach you’ll require the assistance of a certified accountant. The little amount is worthwhile for the lifetime of wealth. You can get plenty of information on the internet. TaxSlayer is among the most trusted and reputable tax preparation companies.

There are many withholding allowances being claimed

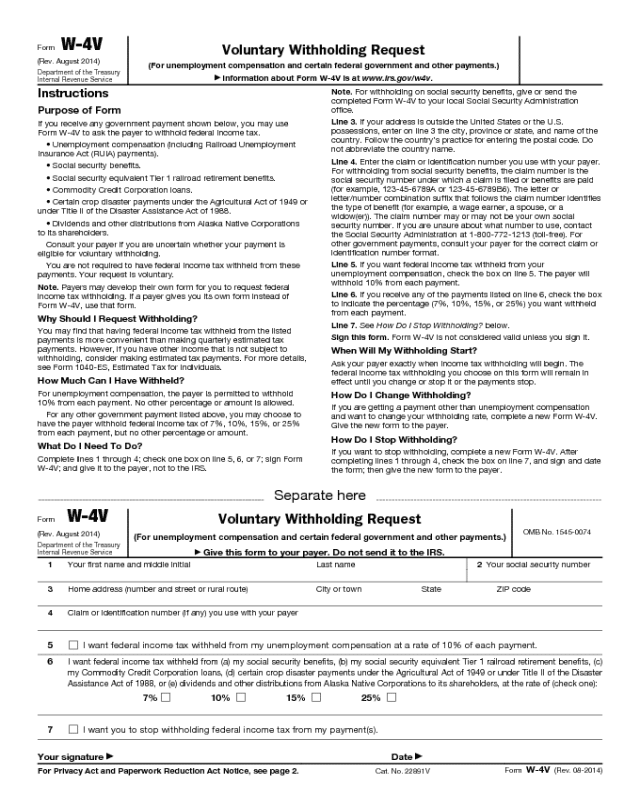

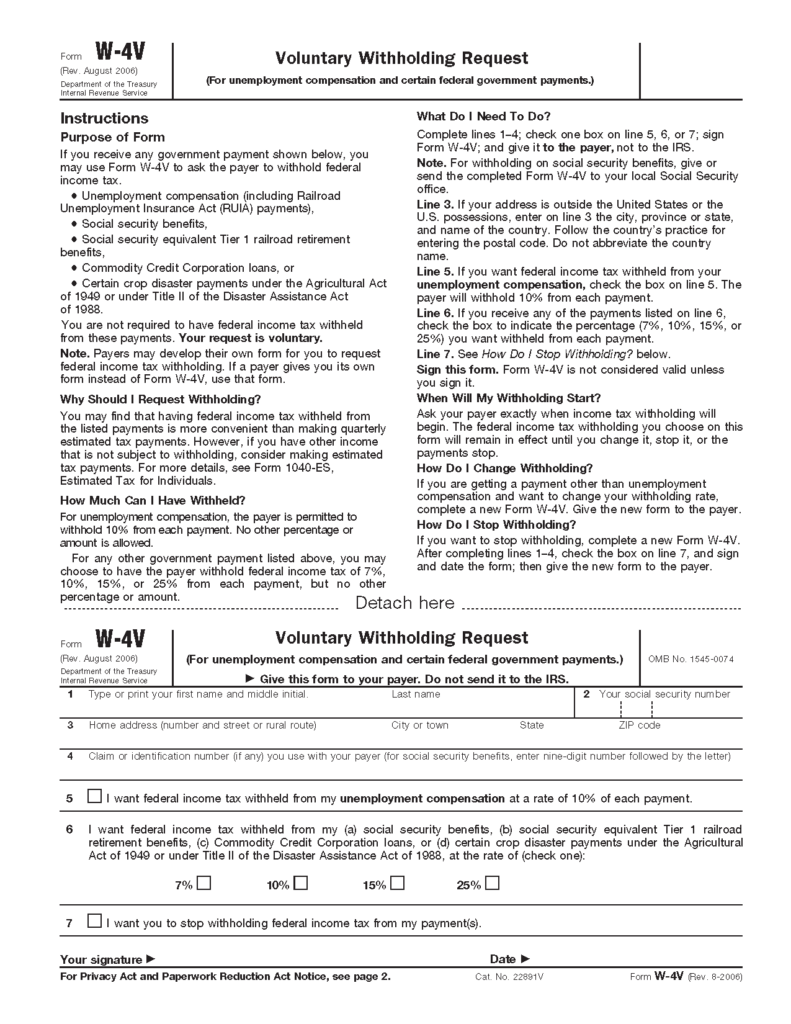

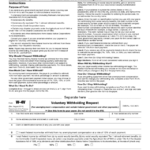

It is important to specify the number of withholding allowances you wish to be able to claim on the form W-4 that you file. This is essential since the withholdings will have an effect on the amount of tax is deducted from your paycheck.

The amount of allowances that you receive will depend on a variety of factors. For example when you’re married, you might be qualified for a head or household exemption. The amount you earn will also impact how many allowances you are eligible to claim. If you earn a high amount it could be possible to receive more allowances.

A tax deduction appropriate for you could help you avoid large tax payments. A refund could be possible if you file your income tax return for the current year. But , you have to choose the right method.

Research as you would with any other financial decision. To determine the amount of tax withholding allowances that need to be claimed, you can utilize calculators. You can also speak to an expert.

Formulating specifications

Withholding taxes from employees need to be reported and collected if you’re an employer. The IRS will accept documents to pay certain taxes. A reconciliation of withholding tax or an annual tax return for quarterly filing, or an annual tax return are examples of additional documents you could need to submit. Here’s some details on the different forms of withholding tax categories as well as the deadlines for filling them out.

To be qualified for reimbursement of withholding tax on the pay, bonuses, commissions or other revenue that your employees receive You may be required to submit withholding tax return. If you pay your employees on time, you could be eligible to receive reimbursement for taxes that you withheld. Remember that these taxes may also be considered taxation by the county. There are also unique withholding techniques which can be utilized under certain conditions.

You must electronically submit withholding forms according to IRS regulations. The Federal Employer Identification Number needs to be listed when you submit to your national tax return. If you don’t, you risk facing consequences.