Ttps Www Tax Ny Gov Forms Withholding_cur_forms Htm – There are numerous reasons that a person might decide to file an application for withholding. This includes the documentation requirements, withholding exclusions as well as the withholding allowances. No matter what the reason is for a person to file documents, there are certain things that you need to remember.

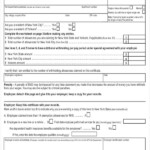

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once each year. If you meet these conditions, you could be eligible for exemptions from the withholding form. The following page lists all exemptions.

The first step in submitting Form 1040 – NR is attaching the Form 1042 S. The form is used to report federal income tax. It details the amount of withholding that is imposed by the tax withholding agent. Make sure that you fill in the correct information when you fill out the form. A person could be treated if this information is not provided.

The non-resident alien withholding tax is 30 percent. A tax exemption may be available if you have a tax burden that is lower than 30%. There are many exemptions offered. Some of them are intended to be used by spouses, while some are meant to be used by dependents like children.

The majority of the time, a refund is available for chapter 4 withholding. In accordance with Section 1471 through 1474, refunds are granted. The refunds are made to the withholding agent that is the person who collects the tax at the source.

Status of relationships

A form for a marital withholding is an excellent way to make your life easier and aid your spouse. You’ll be surprised at how much money you can put in the bank. It is difficult to decide which of the many options you’ll pick. Certain, there are things you should avoid doing. Making the wrong choice could result in a significant cost. If you stick to the directions and be alert for any pitfalls You won’t face any issues. If you’re lucky enough you’ll make new acquaintances on the road. Today is the anniversary date of your wedding. I’m hoping you’ll be able to apply it against them to secure that elusive diamond. It’s a difficult job that requires the experience of an expert in taxation. The little amount is worthwhile for the life-long wealth. Online information is readily available. TaxSlayer is among the most trusted and respected tax preparation companies.

