Utah Employee Withholding Form 2024 – There are numerous reasons that a person could choose to submit a withholding application. This includes the need for documentation, exemptions from withholding and the amount of required withholding allowances. However, if one chooses to submit a form, there are a few points to be aware of.

Exemptions from withholding

Nonresident aliens are required once every year to file Form1040-NR. If you satisfy these requirements, you may be eligible to receive an exemption from the form for withholding. On this page, you will find the exclusions available to you.

The application of Form 1042-S to Form 1042-S is a first step to file Form 1040-NR. The form provides information about the withholding that is performed by the tax agency that handles withholding for federal tax reporting purposes. Please ensure you are entering the right information when filling out this form. One individual may be treated if this information is not entered.

Nonresident aliens pay 30 percent withholding tax. A tax exemption may be granted if you have a the tax burden less than 30%. There are many exemptions. Some are only for spouses or dependents like children.

Generally, a refund is accessible for Chapter 4 withholding. Refunds can be made according to Sections 1400 through 1474. Refunds are given to the tax agent withholding, the person who withholds the tax at the source.

Relational status

A marital withholding form can make your life easier and assist your spouse. You’ll be amazed at how much you can deposit at the bank. It is difficult to decide what option you’ll choose. There are certain things that you should not do. A bad decision can result in a significant cost. However, if you adhere to the instructions and be alert for any pitfalls and pitfalls, you’ll be fine. If you’re lucky, you may even meet new friends while you travel. Today is your anniversary. I’m hoping that they will make it work against you to get you that elusive engagement ring. It is best to seek the advice of a certified tax expert to complete it correctly. The tiny amount is worth it for a lifetime of wealth. There is a wealth of details online. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

number of claimed withholding allowances

It is crucial to indicate the amount of the withholding allowance you would like to claim on the Form W-4. This is crucial because your pay will be affected by the amount of tax that you pay.

There are a variety of factors that affect the amount of allowances requested.If you’re married, for instance, you could be eligible to claim an exemption for head of household. Your income will determine how many allowances you are eligible for. You could be eligible to claim a greater allowance if you have a large amount of income.

It is possible to avoid paying a large tax bill by deciding on the right amount of tax deductions. Even better, you might even get a refund if the annual tax return has been completed. However, it is crucial to choose the right approach.

It is essential to do your homework the same way you would with any other financial decision. Calculators can be utilized to figure out the amount of withholding allowances that are required to be made. Another option is to talk with a professional.

