Update Tax Withholding Form – There are many reasons why an individual might decide to fill out forms withholding. These factors include the documents required, the exclusion of withholding and withholding allowances. Whatever the reason behind an individual to file a document, there are certain things to keep in mind.

Exemptions from withholding

Non-resident aliens are required to submit Form1040-NR once each year to fill out Form1040-NR. You may be eligible to apply for an exemption for withholding tax if you meet all the conditions. This page you’ll see the exemptions that are for you to choose from.

For submitting Form 1040-NR attach Form 1042-S. The form is used to report federal income tax. It outlines the withholding of the withholding agent. Make sure you fill out the form correctly. If the correct information isn’t provided, one individual could be treated.

The 30% non-resident alien tax withholding tax rate is 30 percent. The tax burden of your business must not exceed 30% to be exempt from withholding. There are many exemptions. Some are for spouses and dependents, like children.

In general, the chapter 4 withholding allows you to receive the possibility of a refund. According to Sections 1471 through 1474, refunds are given. The refunds are made to the tax agent withholding the person who withholds the tax at the source.

Status of relationships

An appropriate marital status that is withheld can make it simpler for both of you to accomplish your job. You will be pleasantly surprised by how much you can transfer to the bank. The trick is to decide what option to pick. Be cautious about what you do. A bad decision can result in a significant cost. If you stick to the guidelines and follow them, there shouldn’t be any problems. If you’re lucky you might make new acquaintances on your trip. Today is your birthday. I hope you will use it against them to locate that perfect engagement ring. For a successful completion of the task it is necessary to get the help of a certified tax expert. The accumulation of wealth over time is more than the modest payment. There are numerous online resources that provide information. TaxSlayer is among the most trusted and respected tax preparation companies.

