What Form Is State Withholding Return – There stand a digit of explanations why somebody could decide to fill out a form for withholding. The reasons include the need for documentation, withholding exemptions, and the quantity of requested withholding allowances. There are certain important things to keep in mind, regardless of the reason the person fills out the form.

Withholding exemptions

Non-resident aliens must complete Form 1040-NR every year. If you satisfy these conditions, you could be able to claim an exemption from the withholding forms. This page will provide the exclusions.

The application of Form 1042-S to Form 1042-S is a first step to submit Form 1040-NR. The form outlines the withholdings made by the agency. Make sure you fill out the form correctly. There is a possibility for a person to be treated differently if the information isn’t provided.

Non-resident aliens are subjected to a 30% withholding rate. An exemption from withholding may be possible if you’ve got a an income tax burden of lower than 30%. There are many exclusions. Certain of them apply to spouses, dependents, or children.

In general, you’re entitled to a reimbursement under chapter 4. Refunds are permitted under Sections 1471-1474. Refunds are given by the agent who withholds tax. The withholding agent is the individual responsible for withholding the tax at the point of origin.

Relational status

A valid marital status withholding will make it easier for you and your spouse to complete your tasks. You’ll be amazed by the amount that you can deposit at the bank. It can be difficult to choose what option you will choose. Certain aspects should be avoided. The wrong decision can cause you to pay a steep price. If you stick to it and pay attention to the instructions, you won’t encounter any issues. If you’re lucky, you could make new acquaintances on your journey. Today is the anniversary date of your wedding. I’m hoping that they will make it work against you to get you the perfect engagement ring. If you want to do this correctly, you’ll need the advice of a tax expert who is certified. The small amount of money you pay is worth the time and money. There is a wealth of information on the internet. TaxSlayer is a reputable tax preparation firm.

