What Form Is Used For Paying Someone But Not Withholding – There are a variety of reasons why a person could choose to submit a withholding application. The reasons include the need for documentation, withholding exemptions, and the quantity of requested withholding allowances. There are some important things to keep in mind regardless of why the person fills out the form.

Exemptions from withholding

Non-resident aliens must complete Form 1040-NR every year. However, if your requirements are met, you could be eligible to request an exemption from withholding. This page will provide all exclusions.

The attachment of Form 1042-S is the first step to submit Form 1040-NR. The form outlines the withholdings that the agency makes. It is crucial to enter exact information when you fill out the form. You may have to treat a single individual if you do not provide the correct information.

The tax withholding rate for non-resident aliens is 30%. You could be eligible to get an exemption from withholding if the tax burden is greater than 30%. There are many exemptions. Some of them are intended for spouses, while others are designed to be used by dependents, such as children.

In general, withholding under Chapter 4 gives you the right to an amount of money back. Refunds are permitted under Sections 1471-1474. Refunds are given by the tax agent. This is the person who is responsible for withholding tax at the source.

Status of relationships

An appropriate marital status that is withheld will make it easier for both of you to do your work. In addition, the amount of money you may deposit in the bank will pleasantly surprise you. Choosing which of the possibilities you’re likely decide is the biggest challenge. There are certain things you should avoid. Making the wrong choice could cause you to pay a steep price. But if you adhere to the guidelines and keep your eyes open for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you might even meet new friends while you travel. Today marks the anniversary. I’m sure you’ll utilize it against them to search for that one-of-a-kind ring. It’s a complex job that requires the knowledge of an accountant. A little amount could create a lifetime’s worth of wealth. You can find plenty of details online. TaxSlayer, a reputable tax preparation company is among the most helpful.

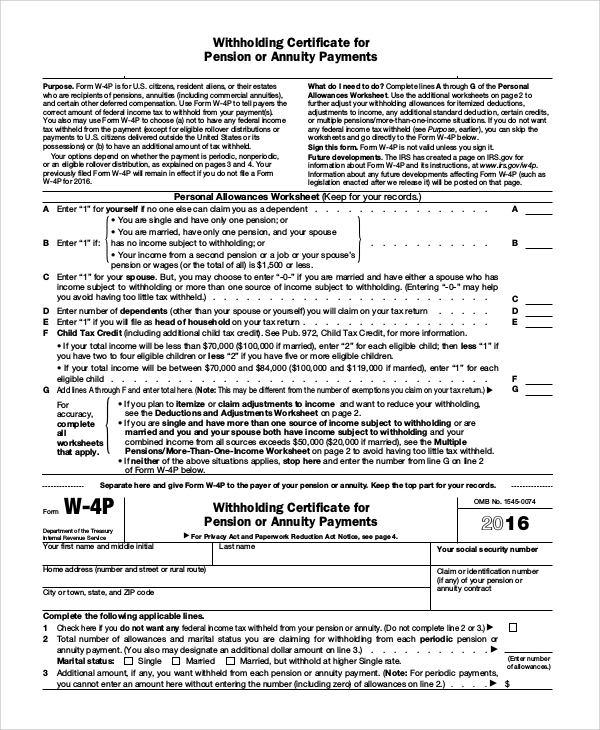

number of claimed withholding allowances

It is important to specify the amount of withholding allowances which you wish to claim on the W-4 form. This is important since your wages could depend on the tax amount you pay.

There are a variety of factors which affect the allowance amount you are able to apply for. If you’re married you could be eligible for a head-of-household exemption. The amount you can claim will depend on the income you earn. If you make a lot of income, you may be eligible for a higher allowance.

Tax deductions that are appropriate for you could aid you in avoiding large tax bills. In fact, if you complete your yearly income tax return, you could even receive a refund. However, be cautious about your approach.

As with any financial decision, it is important to research the subject thoroughly. To determine the amount of withholding allowances to be claimed, you can utilize calculators. An expert might be a viable option.

Submission of specifications

Employers must inform the IRS of any withholding taxes that are being taken from employees. If you are unable to collect the taxes, you are able to send paperwork to IRS. A withholding tax reconciliation, a quarterly tax return, as well as an annual tax return are examples of other paperwork you may have to file. Here are some specifics about the various types of tax forms for withholding as well as the filing deadlines.

In order to be qualified for reimbursement of withholding taxes on the salary, bonus, commissions or other income received from your employees it is possible to submit withholding tax return. Additionally, if you pay your employees on-time it could be possible to qualify to receive reimbursement for taxes that were withheld. Be aware that these taxes could be considered as taxation by the county. There are also unique withholding strategies which can be utilized under certain conditions.

The IRS regulations require that you electronically submit withholding documents. The Federal Employer identification number should be included when you submit to your tax return for the nation. If you don’t, you risk facing consequences.