What Form Is Filled Out For Tax Withholding – There stand a digit of explanations why somebody could decide to complete a withholding form. This includes documentation requirements and withholding exemptions. Whatever the reason a person chooses to file an application it is important to remember a few aspects to consider.

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR once a year. If you meet the criteria, you could be eligible to be exempt from withholding. This page you’ll see the exemptions that are available to you.

For submitting Form 1040-NR attach Form 1042-S. This form lists the amount withheld by the tax authorities for federal income tax reporting to be used for reporting purposes. Fill out the form correctly. If the correct information isn’t provided, one individual could be taken into custody.

Nonresident aliens have 30 percent withholding tax. Your tax burden must not exceed 30% to be exempt from withholding. There are numerous exemptions. Some of them apply to spouses or dependents like children.

In general, you’re entitled to a reimbursement under chapter 4. According to Sections 1471 through 1474, refunds can be made. Refunds will be made to the agent who withholds tax, the person who withholds taxes from the source.

Status of relationships

A valid marital status withholding can help both you and your spouse to do your work. You’ll be amazed at the amount that you can deposit at the bank. Knowing which of the several options you’re likely to pick is the tough part. Be cautious about with what you choose to do. It’s costly to make a wrong decision. If the rules are followed and you pay attention to the rules, you shouldn’t have any problems. You may make new acquaintances if fortunate. Today is your anniversary. I’m hoping that you can leverage it to find that perfect ring. To complete the task correctly you must get the help of a certified tax expert. A lifetime of wealth is worth that small amount. It is a good thing that you can access a ton of information online. TaxSlayer and other reputable tax preparation companies are some of the top.

