Ucsd Withholding Form – There are many reasons that someone could complete a form for withholding. These factors include documentation requirements including withholding exemptions and the amount of withholding allowances. You must be aware of these factors regardless of why you choose to file a request form.

Exemptions from withholding

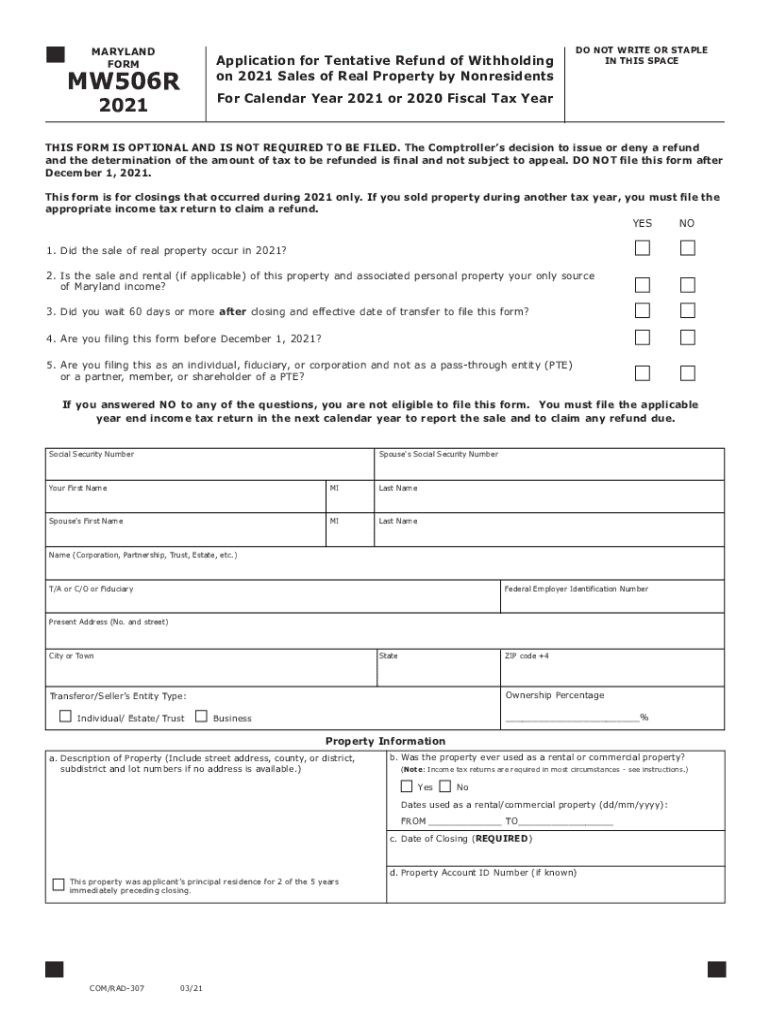

Nonresident aliens are required once every year to file Form1040-NR. However, if your requirements are met, you could be eligible to apply for an exemption from withholding. On this page, you will discover the exemptions for you to choose from.

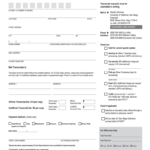

The first step for filling out Form 1040-NR is to attach Form 1042 S. The form outlines the withholdings made by the agency. Make sure you enter the right information when filling in this form. The information you provide may not be disclosed and cause one person to be treated.

Non-resident aliens are subject to 30 percent withholding tax. Your tax burden should not exceed 30% to be exempt from withholding. There are several different exclusions that are available. Certain of them apply to spouses and dependents such as children.

You can claim an amount of money if you do not follow the terms of chapter 4. Refunds are granted according to Sections 1471-1474. The withholding agent or the individual who collects the tax at source, is the one responsible for distributing these refunds.

Status of relationships

The work of your spouse and you can be made easier by a proper marriage-related status withholding document. The bank could be shocked by the amount that you deposit. It can be difficult to choose which of many choices is the most attractive. You should be careful when you make a decision. Making the wrong choice could cause you to pay a steep price. If you stick to it and pay attention to instructions, you won’t run into any problems. If you’re lucky, you might be able to make new friends as traveling. Today is the anniversary day of your wedding. I’m sure you’ll be able to use this to get the elusive wedding ring. To do it right you’ll require the aid of a qualified accountant. The accumulation of wealth over time is more than that tiny amount. Fortunately, you can find plenty of information on the internet. TaxSlayer, a reputable tax preparation firm, is one of the most effective.

