Virginia State Withholding Tax Form 2024 – There are numerous reasons that a person could choose to submit a withholding application. This includes the document requirements, exclusions from withholding, and the requested withholding allowances. Whatever the reason the person decides to fill out the form there are some aspects to consider.

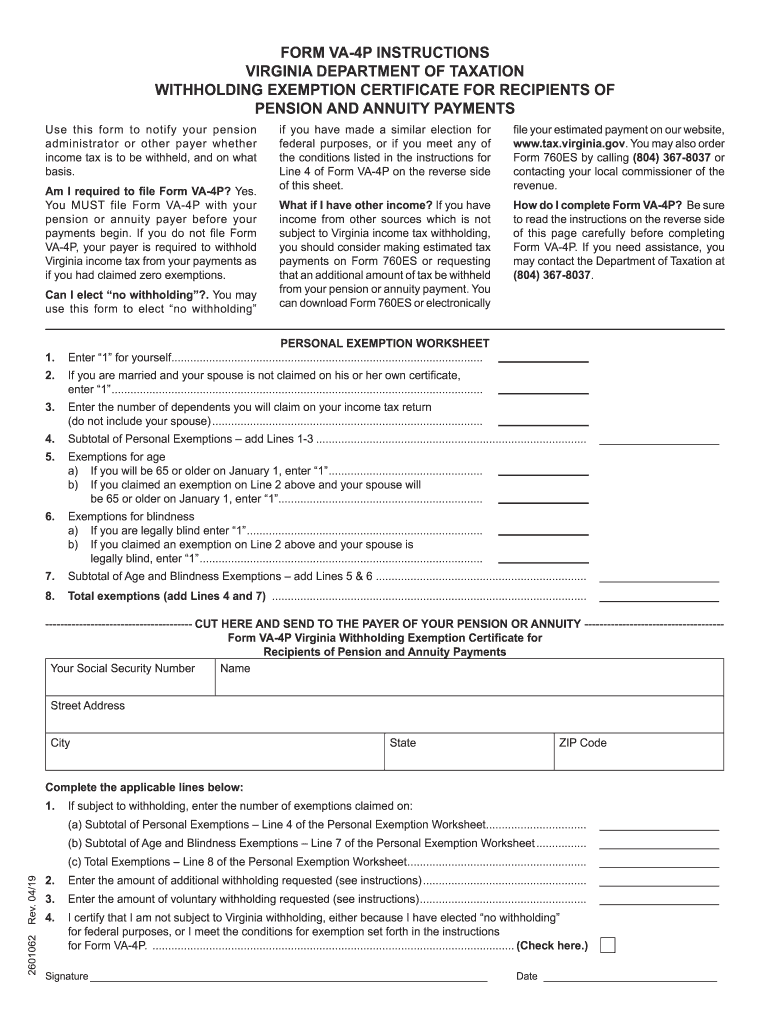

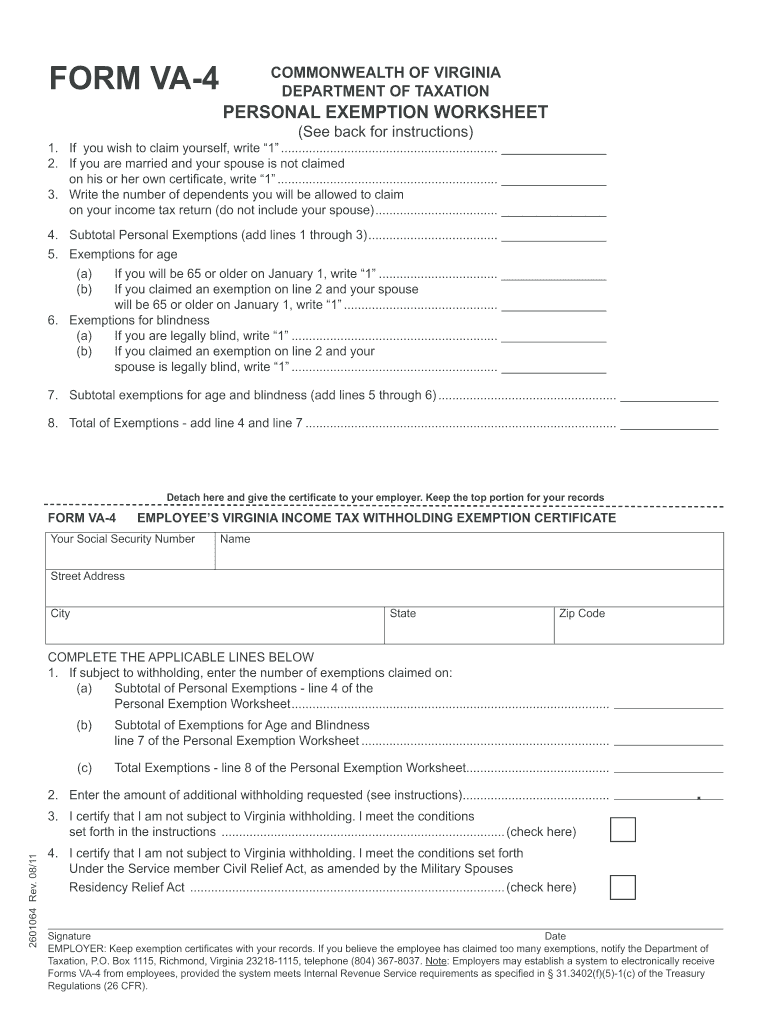

Withholding exemptions

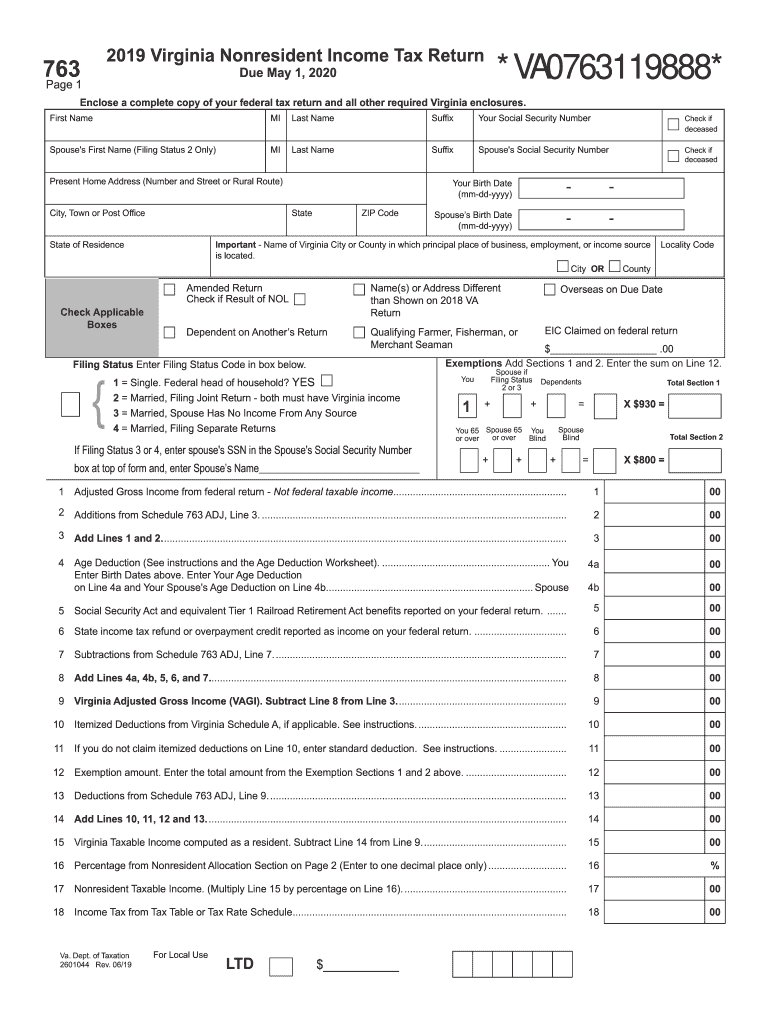

Non-resident aliens must submit Form 1040–NR at least once per calendar year. It is possible to submit an exemption form from withholding if you meet all the criteria. The exclusions are that you can access on this page.

The first step in filling out Form 1040-NR is attaching the Form 1042 S. The form outlines the withholdings that the agency makes. When you fill out the form, make sure you fill in the accurate information. If the correct information isn’t given, a person could be treated.

Non-resident aliens are subject to a 30% withholding rate. If your tax burden is less than 30% of your withholding, you may be eligible to be exempt from withholding. There are a variety of exclusions. Some of them are only available to spouses or dependents like children.

You can claim a refund if you violate the rules of chapter 4. Refunds are granted according to Sections 1471-1474. These refunds are provided by the withholding agent (the person who is responsible for withholding tax at source).

Relational status

An official marital status form withholding forms will assist both of you to make the most of your time. Additionally, the quantity of money that you can deposit at the bank can surprise you. Choosing which of the possibilities you’re most likely to pick is the tough part. You should be careful when you make a decision. It can be costly to make the wrong choice. You won’t have any issues If you simply follow the directions and pay attention. If you’re lucky, you may even make new acquaintances while traveling. Today is the anniversary. I’m hoping they reverse the tide to help you get the elusive engagement ring. It is best to seek the advice of a certified tax expert to ensure you’re doing it right. It’s worthwhile to accumulate wealth over the course of a lifetime. There are numerous websites that offer information. TaxSlayer is one of the most trusted and respected tax preparation firms.