Number of claimed withholding allowances

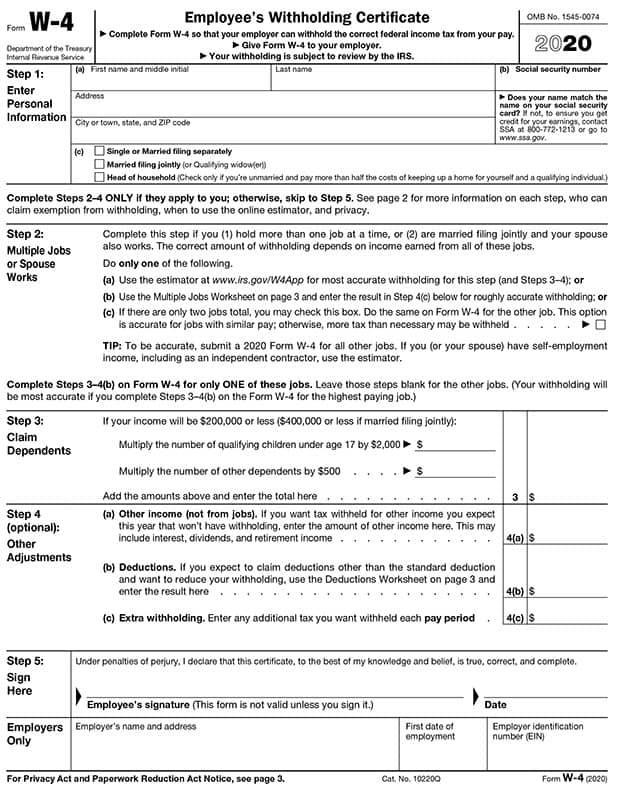

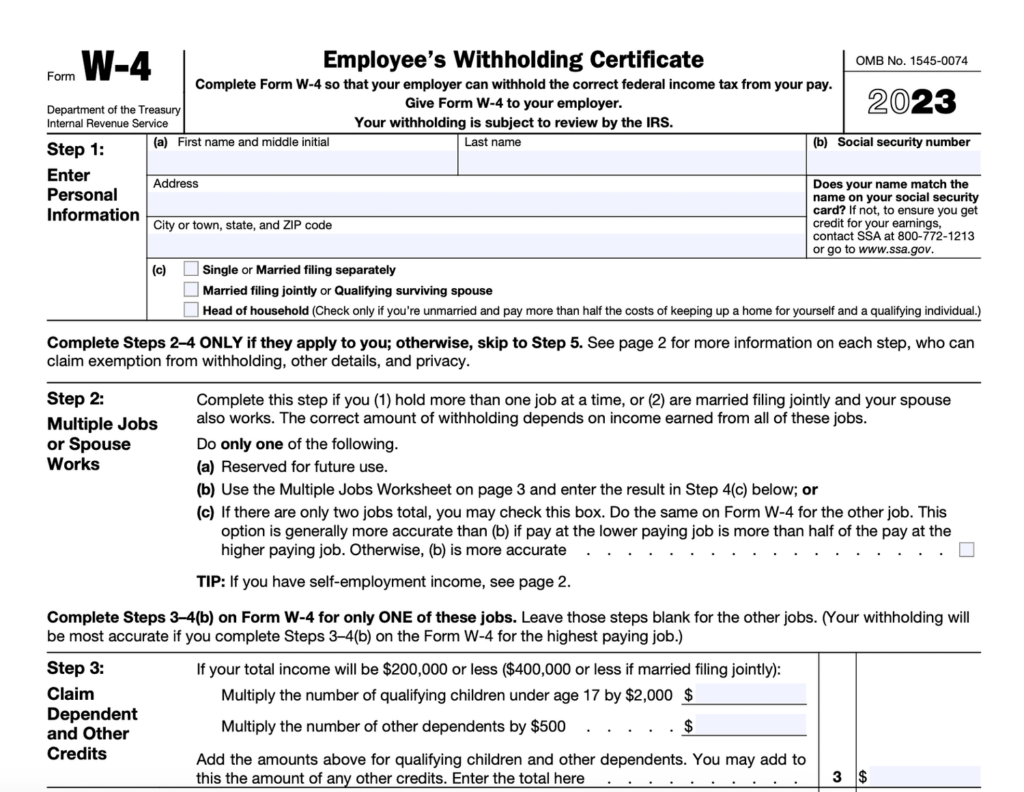

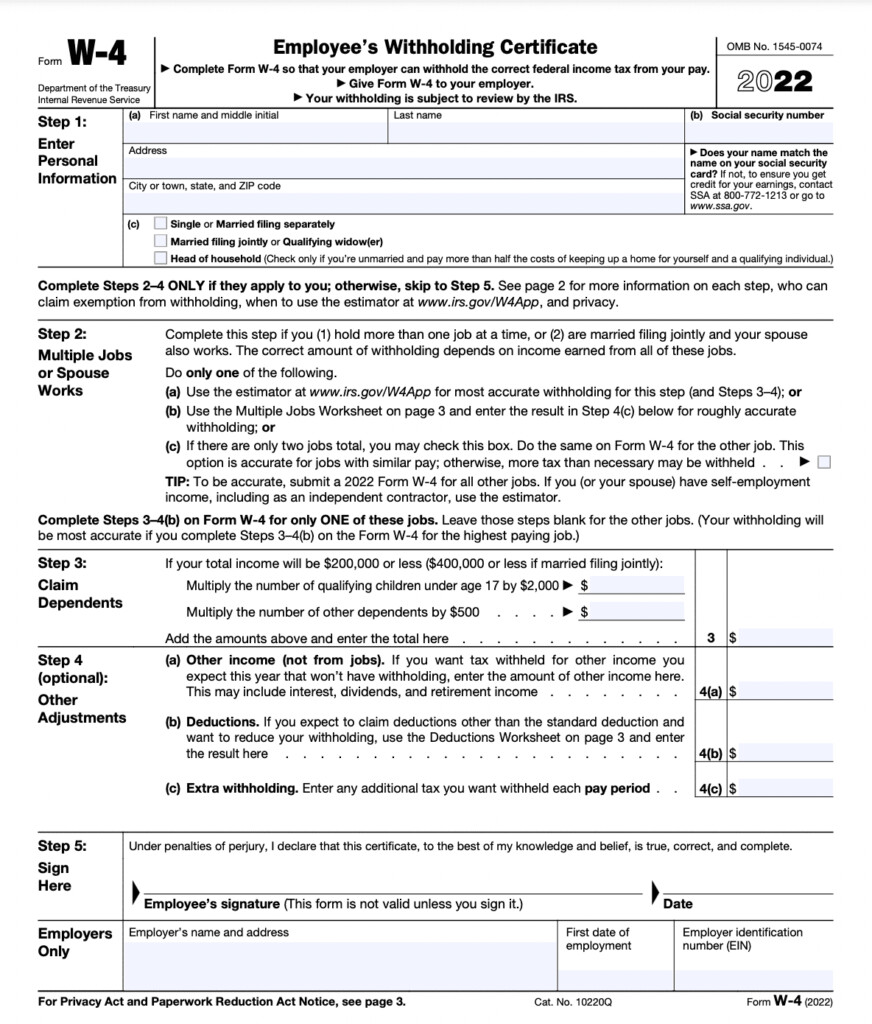

The Form W-4 must be completed with the amount of withholding allowances you wish to claim. This is important because the tax amount withdrawn from your pay will depend on how much you withhold.

You could be eligible to apply for an exemption on behalf of your spouse in the event that you are married. You can also claim more allowances depending on how much you earn. You can apply for an increase in allowances if you have a large amount of income.

A tax deduction that is appropriate for your situation could help you avoid large tax bills. The possibility of a refund is possible if you submit your tax return on income for the current year. But it is important to choose the right approach.

Conduct your own research, just like you would with any financial decision. Calculators are readily available to help you determine how much withholding allowances you can claim. Other options include talking to an expert.

Specifications that must be filed

Employers are required to report the company who withholds taxes from employees. The IRS will accept documents for certain taxes. You may also need additional forms that you might need, such as an annual tax return, or a withholding reconciliation. Here’s some information about the different forms of withholding tax categories and the deadlines for filling them out.

Tax withholding returns can be required for income like bonuses, salary or commissions as well as other earnings. Additionally, if you paid your employees in time, you may be eligible for reimbursement of taxes that you withheld. It is important to note that not all of these taxes are local taxes. There are also unique withholding procedures that can be used in specific circumstances.

In accordance with IRS rules, you are required to electronically submit withholding forms. The Federal Employer identification number should be included when you submit at your national tax return. If you don’t, you risk facing consequences.