There are numerous withholding allowances that are being claimed

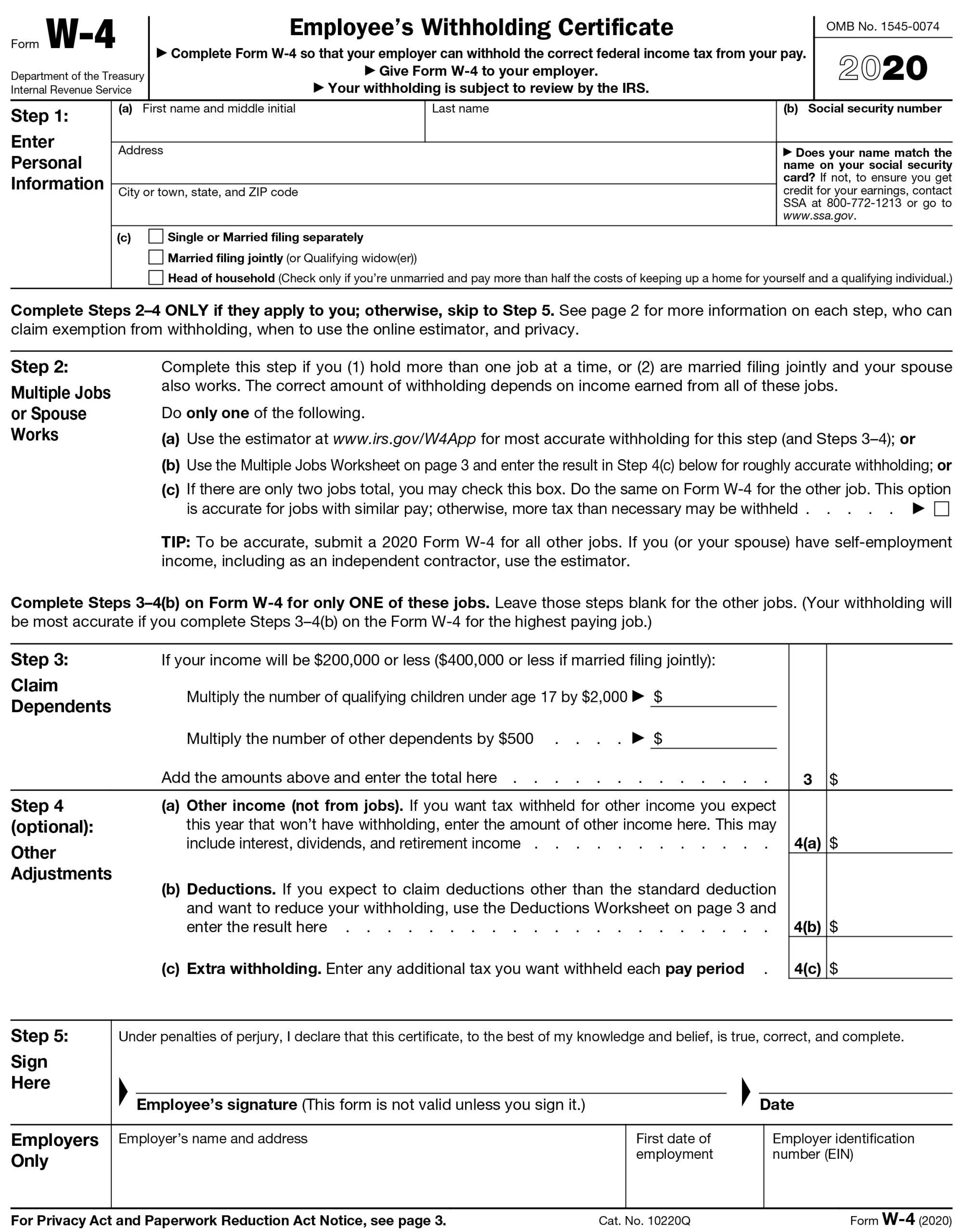

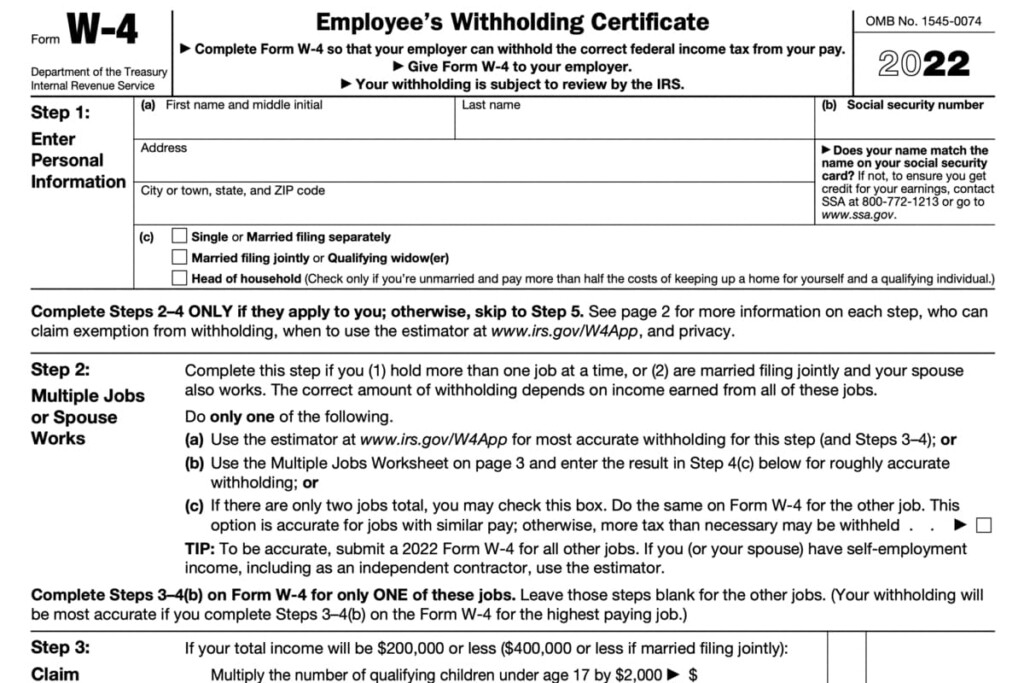

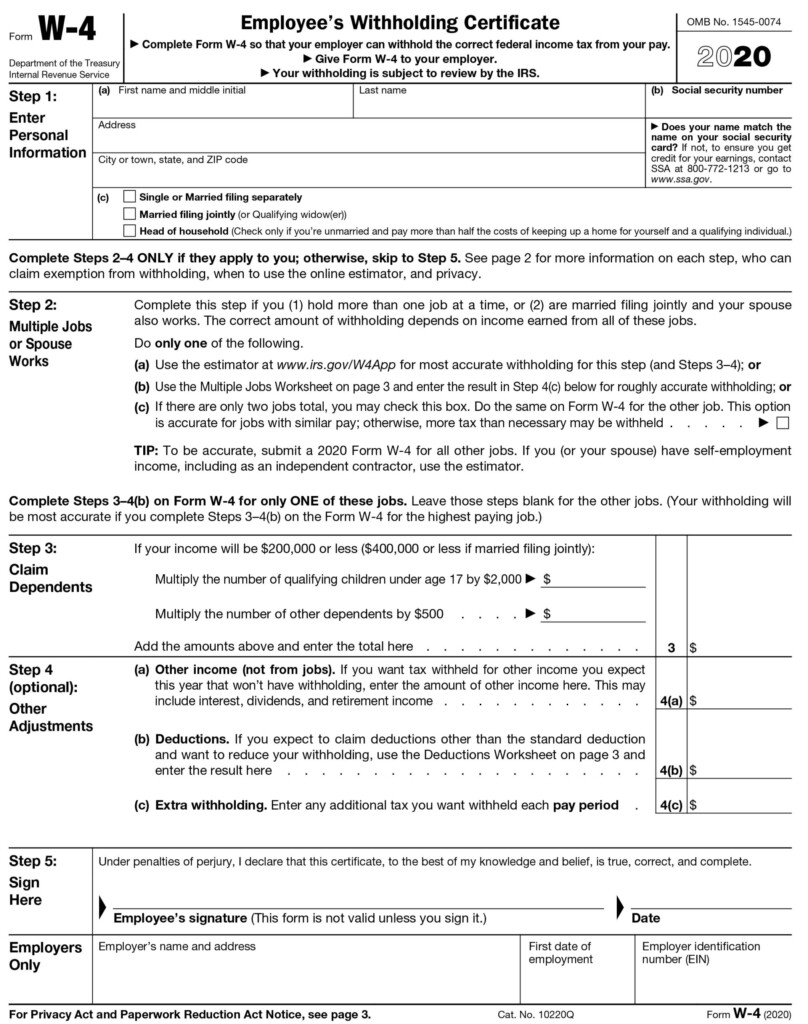

On the Form W-4 that you submit, you must specify the amount of withholding allowances you seeking. This is important because the tax withheld can affect how much is taken from your pay check.

Many factors influence the amount you qualify for allowances. Your income level also affects the amount of allowances you’re qualified to receive. An additional allowance could be granted if you make an excessive amount.

It could save you thousands of dollars by selecting the appropriate amount of tax deductions. Refunds could be feasible if you submit your tax return on income for the previous year. Be sure to select the right method.

Research as you would in any other financial decision. To determine the amount of withholding allowances to be claimed, use calculators. A better option is to consult to a professional.

