Where Do I Mail My Social Security Withholding Form – There are many reasons someone may choose to fill out withholding forms. This includes documentation requirements and exemptions from withholding. Whatever the motive someone has to fill out the Form, there are several aspects to keep in mind.

Exemptions from withholding

Nonresident aliens are required once a year to submit Form1040-NR. However, if you meet the minimum requirements, you could be eligible to submit an exemption from withholding form. The following page lists all exemptions.

To complete Form 1040-NR, include Form 1042-S. To report federal income tax reasons, this form details the withholding process of the withholding agency. Make sure you enter the correct information when filling out this form. It is possible for a individual to be treated in a manner that is not correct if the information is not given.

The non-resident alien tax withholding tax rate is 30 percent. Tax burdens must not exceed 30% in order to be exempt from withholding. There are many exemptions. Some are only for spouses, dependents, or children.

In general, you’re entitled to a reimbursement in accordance with chapter 4. Refunds are made under Sections 471 through 474. Refunds are to be given by the tax withholding agents who is the person who withholds taxes at the source.

Status of the relationship

Your and your spouse’s job will be made easy with a valid marriage-related status withholding document. You’ll be amazed by the amount you can deposit to the bank. It is difficult to decide what option you’ll choose. Certain things are best avoided. Making a mistake can have costly results. But, if the directions are followed and you pay attention you shouldn’t face any problems. If you’re lucky to meet some new acquaintances driving. Today is your anniversary. I’m hoping you’ll use it against them in order to get the sought-after diamond. It’s a complex task that requires the expertise of an expert in taxation. This tiny amount is enough to last the life of your wealth. There is a wealth of information online. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

The number of withholding allowances claimed

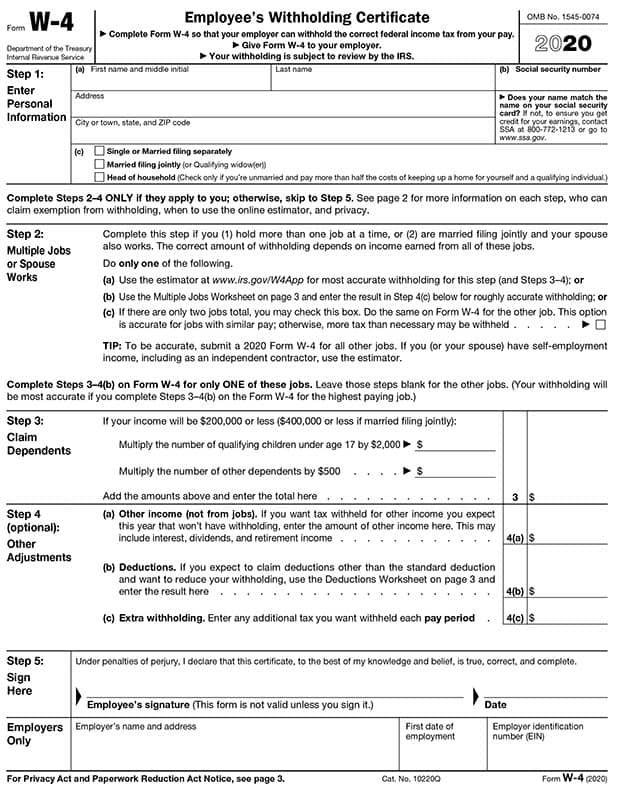

The form W-4 should be completed with the amount of withholding allowances that you wish to claim. This is crucial since the withholdings will have an impact on how much tax is taken out of your paycheck.

There are a variety of factors that influence the allowance amount that you can request. If you’re married you might be qualified for an exemption for head of household. Your income will influence how many allowances your are entitled to. If you have high income you may be eligible to receive more allowances.

Choosing the proper amount of tax deductions might save you from a large tax payment. Refunds could be feasible if you submit your income tax return for the previous year. However, be careful about how you approach the tax return.

As with any financial decision, it is important to do your research. Calculators can be used to determine how many allowances for withholding must be requested. Alternative options include speaking with a specialist.

Sending specifications

Employers must inform the IRS of any withholding taxes that are being taken from employees. Certain of these taxes can be filed with the IRS through the submission of paperwork. There may be additional documentation , like a withholding tax reconciliation or a quarterly tax return. Below are details about the different tax forms that you can use for withholding as well as their deadlines.

You may have to file tax returns for withholding in order to report the income you get from your employees, such as bonuses and commissions or salaries. If you pay your employees on time, then you could be eligible for reimbursement of any withheld taxes. Be aware that these taxes may also be considered local taxes. In addition, there are specific tax withholding procedures that can be used in certain circumstances.

According to IRS regulations Electronic filings of tax withholding forms are required. The Federal Employer Identification number must be noted when you file your national tax return. If you don’t, you risk facing consequences.