Vermont Withholding Form Wht-436 – There are many reasons why one might choose to fill out forms withholding. This includes documentation requirements and exemptions from withholding. You must be aware of these things regardless of the reason you decide to submit a request form.

Withholding exemptions

Nonresident aliens are required once a year to submit Form1040-NR. However, if you satisfy the criteria, you may be eligible for an exemption from the withholding form. This page will provide the exclusions.

The attachment of Form 1042-S is the first step in submitting Form 1040-NR. To report federal income tax purposes, this form details the withholdings made by the tax agency that handles withholding. It is essential to fill in exact information when you fill out the form. There is a possibility for one person to be treated differently if the information isn’t provided.

Nonresident aliens have a 30% withholding tax. A nonresident alien may be qualified for exemption. This is the case if your tax burden less than 30 percent. There are several different exclusions offered. Certain are only for spouses and dependents, such as children.

In general, chapter 4 withholding entitles you to a refund. Refunds are granted according to Sections 1401, 1474, and 1475. Refunds will be made to the agent who withholds tax, the person who withholds the tax at the source.

Status of relationships

The proper marital status and withholding forms will ease the job of both you and your spouse. You’ll be amazed by the amount of money you can put in the bank. The trick is to decide which of the numerous options to choose. There are certain actions you shouldn’t do. Unwise decisions could lead to expensive results. But if you follow it and pay attention to the instructions, you won’t encounter any issues. If you’re lucky, you may even make new acquaintances while traveling. Today is the anniversary. I hope you will use it against them to locate that perfect ring. It will be a complicated job that requires the experience of a tax professional. A little amount could create a lifetime’s worth of wealth. It is a good thing that you can access plenty of information on the internet. TaxSlayer is among the most trusted and respected tax preparation firms.

There are many withholding allowances that are being claimed

You must specify how many withholding allowances you want to claim on the Form W-4 you submit. This is crucial since the withholdings will have an effect on the amount of tax that is taken from your paycheck.

The amount of allowances you get will be contingent on a variety of factors. For instance when you’re married, you may be eligible for a head or household exemption. Your income level can also determine the amount of allowances accessible to you. A larger allowance might be granted if you make an excessive amount.

Making the right choice of tax deductions can save you from a large tax payment. If you file your annual income tax return, you may even receive a refund. But be sure to choose the right method.

In any financial decision, it is important to conduct your own research. Calculators can be used to figure out how many withholding allowances should be claimed. An expert could be a good alternative.