The amount of withholding allowances claimed

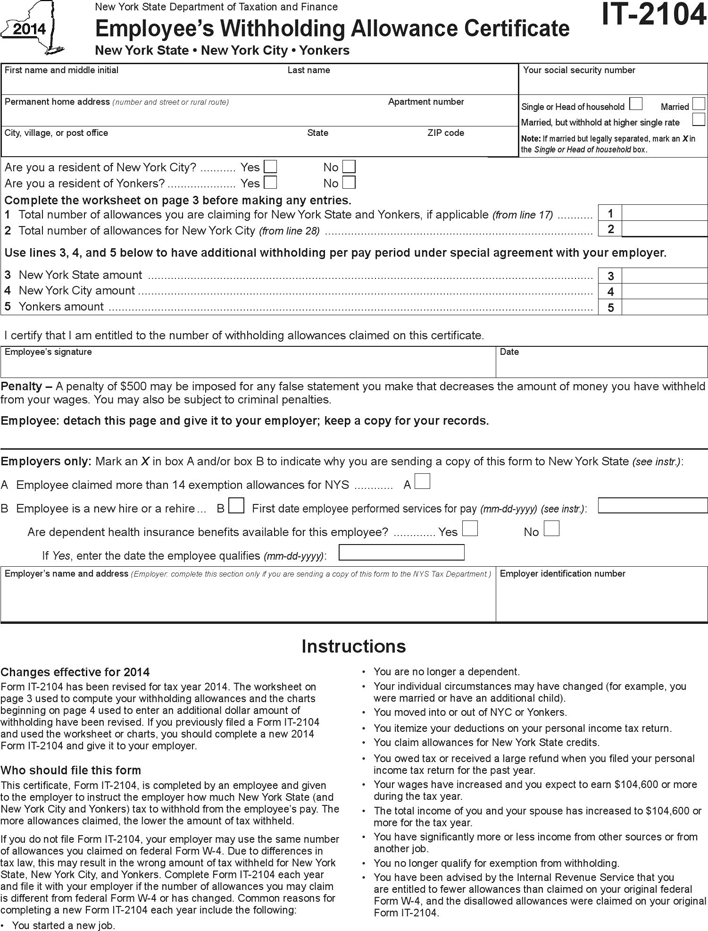

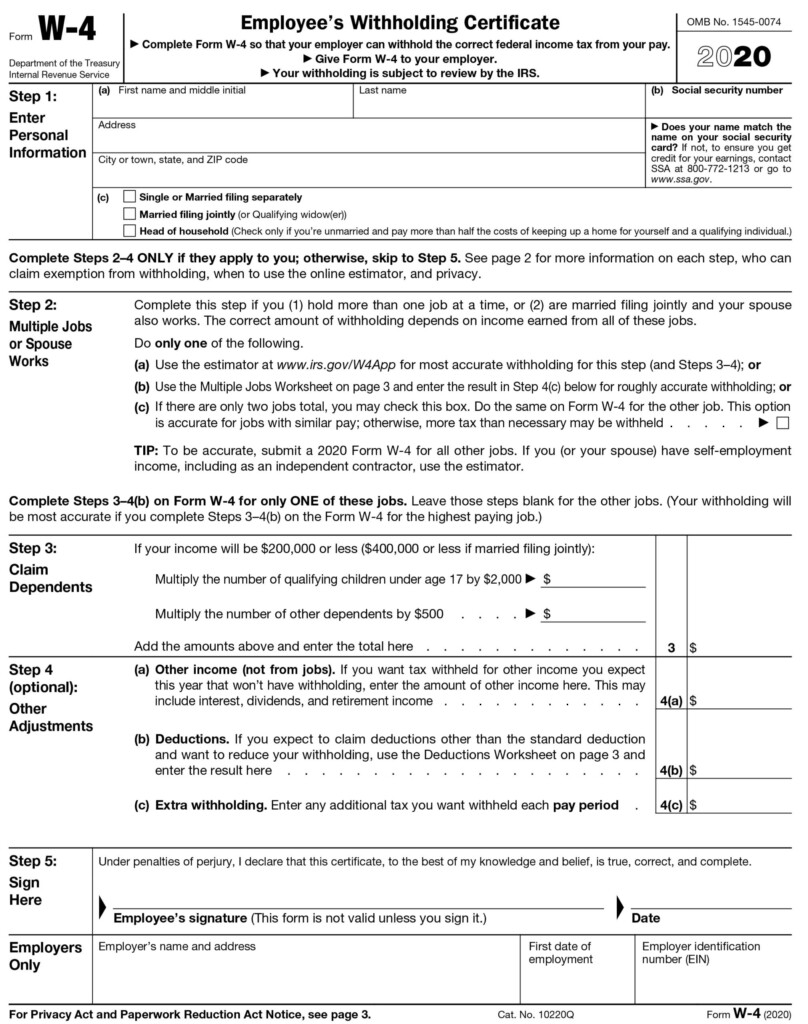

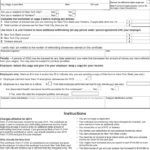

When submitting Form W-4, you should specify the number of withholdings allowances you would like to claim. This is critical as your paychecks may be affected by the amount of tax you have to pay.

You may be able to apply for an exemption on behalf of the head of your household when you’re married. The amount you earn will affect the amount of allowances you are eligible for. If you earn a substantial amount of income, you may get a bigger allowance.

It can save you lots of money by choosing the correct amount of tax deductions. You may even get a refund if you file your annual tax return. It is important to be cautious regarding how you go about this.

Like any financial decision you make it is crucial to research the subject thoroughly. To determine the amount of tax withholding allowances to be claimed, make use of calculators. A professional might be a viable alternative.

Filing specifications

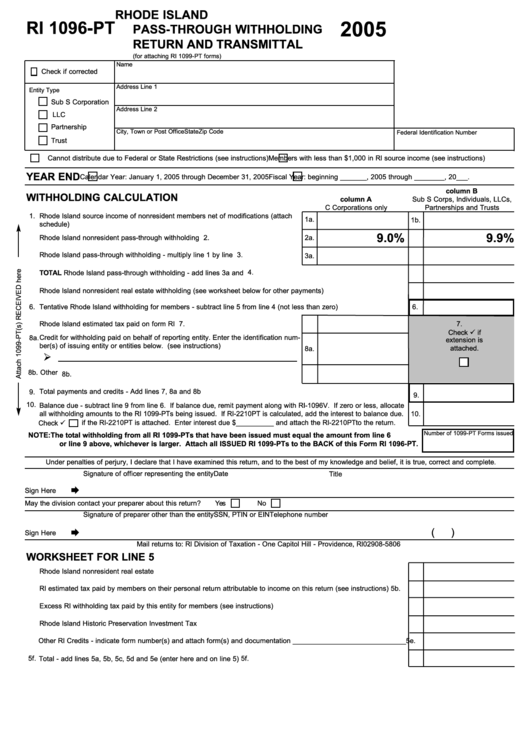

Employers must collect withholding taxes from their employees and report the amount. If you are unable to collect the taxes, you are able to provide documentation to the IRS. Additional paperwork that you may need to submit include a withholding tax reconciliation and quarterly tax returns and an annual tax return. Here are some information on the different types of tax withholding forms along with the filing deadlines.

You may have to file withholding tax returns to claim the earnings you earn from employees, like bonuses or commissions. You may also have to file for salary. Additionally, if you pay your employees on time you may be eligible for reimbursement for any taxes that were not withheld. It is important to note that some of these taxes are local taxes. There are special methods of withholding that are suitable in certain situations.

In accordance with IRS regulations, you must electronically submit forms for withholding. If you are submitting your tax return for national revenue, please include the Federal Employer Identification number. If you don’t, you risk facing consequences.