What Is Withholding Tax On A New Mexico Crs Form – There are many reasons someone might decide to file a withholding application. These factors include documentation requirements and withholding exemptions. No matter the reason someone chooses to file the Form, there are several points to be aware of.

Exemptions from withholding

Non-resident aliens are required to file Form 1040–NR once a calendar year. If the requirements are met, you may be eligible to request an exemption from withholding. You will discover the exclusions accessible to you on this page.

To submit Form 1040-NR, attach Form 1042-S. The document is required to report the federal income tax. It outlines the withholding by the withholding agent. It is crucial to enter correct information when you complete the form. It is possible that you will have to treat one person if you don’t provide this information.

Non-resident aliens have to pay 30 percent withholding. The tax burden of your business is not to exceed 30% in order to be eligible for exemption from withholding. There are numerous exemptions. Some are specifically for spouses, and dependents, such as children.

You are entitled to a refund if you violate the rules of chapter 4. Refunds can be made according to Sections 471 through 474. Refunds are to be given by the withholding agents, which is the person who withholds taxes at the source.

relationship status

The marital withholding form is an excellent way to make your life easier and help your spouse. Furthermore, the amount of money you may deposit at the bank can surprise you. Knowing which of the several possibilities you’re most likely to decide is the biggest challenge. There are certain things you should be aware of. It will be expensive to make the wrong decision. If you adhere to the rules and follow the instructions, you won’t run into any problems. If you’re lucky enough, you could even make new acquaintances while you travel. Today marks the anniversary of your wedding. I’m sure you’ll be able to make use of it to secure that dream engagement ring. It will be a complicated job that requires the experience of an accountant. It’s worthwhile to accumulate wealth over the course of your life. You can get plenty of information on the internet. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

The amount of withholding allowances claimed

When you fill out Form W-4, you must specify how many withholding allowances you wish to claim. This is important as your paychecks may depend on the tax amount you have to pay.

The amount of allowances you receive will depend on various factors. For instance when you’re married, you may be eligible for an exemption for the head of household or for the household. Your income level will also influence how many allowances your are eligible for. If you have high income it could be possible to receive more allowances.

The proper amount of tax deductions could aid you in avoiding a substantial tax bill. It is possible to receive the amount you owe if you submit your annual income tax return. But you need to pick the right method.

Do your research the same way you would with any other financial option. To determine the amount of withholding allowances to be claimed, make use of calculators. Alternate options include speaking to a specialist.

filing specifications

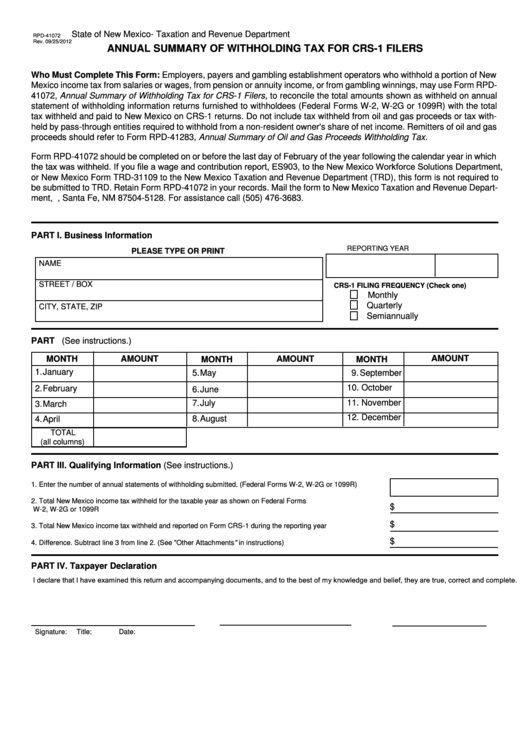

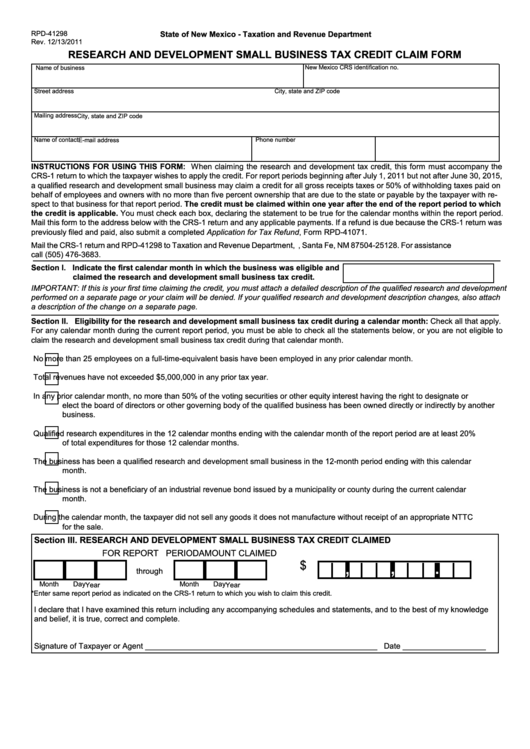

Employers must report any withholding tax that is being paid by employees. For a limited number of the taxes, you are able to provide documentation to the IRS. A reconciliation of withholding tax and an annual tax return for quarterly filing, as well as an annual tax return are examples of other paperwork you may be required to submit. Here’s some information about the different tax forms, and when they need to be submitted.

Employees may need you to submit withholding taxes returns in order to receive their bonuses, salary and commissions. If you make sure that your employees are paid on time, you may be eligible to receive reimbursement of any withheld taxes. It is crucial to remember that some of these taxes are local taxes. In certain situations, withholding rules can also be different.

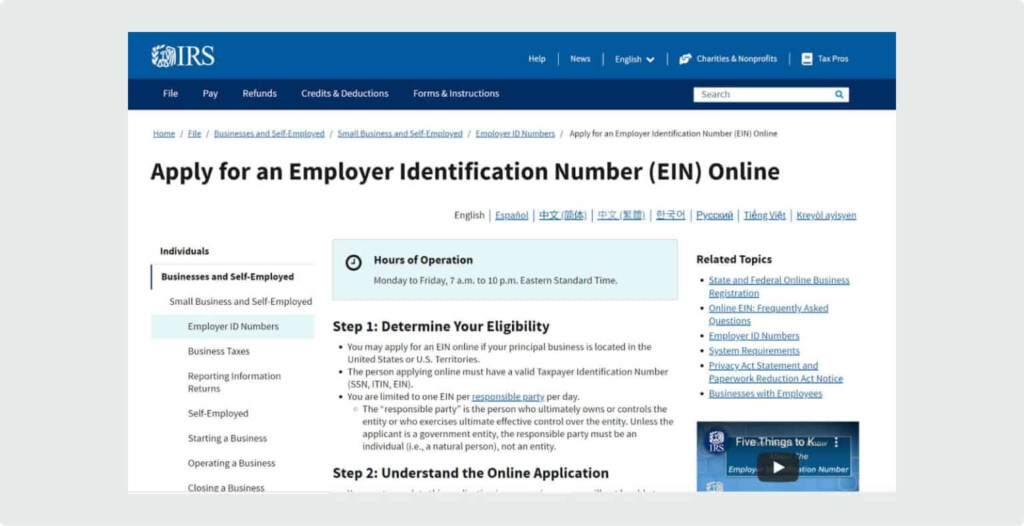

You have to submit electronically tax withholding forms as per IRS regulations. When filing your national revenue tax returns, be sure to provide your Federal Employee Identification Number. If you don’t, you risk facing consequences.