Vermont Tax Withholding Form 2024 – There are many reasons that an individual could submit an application for withholding. These include the need for documentation and exemptions for withholding. No matter the motive someone has to fill out a Form, there are several aspects to keep in mind.

Exemptions from withholding

Non-resident aliens are required to submit Form 1040 NR at least once every year. If the requirements are met, you could be eligible for an exemption from withholding. The exclusions you can find on this page are yours.

When you submit Form1040-NR, attach Form 1042S. The document lists the amount withheld by the tax authorities for federal income tax reporting purposes. Complete the form in a timely manner. The information you provide may not be provided and could cause one person to be treated.

The non-resident alien withholding tax is 30%. A tax exemption may be granted if you have a the tax burden lower than 30 percent. There are a variety of exclusions. Some are for spouses or dependents, like children.

Generally, a refund is accessible for Chapter 4 withholding. Refunds can be made according to Sections 471 through 474. The refunds are made by the agents who withhold taxes that is, the person who is responsible for withholding taxes at the source.

Status of the relationship

You and your spouse’s work is made simpler by the proper marriage status withholding form. In addition, the amount of money that you can deposit at the bank can be awestruck. The difficulty lies in selecting the best option from the multitude of choices. There are certain items you must avoid. Making a mistake can have expensive negative consequences. However, if the instructions are followed and you pay attention to the rules, you shouldn’t have any problems. If you’re lucky, you could make new acquaintances on your trip. Today is the anniversary date of your wedding. I’m hoping they make it work against you to help you get that elusive engagement ring. For a successful completion of the task it is necessary to seek the assistance of a tax professional who is certified. A little amount could create a lifetime’s worth of wealth. You can get many sources of information online. TaxSlayer as well as other reliable tax preparation companies are some of the top.

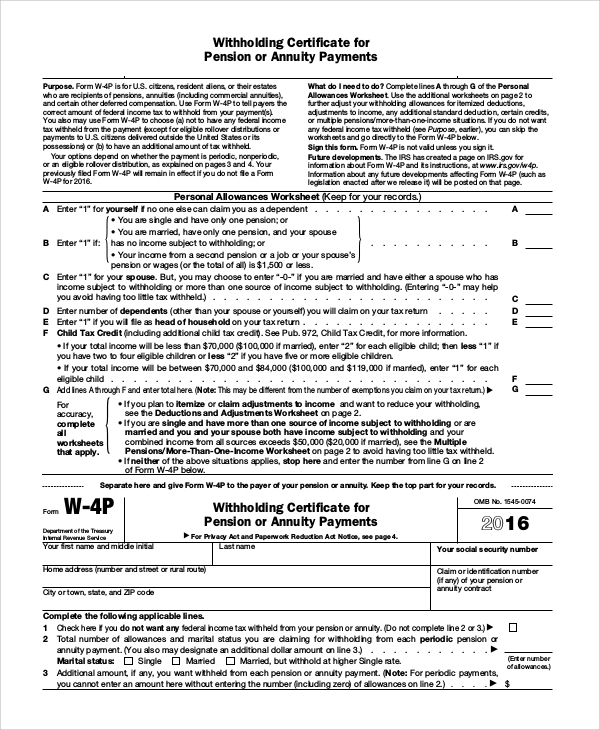

Amount of withholding allowances claimed

It is crucial to indicate the amount of withholding allowances you would like to claim on the Form W-4. This is essential because the tax amount taken from your pay will be affected by how you withhold.

There are a variety of factors that can determine the amount that you can claim for allowances. Your income will influence how many allowances your can receive. If you earn a substantial amount of income, you may be eligible for a higher allowance.

A tax deduction that is appropriate for you could allow you to avoid tax obligations. You could actually receive the amount you owe if you submit your annual income tax return. However, be careful about how you approach the tax return.

As with any financial decision you make it is crucial to research the subject thoroughly. Calculators can be utilized to determine the amount of withholding allowances you should claim. If you prefer contact an expert.

Specifications that must be filed

Employers must report the employer who withholds taxes from employees. If you are unable to collect these taxes, you can submit paperwork to IRS. You might also need additional documentation such as an withholding tax reconciliation or a quarterly tax return. Below are details on the different types of withholding taxes and the deadlines to file them.

In order to be eligible to receive reimbursement for withholding tax on the pay, bonuses, commissions or other revenue that your employees receive, you may need to file a tax return for withholding. If you also pay your employees on-time it could be possible to qualify for reimbursement for any taxes that were taken out of your paycheck. Remember that these taxes can be considered as taxation by the county. There are special methods of withholding that are appropriate in particular situations.

In accordance with IRS rules, you are required to electronically submit forms for withholding. When filing your tax returns for national revenue make sure you include your Federal Employee Identification Number. If you don’t, you risk facing consequences.