Wage Withholding Form – There are a variety of reasons why a person could choose to submit an application for withholding. These factors include the documents required, the exclusion of withholding, and the requested withholding allowances. It doesn’t matter what reason someone chooses to file the Form There are a few points to be aware of.

Exemptions from withholding

Non-resident aliens must submit Form 1040-NR once a year. If you satisfy the requirements, you may be eligible for an exemption to withholding. You will discover the exclusions that you can access on this page.

To complete Form 1040-NR, add Form 1042-S. For federal income tax reporting purposes, this form outlines the withholding made by the tax agency that handles withholding. Fill out the form correctly. If this information is not supplied, one person may be treated.

The non-resident alien tax withholding rate is 30 percent. Nonresident aliens could be qualified for an exemption. This is if your tax burden is less than 30 percent. There are numerous exemptions. Some of these exclusions are only applicable to spouses and dependents such as children.

In general, you’re eligible to receive a refund in accordance with chapter 4. In accordance with Section 1471 through 1474, refunds are granted. The refunds are made to the withholding agent, the person who withholds the tax from the source.

Relational status

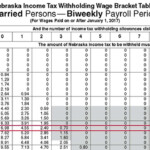

A form for a marital withholding can make your life easier and aid your spouse. Additionally, the quantity of money you may deposit at the bank could surprise you. The problem is choosing the right option from the multitude of choices. You should be careful when you make a decision. Making the wrong choice could result in a significant cost. However, if the instructions are followed and you pay attention to the rules, you shouldn’t have any problems. If you’re fortunate, you might even make a few new pals while traveling. In the end, today is the date of your wedding anniversary. I’m hoping you’ll be able to use it against them to search for that one-of-a-kind wedding ring. It is best to seek the advice of a certified tax expert to finish it properly. A small amount of money can make a lifetime of wealth. There are numerous online resources that can provide you with information. Reputable tax preparation firms like TaxSlayer are one of the most useful.

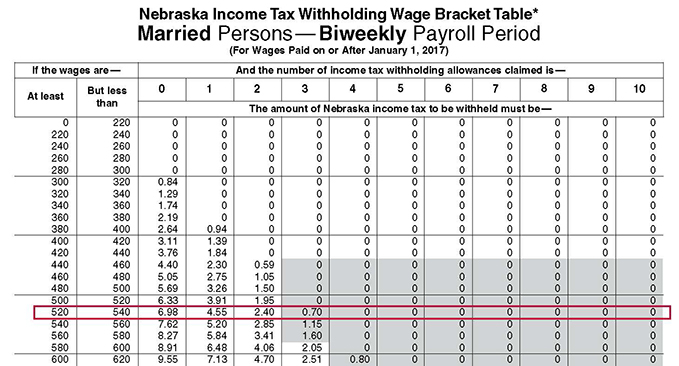

The amount of withholding allowances claimed

You need to indicate how many withholding allowances you want to be able to claim on the form W-4 that you file. This is important since it will affect how much tax you receive from your paychecks.

There are a variety of factors that can influence the amount you qualify for allowances. Your income level also affects how many allowances you are entitled to. If you earn a significant amount of money, you could get a bigger allowance.

The right amount of tax deductions could aid you in avoiding a substantial tax cost. In addition, you could even receive a tax refund if your annual income tax return is completed. But, you should be aware of your choices.

Like any other financial decision, you should do your homework. Calculators are a great tool to figure out how many withholding allowances you should claim. It is also possible to speak with an expert.

Submission of specifications

Employers must report the employer who withholds tax from employees. In the case of a small amount of these taxes, you may submit paperwork to IRS. A tax return for the year, quarterly tax returns or the reconciliation of withholding tax are all types of documents you could need. Here’s some information about the different tax forms and when they need to be filed.

In order to be eligible for reimbursement of withholding tax on the compensation, bonuses, salary or any other earnings earned by your employees You may be required to submit withholding tax return. Also, if your employees receive their wages in time, you could be eligible to get the tax deductions you withheld. It is important to note that not all of these taxes are local taxes. Furthermore, there are special tax withholding procedures that can be implemented in specific conditions.

The IRS regulations require that you electronically file withholding documents. You must provide your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.