Washington State Tax Withholding Form – There are many reasons why one might choose to fill out forms for withholding. This includes the need for documentation, exemptions from withholding and also the amount of required withholding allowances. There are some important things to keep in mind regardless of why the person fills out the form.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR once each year. If you fulfill the requirements, you might be eligible to submit an exemption from withholding form. This page will list all exclusions.

If you are submitting Form1040-NR to the IRS, include Form 1042S. The form is used to record the federal income tax. It details the withholding of the withholding agent. Make sure you enter the correct information as you complete the form. If the correct information isn’t provided, one individual could be treated.

The non-resident alien withholding rate is 30%. An exemption from withholding may be available if you have the tax burden lower than 30%. There are numerous exemptions. Some are only for spouses or dependents like children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds are permitted under Sections 1471-1474. Refunds are provided by the agent who withholds tax. This is the individual who is responsible for withholding tax at the source.

Status of relationships

A form for a marital withholding is a good way to make your life easier and aid your spouse. The bank may be surprised by the amount of money that you have to deposit. It can be difficult to decide which of the many options is most attractive. Be cautious about what you do. A bad decision can cost you a lot. But, if the directions are adhered to and you are attentive you shouldn’t face any issues. If you’re fortunate you may even meet a few new pals when you travel. Today is the anniversary. I’m hoping you’ll be able to apply it against them in order to find the elusive diamond. For a successful approach, you will need the help of a certified accountant. The accumulation of wealth over time is more than the modest payment. You can find plenty of information online. Reputable tax preparation firms like TaxSlayer are among the most efficient.

Number of claimed withholding allowances

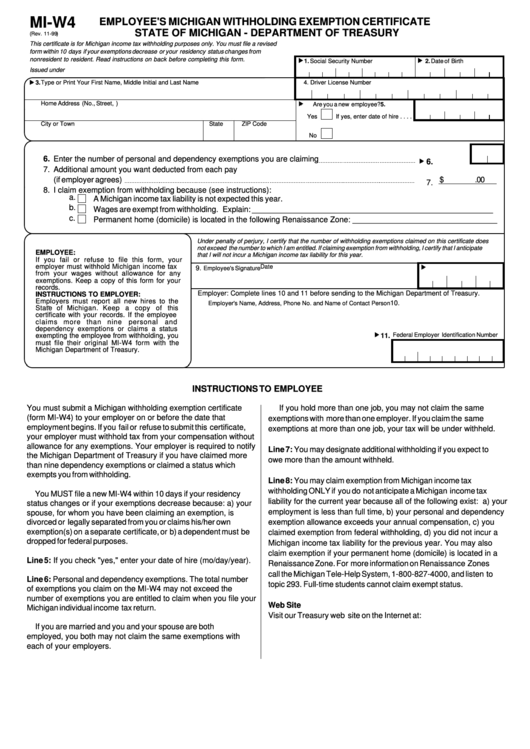

In submitting Form W-4 you need to specify how many withholdings allowances you would like to claim. This is crucial since the tax withheld will impact how much is taken from your paycheck.

There are many variables that influence the allowance amount you are able to claim. If you’re married you might be qualified for an exemption for head of household. Your income also determines how many allowances you are entitled to. If you earn a significant amount of money, you could be eligible for a larger allowance.

A tax deduction that is appropriate for your situation could aid you in avoiding large tax payments. You may even get a refund if you file your annual income tax return. Be sure to select the right method.

Just like with any financial decision it is essential to research the subject thoroughly. Calculators can assist you in determining how much withholding allowances are required to be claimed. A professional could be a good alternative.

