West Virginia State Tax Withholding Forms – There are many reasons why an individual might want to fill out a withholding form. This is due to the requirement for documentation, exemptions to withholding and also the amount of withholding allowances. No matter what the reason is for an individual to file documents it is important to remember certain points that you need to remember.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once every year to file Form1040-NR. However, if you meet the minimum requirements, you could be eligible for an exemption form from withholding. The exemptions you will find here are yours.

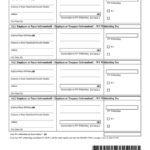

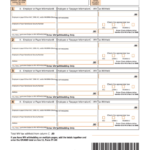

For submitting Form 1040-NR include Form 1042-S. For federal income tax reporting reasons, this form details the withholding made by the tax agency that handles withholding. Complete the form in a timely manner. This information might not be disclosed and cause one person to be treated differently.

The tax withholding rate for non-resident aliens is 30%. If your tax burden is lower than 30 percent of your withholding, you could be eligible to be exempt from withholding. There are a variety of exemptions offered. Certain are only for spouses and dependents, such as children.

In general, you’re entitled to a reimbursement under chapter 4. Refunds are made according to Sections 471 through 474. These refunds are made by the agent who withholds tax (the person who withholds tax at the source).

Status of relationships

The proper marital status and withholding forms can simplify the work of you and your spouse. You’ll also be surprised by with the amount of money you can deposit at the bank. The problem is deciding what option to select. You should be careful what you do. The wrong decision can cost you dearly. If you adhere to the directions and adhere to them, there won’t be any problems. It is possible to make new acquaintances if fortunate. Today is your anniversary. I’m hoping that they will make it work against you in order to assist you in getting the elusive engagement ring. It will be a complicated job that requires the experience of a tax professional. It’s worth it to build wealth over the course of a lifetime. It is a good thing that you can access a ton of information online. TaxSlayer is a trusted tax preparation firm.

There are a lot of withholding allowances that are being made available

The form W-4 should be completed with the amount of withholding allowances that you want to take advantage of. This is vital since it will affect how much tax you receive from your wages.

Many factors affect the allowances requested.If you’re married as an example, you may be able to apply for a head of household exemption. Additionally, you can claim additional allowances based on the amount you earn. If you have high income it could be possible to receive higher amounts.

You might be able to reduce the amount of your tax bill by deciding on the correct amount of tax deductions. In fact, if you submit your annual income tax return, you might even receive a refund. You need to be careful when it comes to preparing this.

Like any financial decision it is essential to conduct your research. Calculators can be utilized to determine the amount of withholding allowances that need to be requested. An alternative is to speak with a professional.