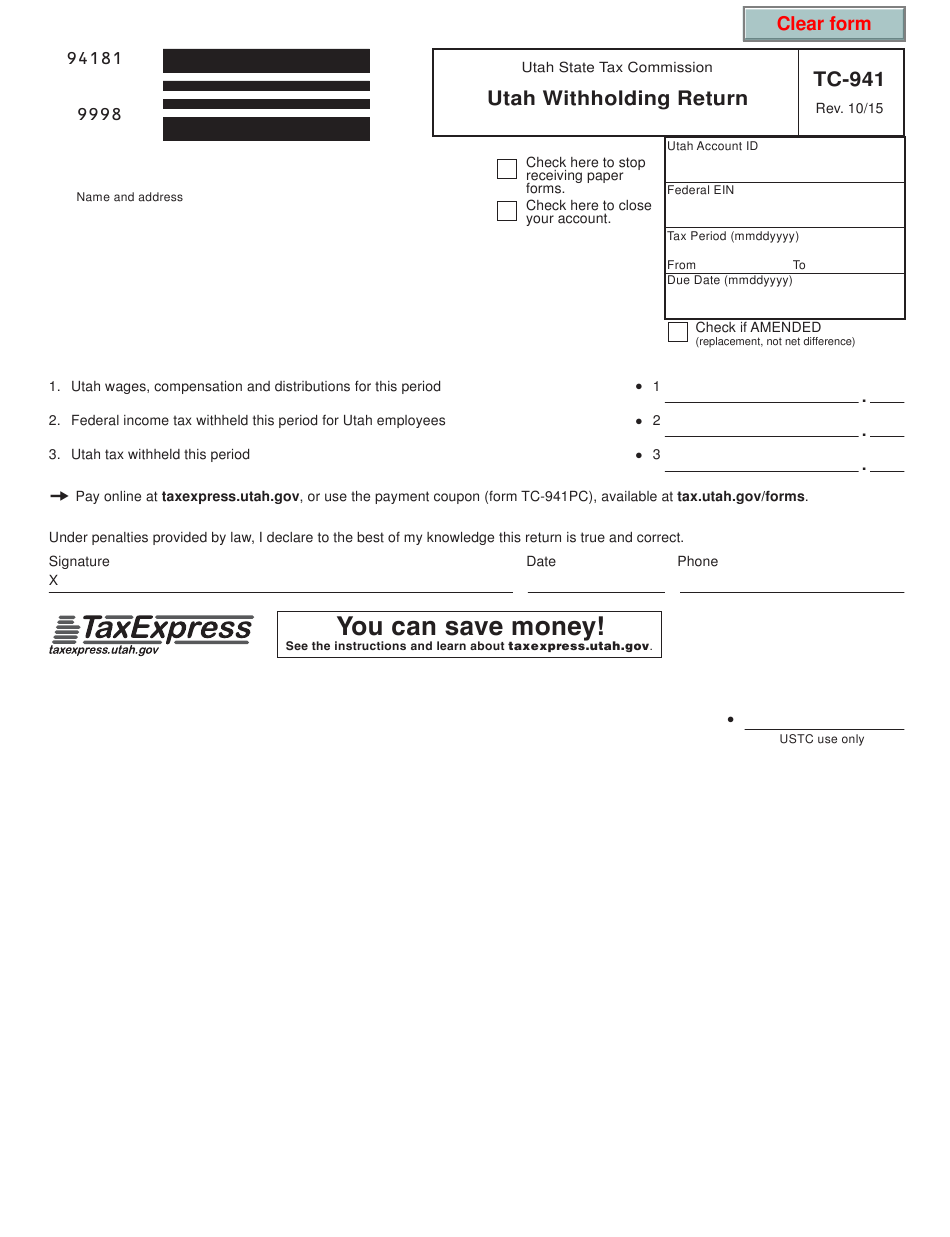

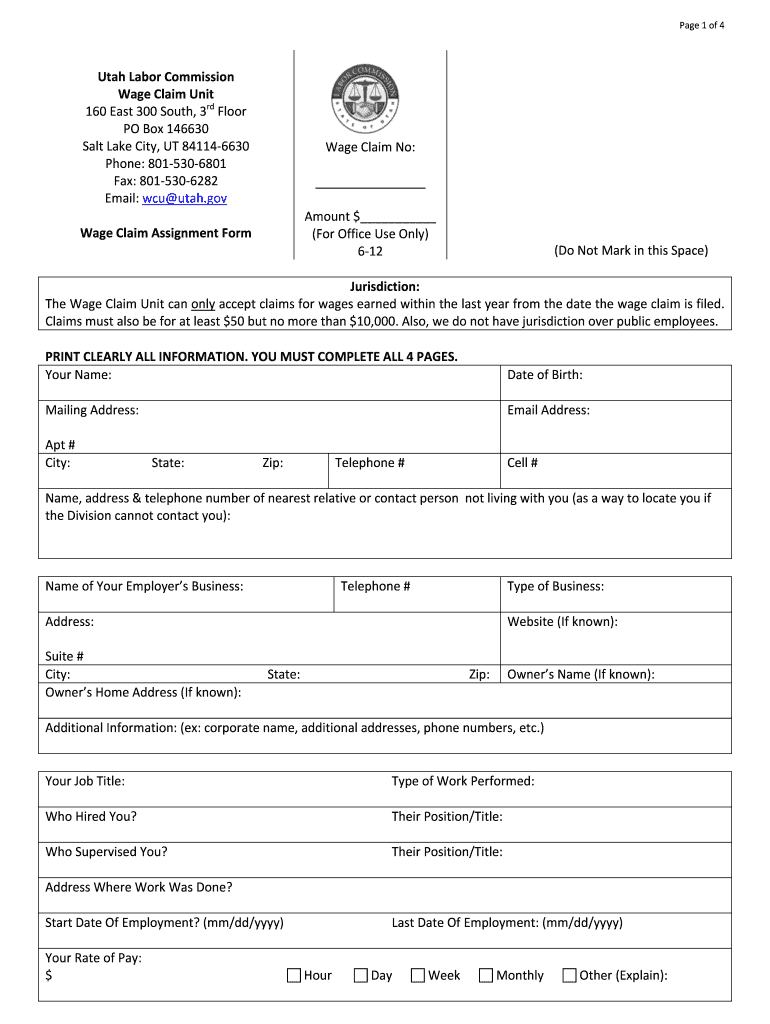

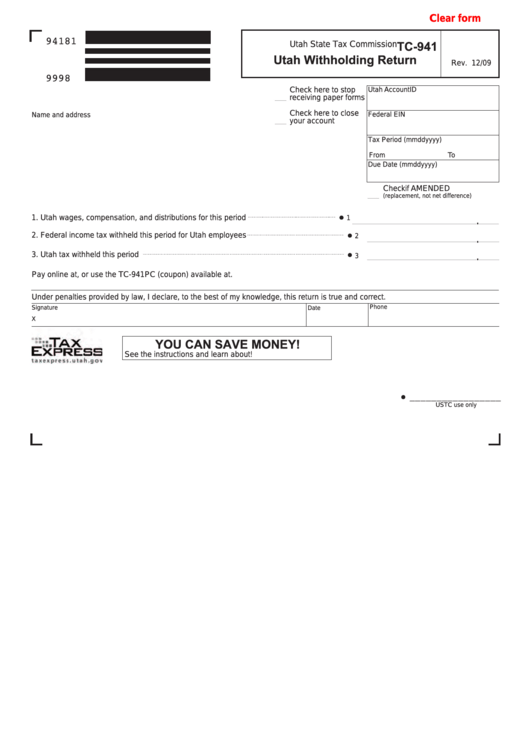

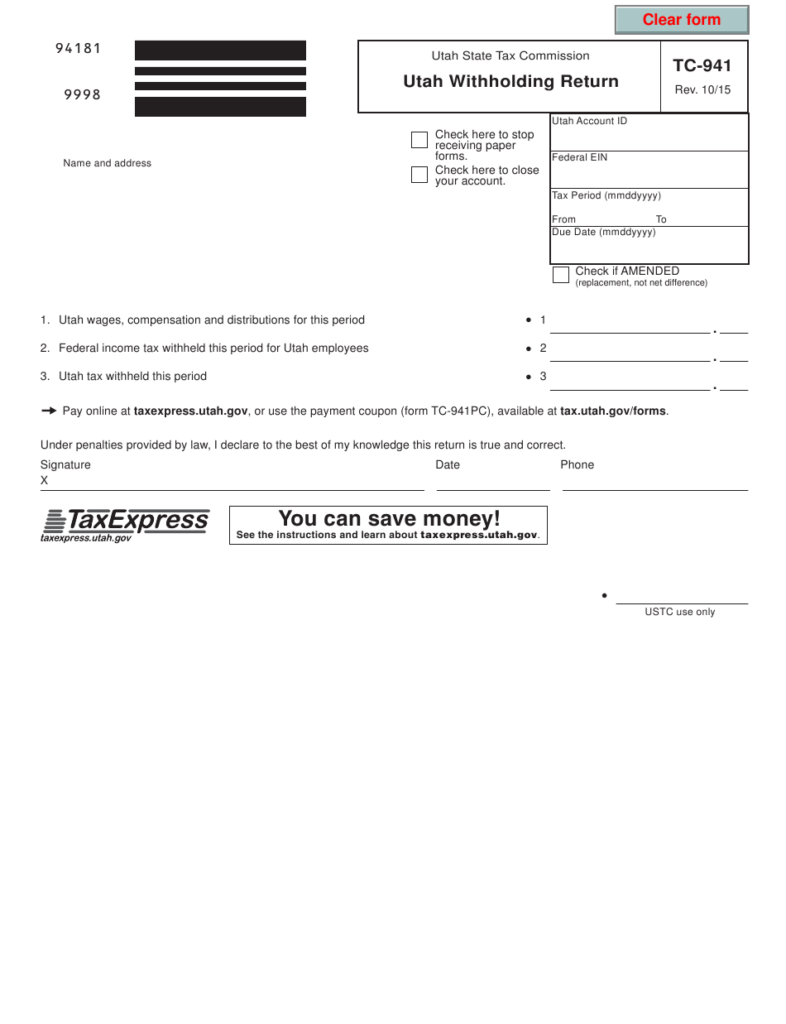

Formulating specifications

Withholding taxes from your employees have to be reported and collected if you’re an employer. For a limited number of these taxes, you may provide documentation to the IRS. A tax return that is annually filed, quarterly tax returns or tax withholding reconciliations are just a few examples of paperwork you might need. Here are some specifics about the various types of withholding tax forms along with the deadlines for filing.

To be eligible to receive reimbursement for withholding taxes on the compensation, bonuses, salary or any other earnings received from your employees it is possible to submit withholding tax return. Additionally, if employees are paid on time, you may be eligible to get the tax deductions you withheld. Noting that certain of these taxes may be taxes imposed by the county, is vital. Additionally, there are unique methods of withholding that are applied under particular situations.

You are required to electronically submit tax withholding forms as per IRS regulations. It is mandatory to provide your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.