Specifications to be filed

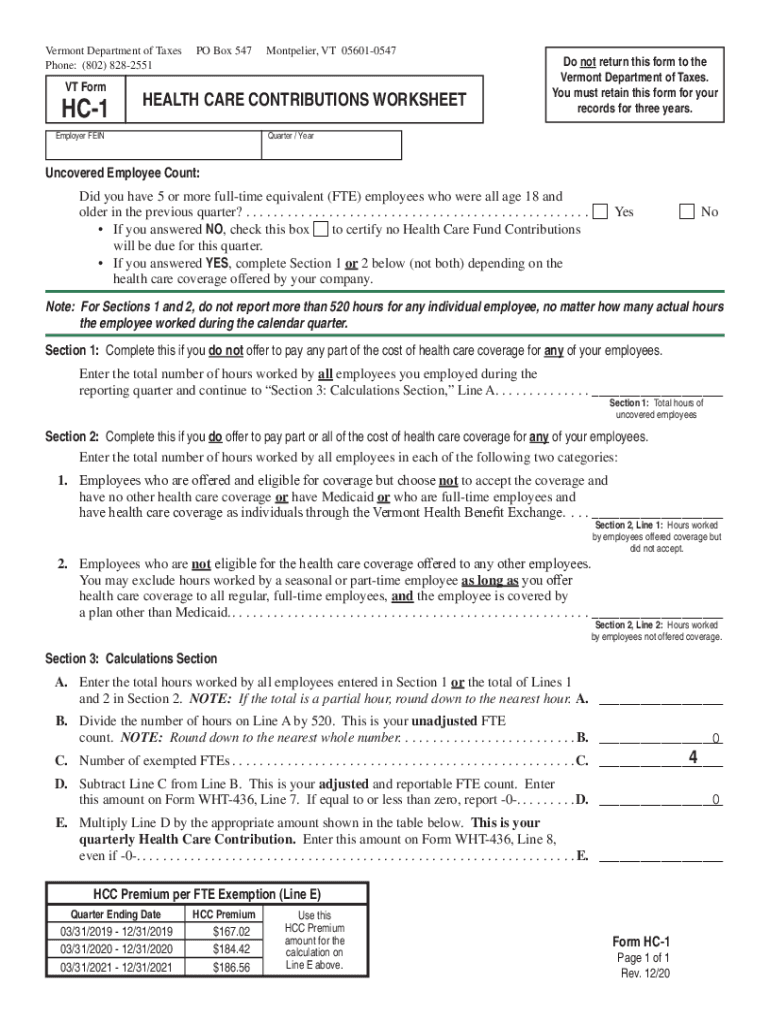

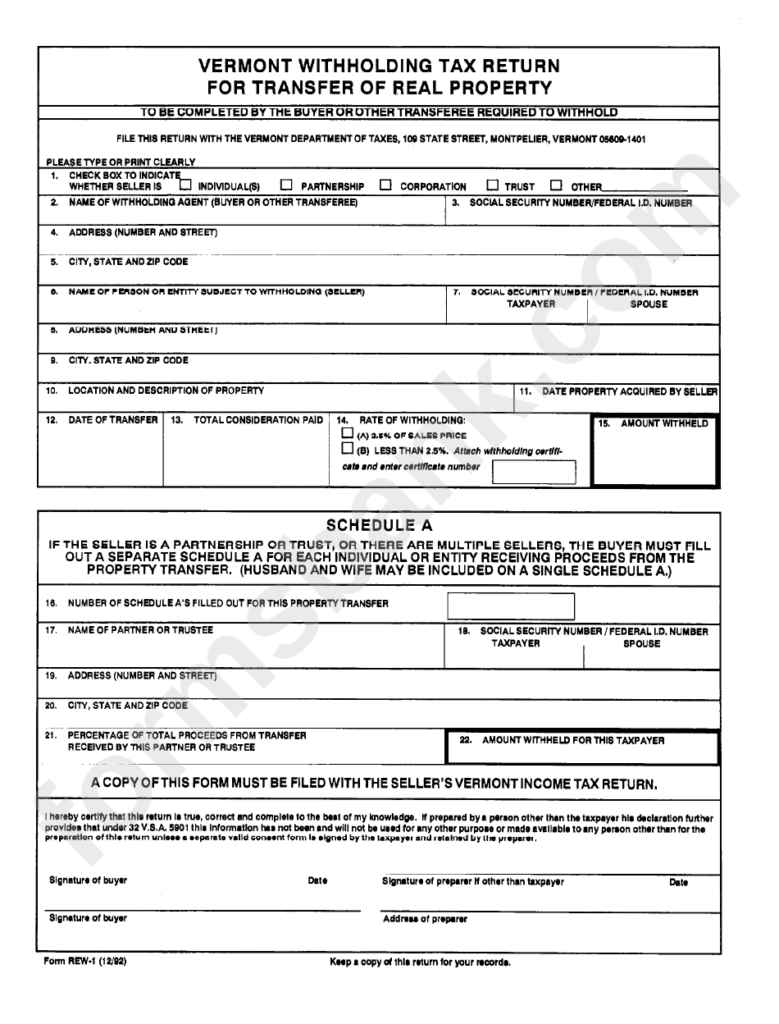

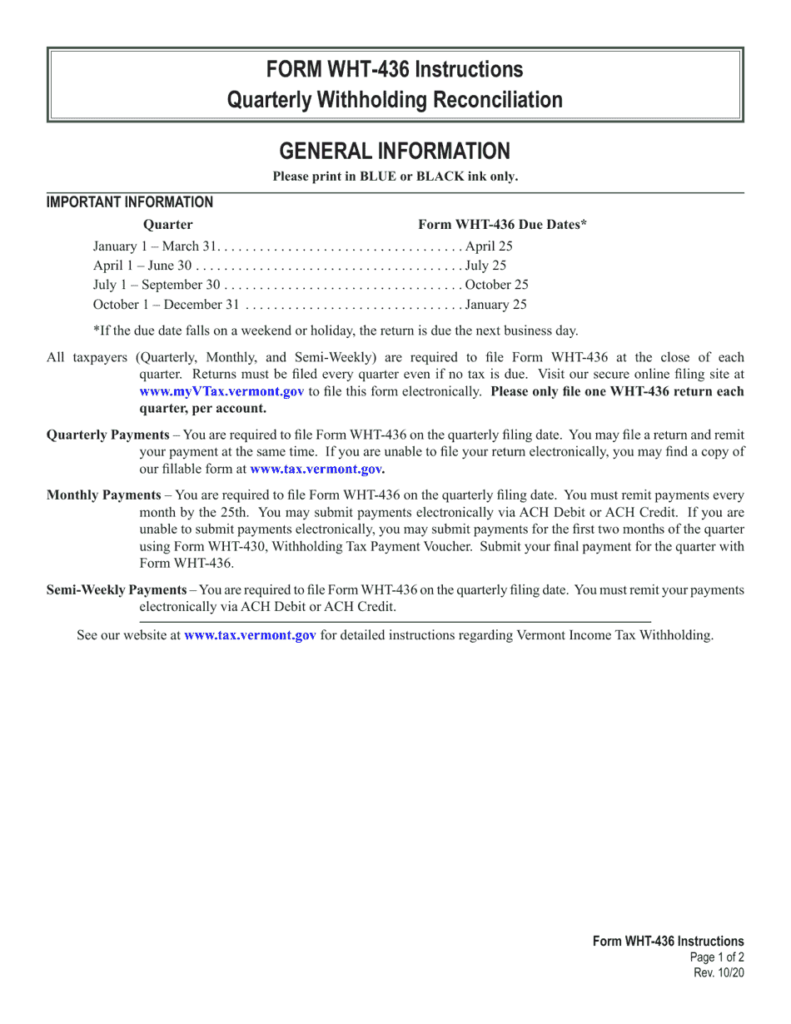

Withholding tax from employees need to be collected and reported when you’re an employer. Certain of these taxes can be submitted to the IRS by submitting forms. Additional documents that you could require to submit includes a withholding tax reconciliation as well as quarterly tax returns as well as the annual tax return. Here’s some information about the different tax forms for withholding categories, as well as the deadlines to the submission of these forms.

The compensation, bonuses commissions, bonuses, and other earnings you earn from your employees could necessitate you to file withholding tax returns. Additionally, if you pay your employees on time, you could be eligible to receive reimbursement for taxes that you withheld. Be aware that certain taxes could be considered to be local taxes. In certain situations there are rules regarding withholding that can be different.

Electronic submission of forms for withholding is mandatory according to IRS regulations. If you are submitting your tax return for national revenue be sure to include your Federal Employer Identification number. If you don’t, you risk facing consequences.