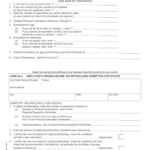

number of claimed withholding allowances

On the Form W-4 that you submit, you must specify the amount of withholding allowances you asking for. This is crucial since the tax withheld will affect the amount taken out of your paycheck.

There are many variables that influence the amount of allowances you can claim. If you’re married you could be qualified for an exemption for head of household. You may also be eligible for higher allowances based on the amount you earn. If you make a lot of money, you might get a bigger allowance.

It can save you thousands of dollars by determining the right amount of tax deductions. In addition, you could even receive a tax refund if your annual income tax return has been completed. It is important to be cautious about how you approach this.

Do your research, just like you would for any financial decision. Calculators are useful for determining how many withholding allowances must be requested. If you prefer to a consultation with a specialist.

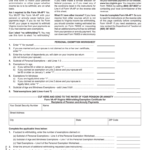

Formulating specifications

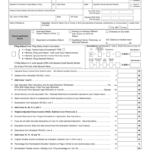

Withholding taxes on your employees have to be collected and reported if you are an employer. You can submit paperwork to the IRS to collect a portion of these taxation. There may be additional documentation , like a withholding tax reconciliation or a quarterly tax return. Here is more information on the various forms of withholding tax and the deadlines to file them.

Your employees may require you to submit withholding taxes return forms to get their wages, bonuses and commissions. If employees are paid on time, you may be eligible for reimbursement of withheld taxes. Be aware that these taxes can be considered as taxation by the county. Furthermore, there are special withholding practices that can be implemented in specific situations.

You must electronically submit withholding forms according to IRS regulations. You must include your Federal Employer ID Number when you point at your income tax return from the national tax system. If you don’t, you risk facing consequences.