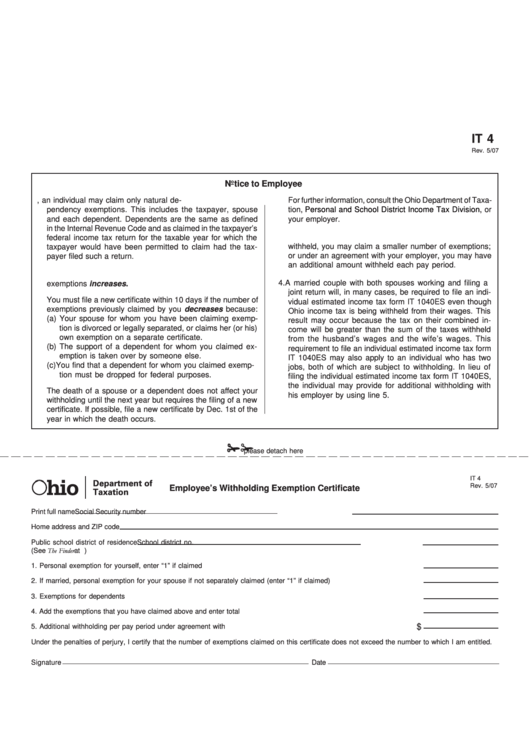

Formulating specifications

Employers must report any withholding taxes being taken from employees. If you are taxed on a specific amount, you may submit paperwork to the IRS. There are other forms you might need for example, an annual tax return, or a withholding reconciliation. Here are the details on various tax forms for withholding and the deadlines for each.

Your employees might require the submission of withholding tax returns in order to receive their wages, bonuses and commissions. If you make sure that your employees are paid on time, you may be eligible to receive reimbursement of any withheld taxes. The fact that certain taxes are also county taxes ought to be considered. There are also unique withholding methods that can be used in specific situations.

As per IRS regulations the IRS regulations, electronic submissions of withholding forms are required. The Federal Employer Identification number must be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.