What Is The Nc-4ez Withholding Form Vs The Nc-4 Form – There are a variety of explanations why somebody could decide to fill out a tax form. These factors include the documents required, the exclusion of withholding and withholding allowances. Whatever the motive someone has to fill out the Form There are a few aspects to keep in mind.

Withholding exemptions

Non-resident aliens are required to file Form 1040–NR once a calendar year. If you meet these requirements, you could be eligible for an exemption from the withholding forms. The following page lists all exclusions.

If you are submitting Form1040-NR to the IRS, include Form 1042S. This form is a record of the withholdings that are made by the agency. Please ensure you are entering the right information when filling in this form. It is possible that you will have to treat a single person for not providing this information.

Non-resident aliens are subject to a 30% withholding rate. A nonresident alien may be eligible for an exemption. This happens if your tax burden is less than 30 percent. There are a variety of exemptions. Certain are only for spouses and dependents, such as children.

Generally, a refund is offered for the chapter 4 withholding. Refunds are allowed according to Sections 1471-1474. These refunds are made by the agent who withholds tax (the person who collects tax at source).

Status of the relationship

The correct marital status as well as withholding forms will ease the job of both you and your spouse. You’ll be amazed at how much money you could deposit at the bank. The challenge is choosing the right option among the numerous possibilities. Certain issues should be avoided. False decisions can lead to costly negative consequences. But, if the directions are adhered to and you are attentive to the rules, you shouldn’t have any issues. If you’re lucky, you could be able to make new friends during your trip. Today is the anniversary day of your wedding. I’m hoping you can use it against them to get that elusive engagement ring. For a successful completion of the task it is necessary to seek the assistance from a qualified tax professional. It’s worthwhile to create wealth over a lifetime. There are a myriad of websites that offer information. TaxSlayer and other reputable tax preparation companies are some of the top.

In the amount of withholding allowances requested

The W-4 form must be completed with the amount of withholding allowances you want to claim. This is crucial since the tax withheld will affect the amount taken out of your paycheck.

A number of factors can affect the amount you are eligible for allowances. Your income can affect the number of allowances accessible to you. You may be eligible for more allowances if make a lot of money.

It can save you lots of money by choosing the correct amount of tax deductions. If you submit the annual tax return for income, you may even be qualified for a tax refund. But you need to pick your approach wisely.

Similar to any financial decision, it is important that you should do your homework. Calculators can assist you in determining how much withholding allowances you can claim. An alternative is to speak with a professional.

filing specifications

Employers are required to report any withholding taxes that are being collected from employees. It is possible to submit documents to the IRS for some of these taxation. There may be additional documents, such as a withholding tax reconciliation or a quarterly tax return. Here’s some information about the various tax forms and when they must be submitted.

To be eligible for reimbursement of tax withholding on pay, bonuses, commissions or any other earnings that your employees receive You may be required to submit withholding tax return. If you also pay your employees on time, you might be eligible to be reimbursed for any taxes that were not withheld. It is important to note that there are a variety of taxes that are local taxes. In some situations the rules for withholding can be unique.

Electronic filing of withholding forms is mandatory according to IRS regulations. You must include your Federal Employer Identification Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.