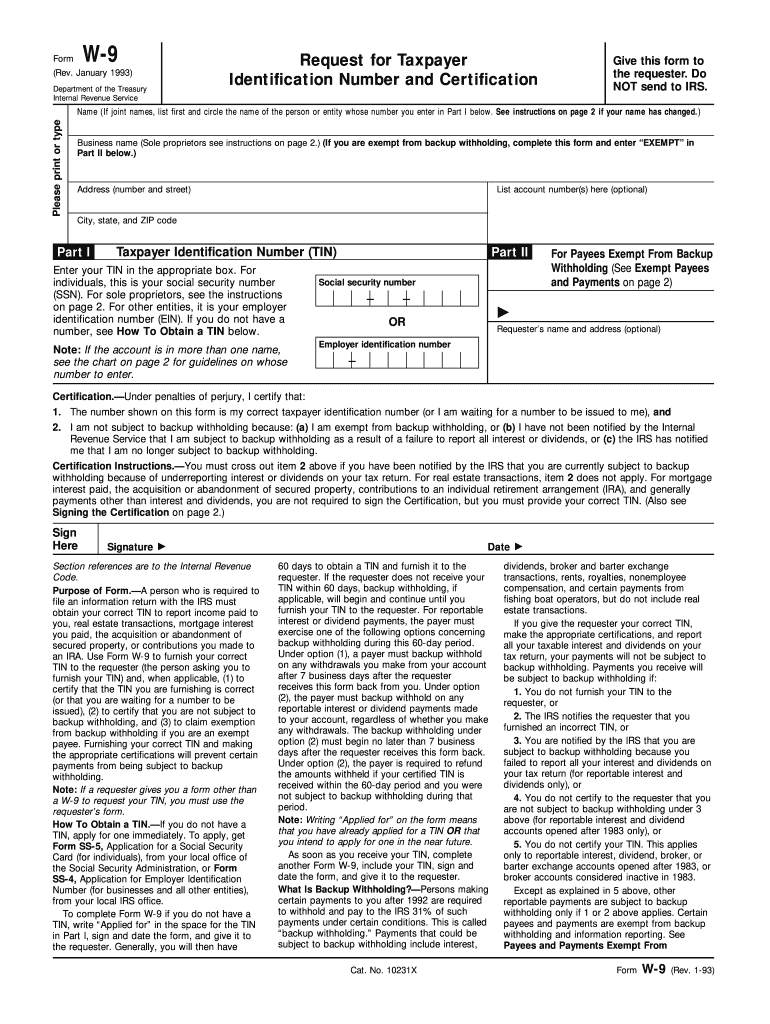

Formulating specifications

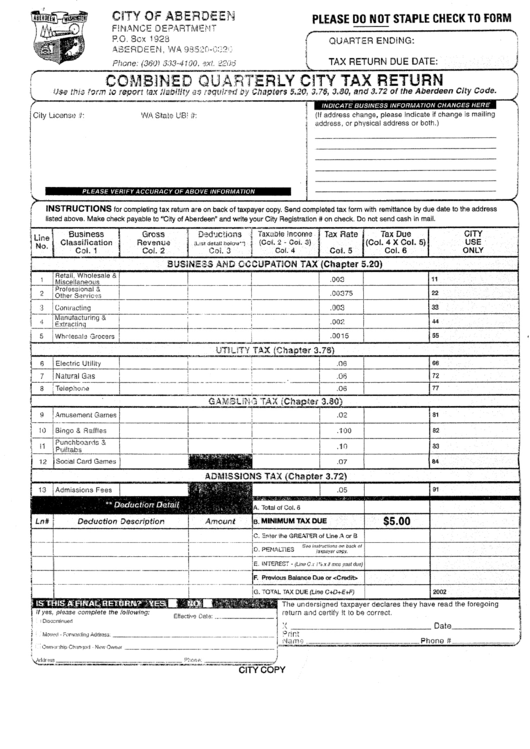

Withholding taxes from your employees have to be collected and reported when you’re an employer. The IRS can accept paperwork for certain taxes. You might also need additional documentation such as a withholding tax reconciliation or a quarterly tax return. Below are details about the different withholding tax forms and their deadlines.

In order to be eligible for reimbursement of withholding taxes on the salary, bonus, commissions or other income received from your employees You may be required to submit withholding tax return. You could also be eligible to get reimbursements of taxes withheld if you’re employees received their wages promptly. Be aware that these taxes could be considered as taxation by the county. There are special withholding strategies that may be suitable in certain circumstances.

The IRS regulations require that you electronically file withholding documents. It is mandatory to include your Federal Employer Identification Number when you point your national income tax return. If you don’t, you risk facing consequences.