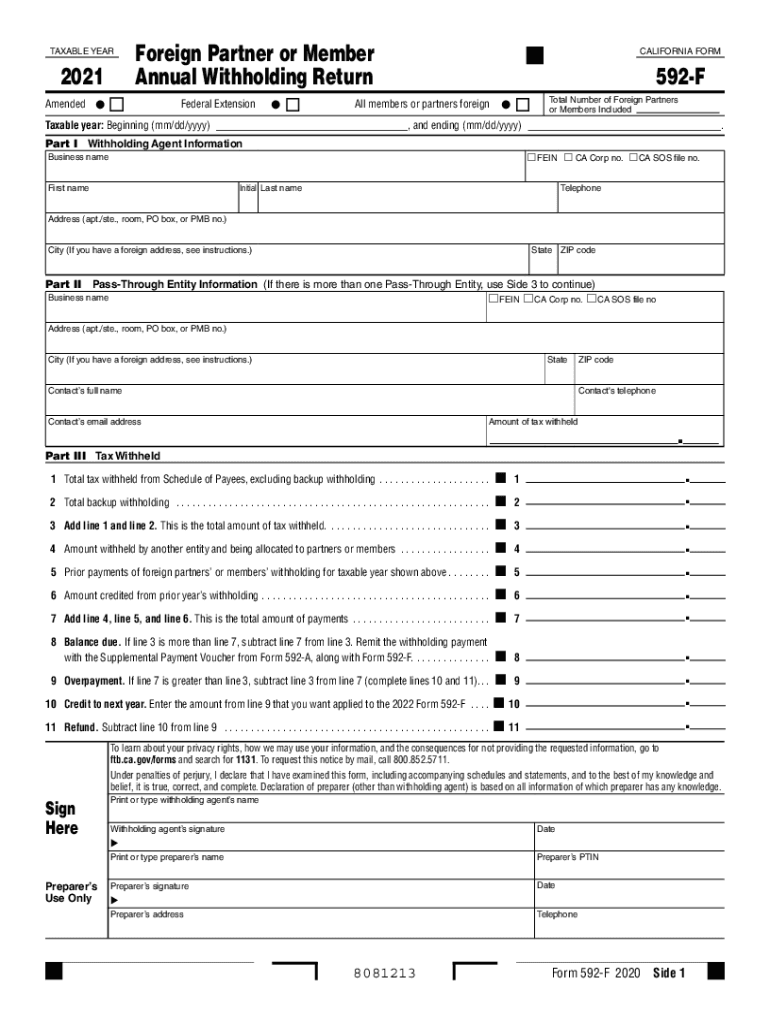

Tennessee Tax Withholding Form – There are many reasons someone may decide to submit a withholding application. This includes the need for documentation, exemptions from withholding and the amount of the required withholding allowances. You must be aware of these things regardless of the reason you decide to file a request form.

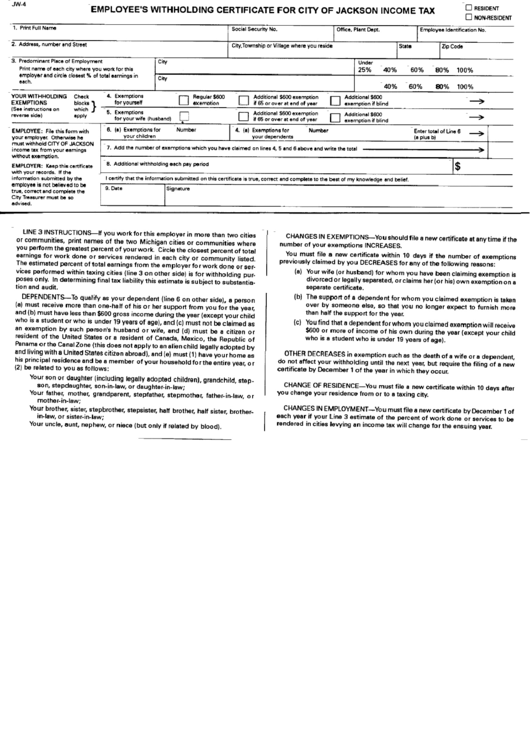

Exemptions from withholding

Non-resident aliens are required to complete Form 1040-NR every year. If you meet the requirements, you could be eligible for an exemption from the form for withholding. The following page lists all exclusions.

The first step in filling out Form 1040-NR is to attach the Form 1042 S. This form lists the amount that is withheld by the withholding agencies to report federal income tax to be used for reporting purposes. When filling out the form, make sure you fill in the exact details. The information you provide may not be disclosed and cause one person to be treated differently.

Non-resident aliens are subject to the option of paying a 30% tax on withholding. If your tax burden is less than 30 percent of your withholding, you could be eligible for an exemption from withholding. There are many exclusions. Some of them are intended to be used by spouses, while some are designed to be used by dependents such as children.

You are entitled to refunds if you have violated the terms of chapter 4. Refunds are allowed according to Sections 1471-1474. Refunds are provided by the withholding agent. The withholding agent is the person responsible for withholding the tax at the source.

Relational status

The proper marital status and withholding forms will ease the work of you and your spouse. The bank may be surprised by the amount that you have to deposit. Knowing which of the many possibilities you’re likely decide is the biggest challenge. Certain, there are items you must avoid. False decisions can lead to expensive negative consequences. If the rules are adhered to and you are attentive you shouldn’t face any problems. If you’re lucky, you might even make a few new pals while traveling. Today marks the anniversary of your marriage. I’m hoping you’ll use it against them to secure that elusive diamond. For a successful completion of the task you must seek the assistance of a certified tax expert. A modest amount of money can make a lifetime of wealth. It is a good thing that you can access a ton of information online. TaxSlayer is one of the most trusted and reputable tax preparation firms.

Amount of withholding allowances claimed

On the W-4 form you file, you should specify how many withholding allowances are you asking for. This is essential since the tax amount taken from your pay will depend on how much you withhold.

The amount of allowances that you receive will depend on a variety of factors. For instance when you’re married, you could be eligible for an exemption for your household or head. The amount of allowances you can claim will depend on the income you earn. A higher allowance may be available if you earn lots of money.

Making the right choice of tax deductions can allow you to avoid a significant tax payment. In reality, if you complete your yearly income tax return, you might even be eligible for a tax refund. Be sure to select the right method.

Conduct your own research, just as you would with any financial decision. Calculators can help you determine how much withholding allowances you can claim. An expert could be a good alternative.

filing specifications

Withholding tax from your employees must be collected and reported in the event that you are an employer. If you are taxed on a specific amount you can submit paperwork to IRS. You may also need additional forms that you may require like an annual tax return, or a withholding reconciliation. Here are some specifics on the different types of withholding tax forms along with the filing deadlines.

In order to be qualified for reimbursement of tax withholding on compensation, bonuses, salary or any other earnings received from your employees You may be required to file a tax return for withholding. Additionally, if you pay your employees on time, you might be eligible for reimbursement for any taxes withheld. It is important to keep in mind that there are a variety of taxes that are local taxes. There are also unique withholding techniques that are applicable under certain conditions.

Electronic submission of withholding forms is mandatory according to IRS regulations. When you file your national revenue tax return be sure to provide the Federal Employer Identification number. If you don’t, you risk facing consequences.