Gallery of What Is The Nc-4ez Withholding Form Vs The Nc-4 Form

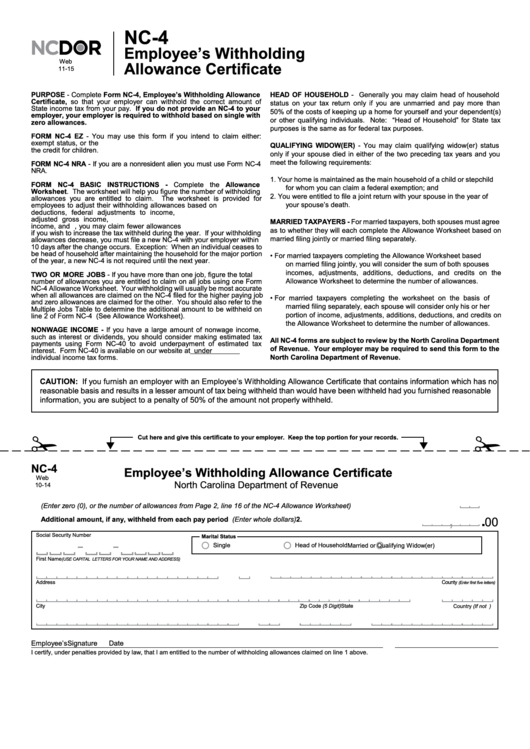

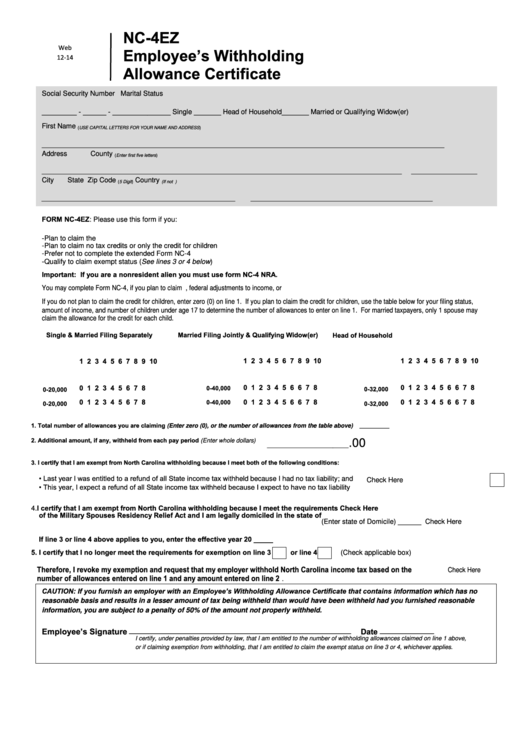

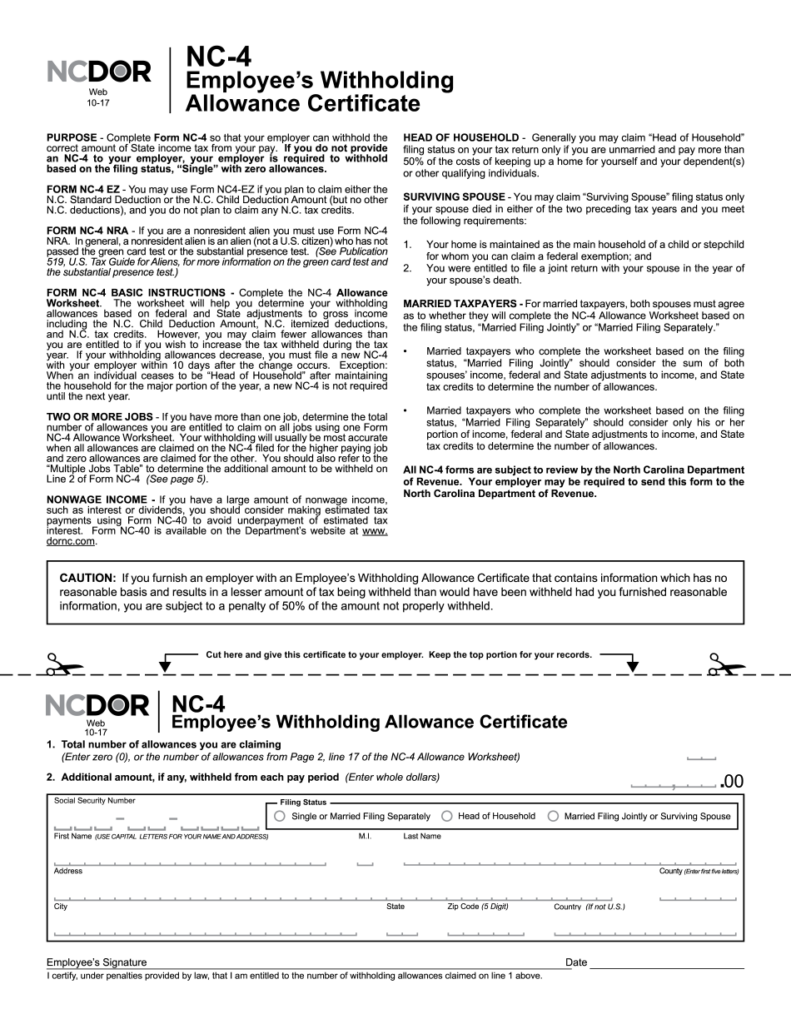

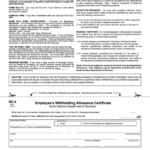

Form Nc 4 Employee S Withholding Allowance Certificate Nc 4p