Virginia Withholding Exemption Form – There are a variety of reasons someone might choose to complete a withholding form. These factors include the documentation requirements, withholding exclusions, and the requested withholding allowances. There are a few points to be aware of, regardless of the reason that a person has to fill out an application.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR once every year. If the requirements meet, you may be eligible to apply for an exemption from withholding. This page will provide the exclusions.

The first step to submitting Form 1040 – NR is attaching Form 1042 S. The form outlines the withholdings made by the agency. It is crucial to enter exact information when you fill out the form. This information might not be disclosed and result in one person being treated differently.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. Tax burdens is not to exceed 30% to be exempt from withholding. There are many exclusions. Certain exclusions are only applicable to spouses and dependents like children.

In general, you’re eligible for a reimbursement under chapter 4. As per Sections 1471 to 1474, refunds are given. The refunds are given by the agent who withholds tax (the person who is responsible for withholding tax at source).

Relationship status

An official marriage status withholding forms will assist your spouse and you both make the most of your time. You will be pleasantly surprised at how much money you can deposit to the bank. It isn’t easy to determine which one of many choices is most appealing. There are some things you shouldn’t do. False decisions can lead to expensive results. If you adhere to the rules and pay attention to instructions, you won’t run into any problems. If you’re lucky, you might find some new acquaintances while traveling. Today is the anniversary day of your wedding. I’m hoping that you can utilize it to secure the elusive diamond. You’ll need the help from a certified tax expert to finish it properly. A little amount could create a lifetime’s worth of wealth. It is a good thing that you can access many sources of information online. TaxSlayer is among the most trusted and respected tax preparation companies.

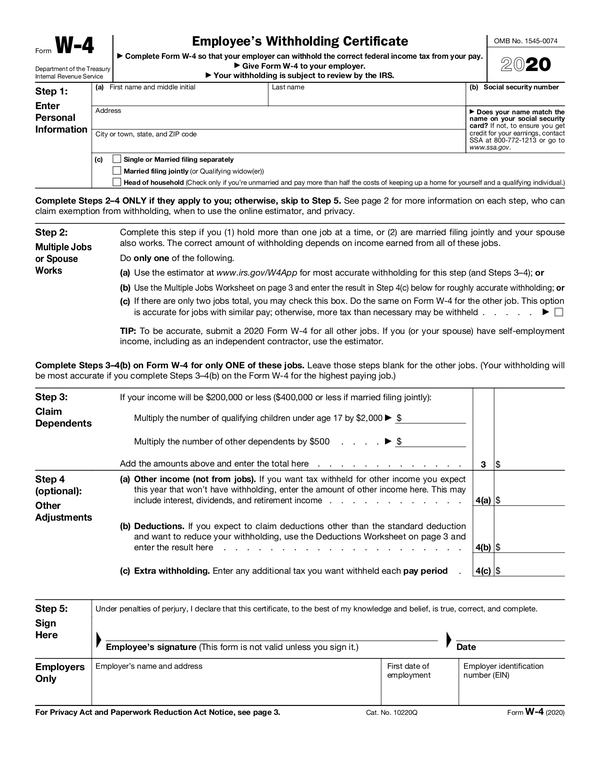

Number of claimed withholding allowances

It is essential to state the amount of withholding allowances you would like to claim on the Form W-4. This is essential since the amount of tax withdrawn from your paychecks will be affected by how much you withhold.

You may be eligible to apply for an exemption on behalf of the head of your household if you are married. Your income level can also impact how many allowances are offered to you. If you earn a high amount it could be possible to receive more allowances.

It can save you thousands of dollars by determining the right amount of tax deductions. Refunds could be possible if you submit your tax return on income for the year. You need to be careful about how you approach this.

Just like with any financial decision, it is important to do your homework. Calculators can be used to determine the amount of withholding allowances you should claim. You may also talk to an expert.

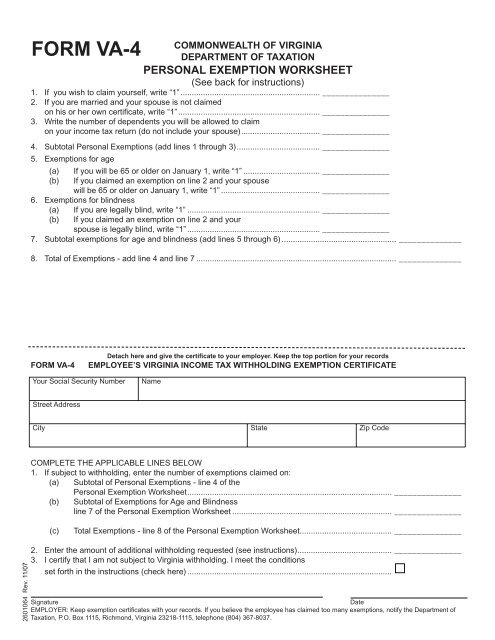

Submitting specifications

Withholding taxes from employees need to be collected and reported in the event that you are an employer. For certain taxes, you may submit paperwork to the IRS. Additional documents that you could require to submit includes an withholding tax reconciliation and quarterly tax returns as well as the annual tax return. Here are the details on different withholding tax forms and the deadlines for each.

You might have to file tax returns withholding to claim the earnings you earn from employees, like bonuses, commissions, or salary. If you also pay your employees on-time it could be possible to qualify for reimbursement for any taxes not withheld. The fact that certain taxes are also county taxes must also be noted. In addition, there are specific withholding practices that can be implemented in specific situations.

In accordance with IRS regulations, you must electronically submit forms for withholding. When you file your tax returns for national revenue make sure you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.