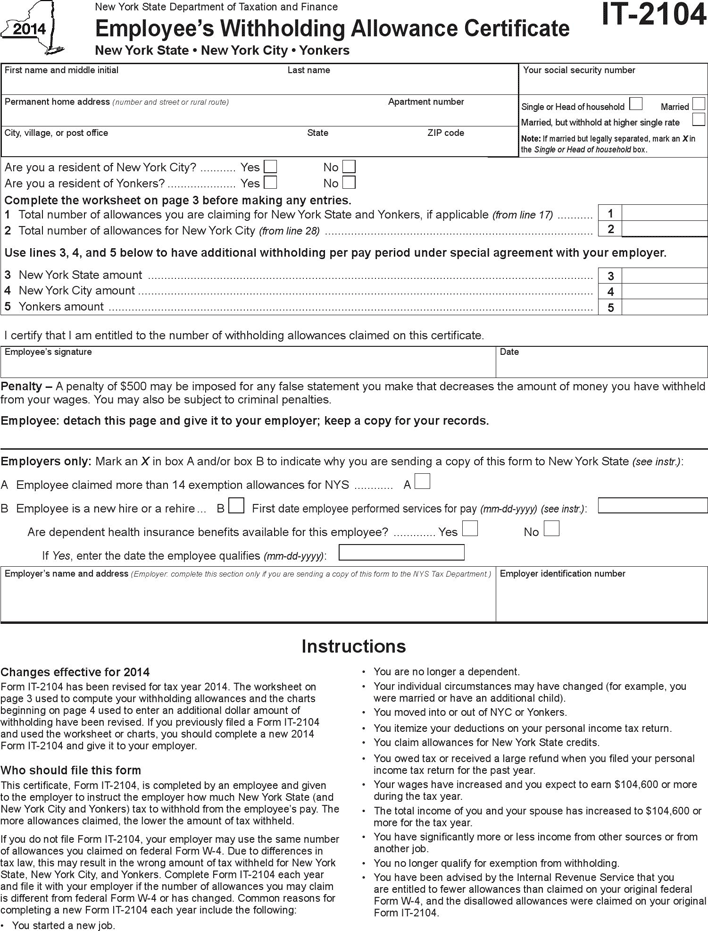

The number of withholding allowances claimed

It is important to specify the number of withholding allowances you wish to claim on the form W-4 that you file. This is crucial since the withholdings will effect on the amount of tax is taken out of your paycheck.

There are a variety of factors that affect the amount of allowances you are able to apply for. If you’re married you could be eligible for a head-of-household exemption. Your income will determine how many allowances you can receive. You may be eligible for a greater allowance if you have a large amount of income.

Tax deductions that are appropriate for you could allow you to avoid tax bills. In reality, if you file your annual income tax return, you might even receive a refund. However, you must choose your strategy carefully.

Like any financial decision, you must do your research. Calculators can be used to figure out how many withholding allowances are required to be claimed. Other options include talking to an expert.

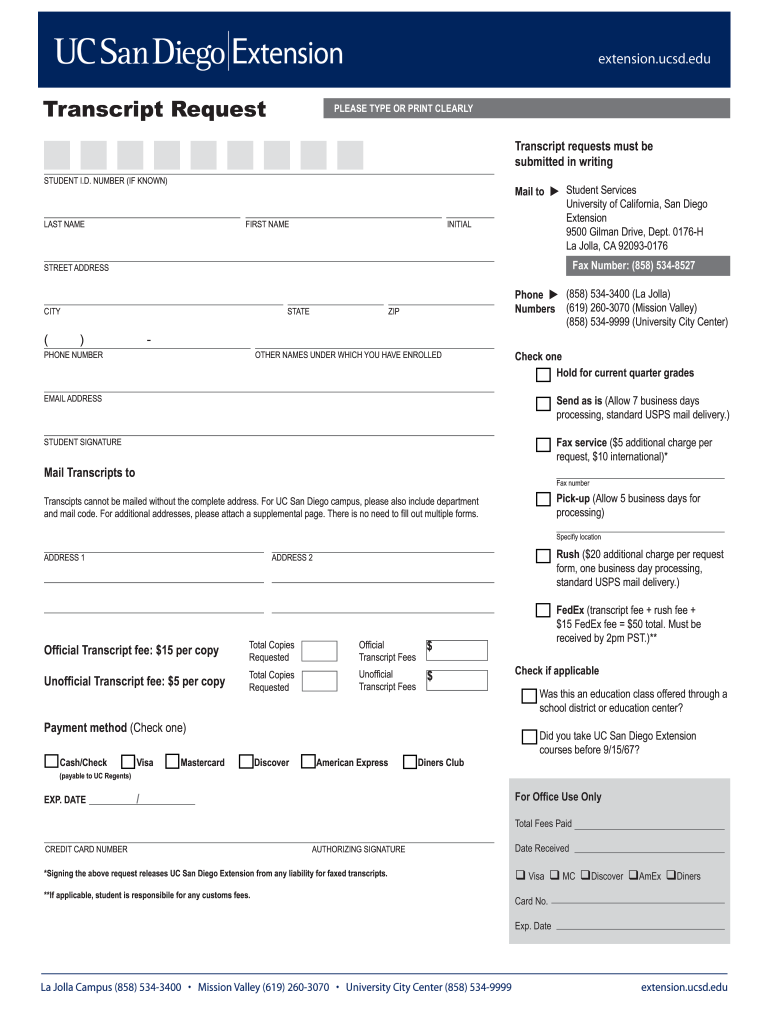

Formulating specifications

Employers must report the employer who withholds taxes from employees. If you are unable to collect the taxes, you are able to submit paperwork to IRS. You may also need additional forms that you might need for example, the quarterly tax return or withholding reconciliation. Here are some specifics on the different types of tax forms for withholding and the deadlines for filing.

Tax withholding returns can be required for income such as bonuses, salary or commissions as well as other earnings. If employees are paid punctually, you might be eligible to get the tax deductions you withheld. Be aware that certain taxes could be considered to be taxes imposed by the county, is crucial. In certain circumstances there are rules regarding withholding that can be different.

Electronic submission of forms for withholding is mandatory according to IRS regulations. When you submit your tax return for national revenue, please include the Federal Employer Identification number. If you don’t, you risk facing consequences.