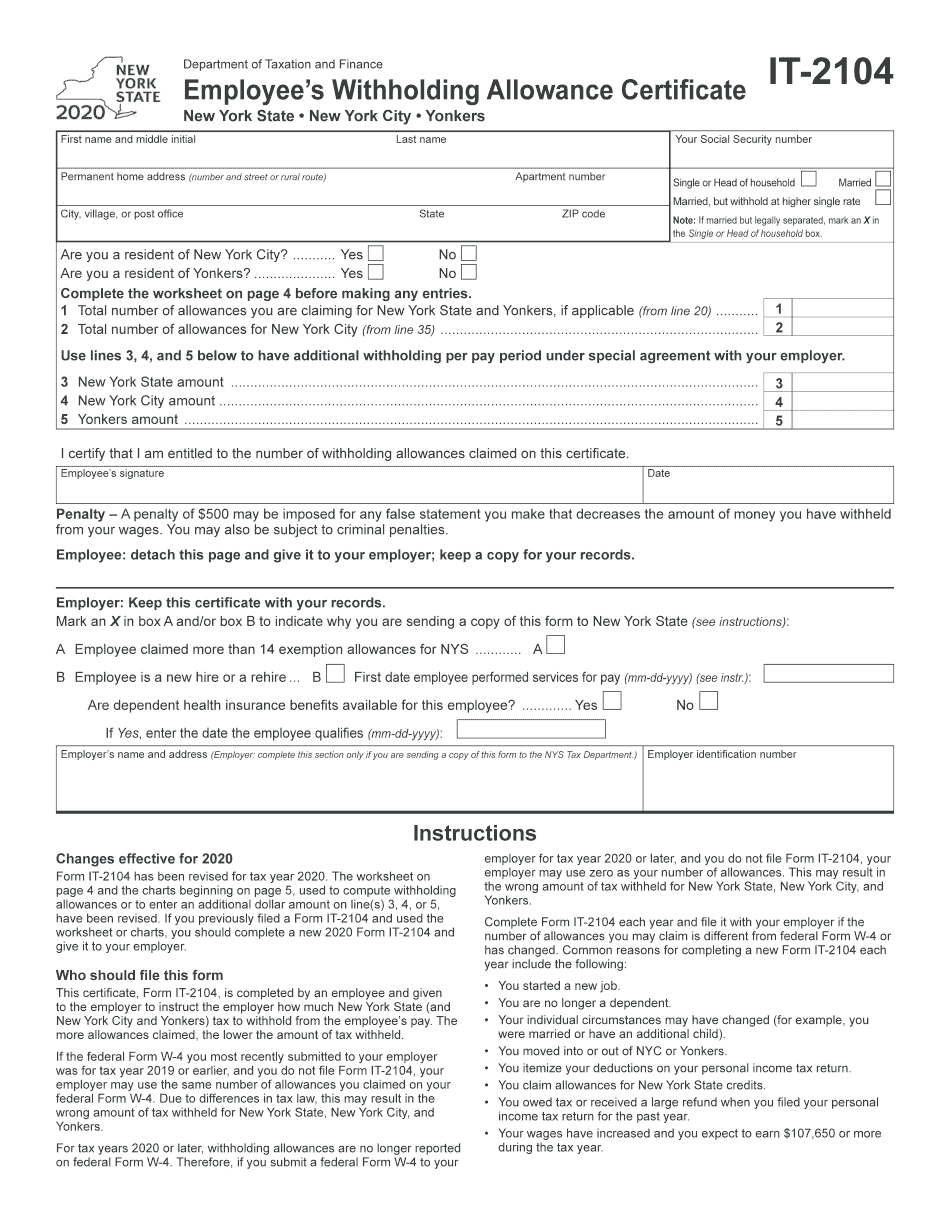

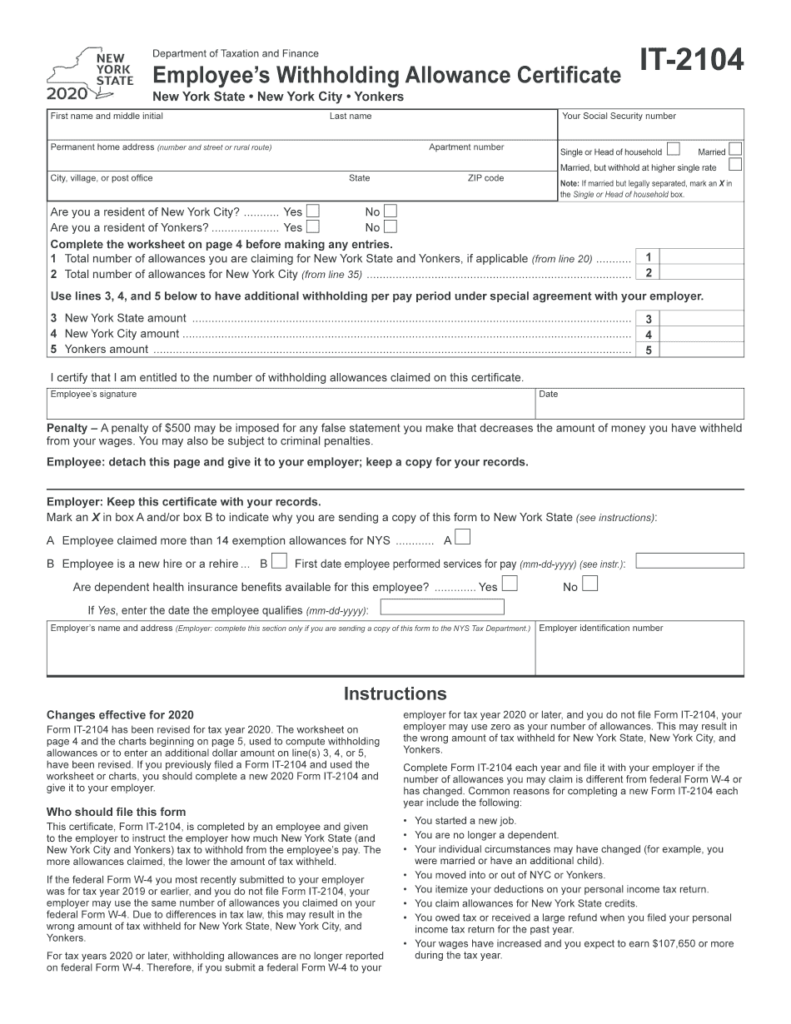

There are numerous withholding allowances being claimed

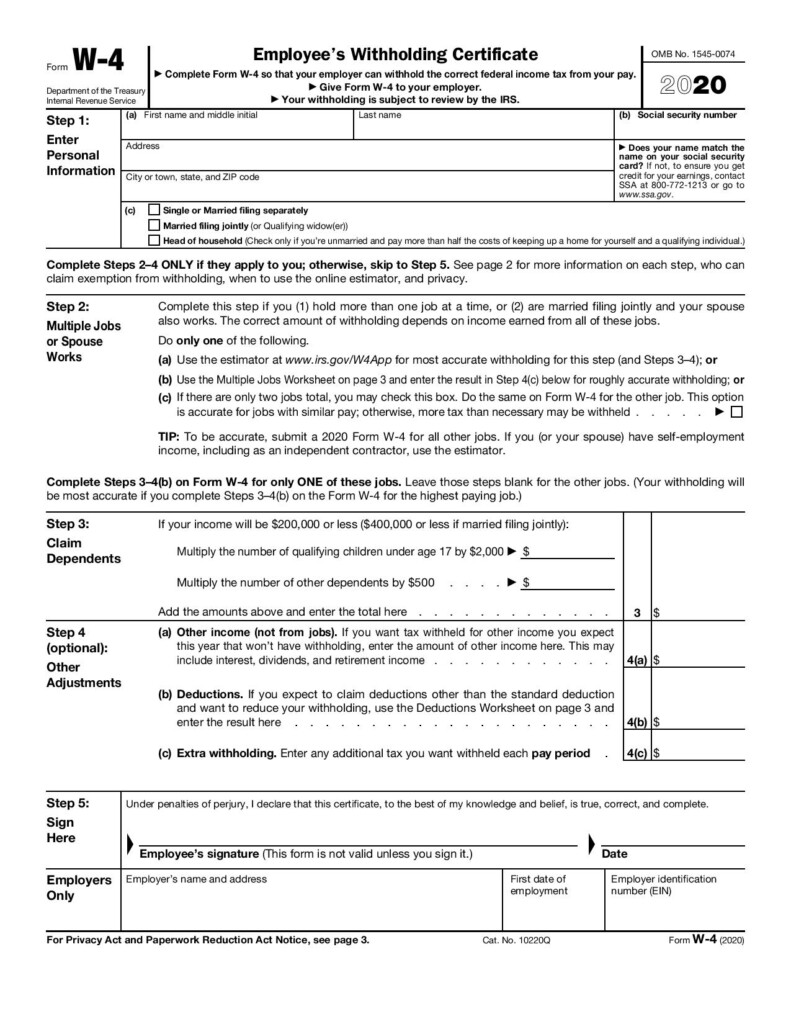

It is crucial to indicate the amount of withholding allowances which you wish to claim on the Form W-4. This is crucial since the tax withheld will impact the amount taken out of your pay check.

There are a variety of factors that can influence the amount you qualify for allowances. Your income level also affects how much allowances you’re qualified to receive. If you earn a substantial amount of income, you may get a bigger allowance.

You could save thousands of dollars by determining the right amount of tax deductions. If you submit your annual income tax returns and you are entitled to a refund. But you need to pick your approach wisely.

As with any financial decision you make it is essential to research the subject thoroughly. Calculators will help you determine the number of withholdings that need to be demanded. An expert might be a viable option.

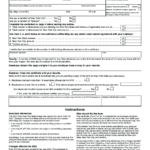

Formulating specifications

Employers are required to report the company who withholds taxes from their employees. Some of these taxes may be submitted to the IRS by submitting forms. An annual tax return and quarterly tax returns, or tax withholding reconciliations are just a few types of documents you could require. Here’s some details about the different tax forms and when they need to be submitted.

To be eligible to receive reimbursement for tax withholding on compensation, bonuses, salary or any other earnings received from your employees, you may need to file a tax return for withholding. Additionally, if employees are paid punctually, you might be eligible to get reimbursement of withheld taxes. Remember that these taxes can be considered to be local taxes. Additionally, there are unique withholding practices that can be used in certain conditions.

Electronic filing of withholding forms is required under IRS regulations. The Federal Employer Identification Number must be listed on your national revenue tax return. If you don’t, you risk facing consequences.