Specifications for filing

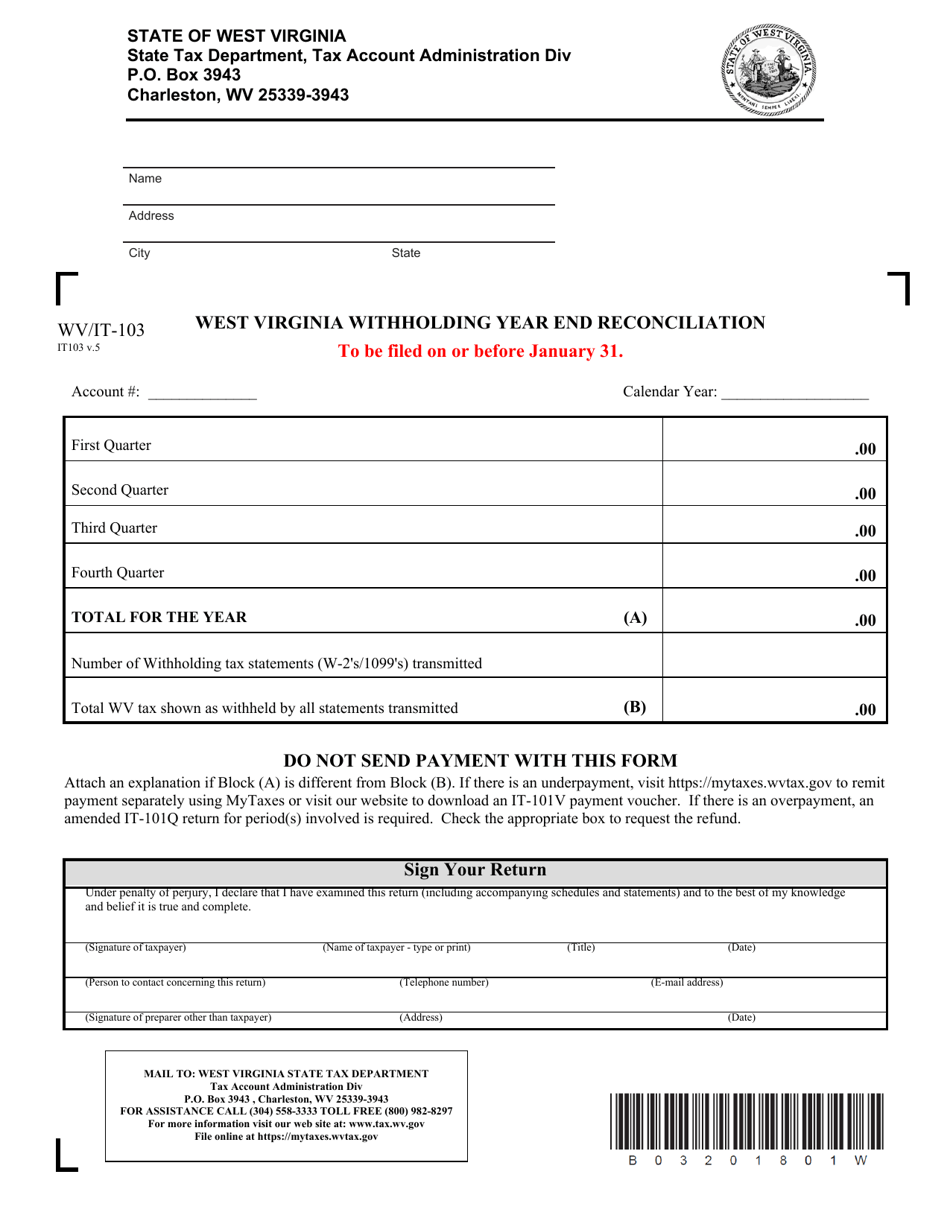

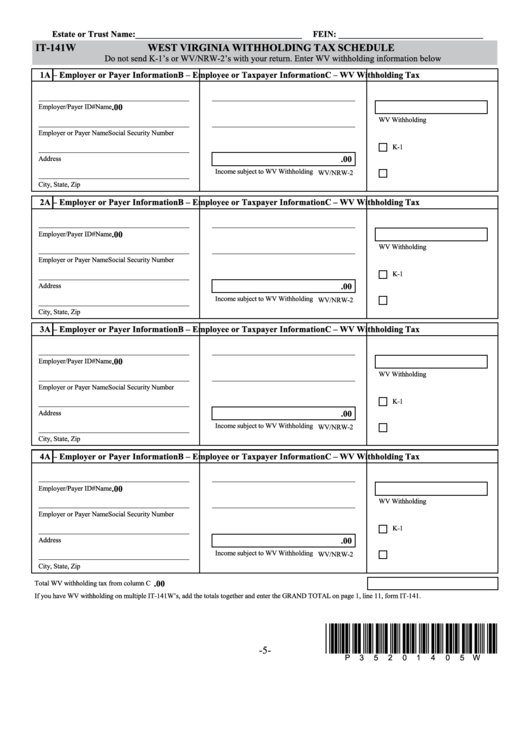

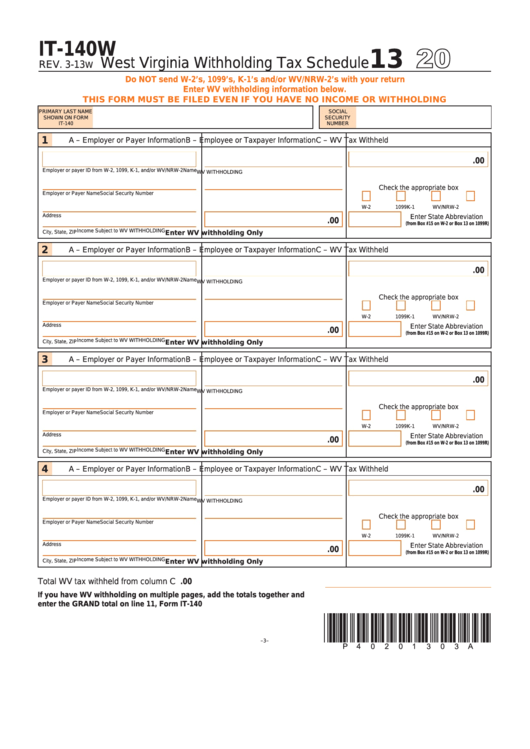

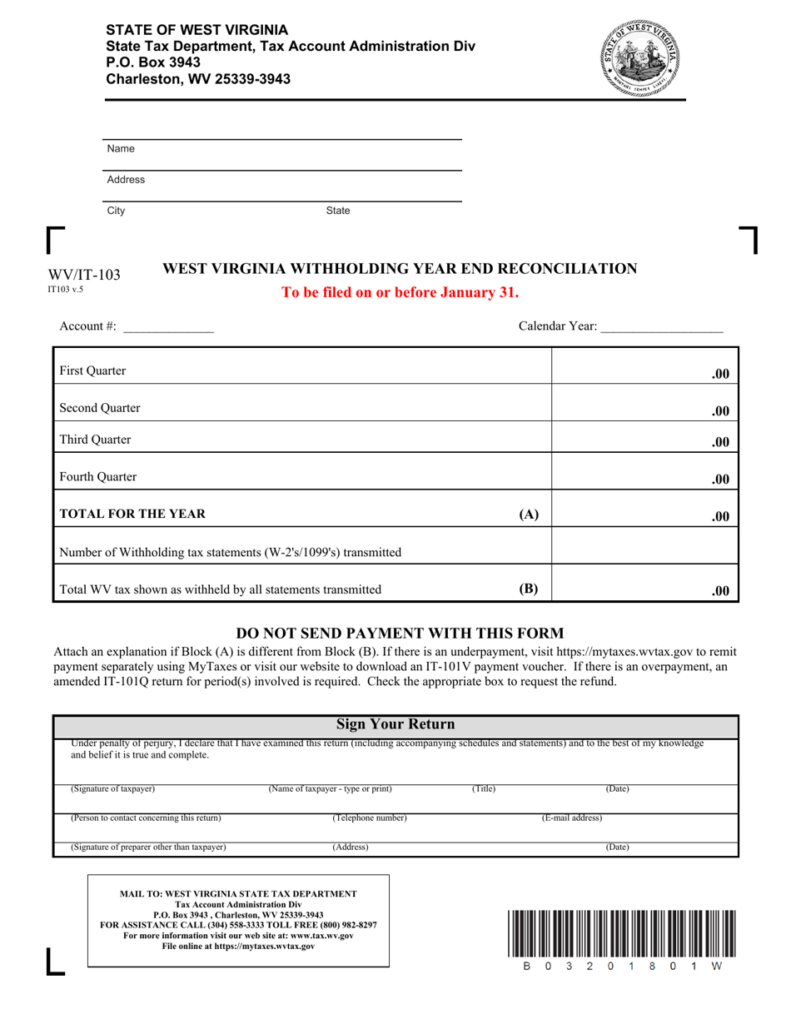

Withholding tax from employees need to be collected and reported when you are an employer. If you are taxed on a specific amount you can submit paperwork to IRS. There are other forms you may require for example, the quarterly tax return or withholding reconciliation. Here’s some information about the different tax forms, and when they need to be filed.

You might have to file tax returns withholding in order to report the income you get from employees, such as bonuses or commissions. You may also have to file for salary. In addition, if you pay your employees in time, you may be eligible to receive reimbursement for taxes that were withheld. The fact that some of these taxes are county taxes must be taken into consideration. In some situations, withholding rules can also be unique.

Electronic filing of withholding forms is required according to IRS regulations. When you file your national tax return make sure you include your Federal Employer Identification number. If you don’t, you risk facing consequences.