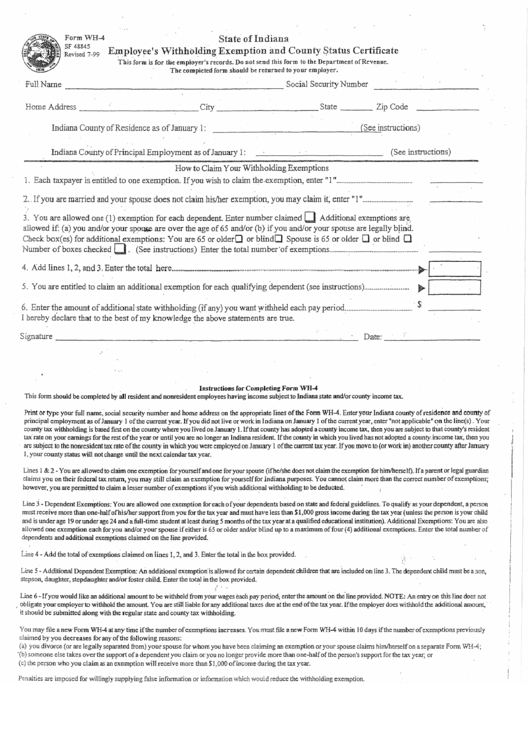

Tax Withholding Indiana Form Wh-4 – There stand a digit of reasons why someone might choose to complete a withholding form. This is due to the requirement for documentation, exemptions to withholding, as well as the amount of the required withholding allowances. It is important to be aware of these things regardless of your reason for choosing to submit a request form.

Exemptions from withholding

Nonresident aliens are required at least once every year to file Form1040-NR. You could be eligible to apply for an exemption for withholding tax in the event that you meet all criteria. The exemptions listed here are yours.

To file Form 1040-NR The first step is to attach Form 1042S. The form lists the amount withheld by the tax authorities to report federal income tax for tax reporting purposes. When you fill out the form, ensure that you provide the exact details. You may have to treat a single person for not providing this information.

Nonresident aliens have 30 percent withholding tax. A nonresident alien may be eligible for an exemption. This is when your tax burden is lower than 30 percent. There are many different exemptions. Some are only for spouses and dependents such as children.

In general, chapter 4 withholding allows you to receive the possibility of a refund. As per Sections 1471 to 1474, refunds are granted. The withholding agent, or the individual who collects the tax at source is responsible for making these refunds.

Status of the relationship

A form for a marital withholding is an excellent way to make your life easier and help your spouse. You’ll be amazed by the amount that you can deposit at the bank. The challenge is in deciding which one of the many options to choose. You must be cautious in when you make a decision. You will pay a lot if you make a wrong choice. There’s no problem If you simply follow the directions and pay attention. If you’re lucky, you may meet some new friends on your trip. Today marks the anniversary of your wedding. I’m hoping you’re capable of using this against them in order to acquire that wedding ring you’ve been looking for. For this to be done correctly, you’ll need the guidance of a qualified Tax Expert. It’s worthwhile to accumulate wealth over the course of a lifetime. There is a wealth of information on the internet. TaxSlayer is a trusted tax preparation company.

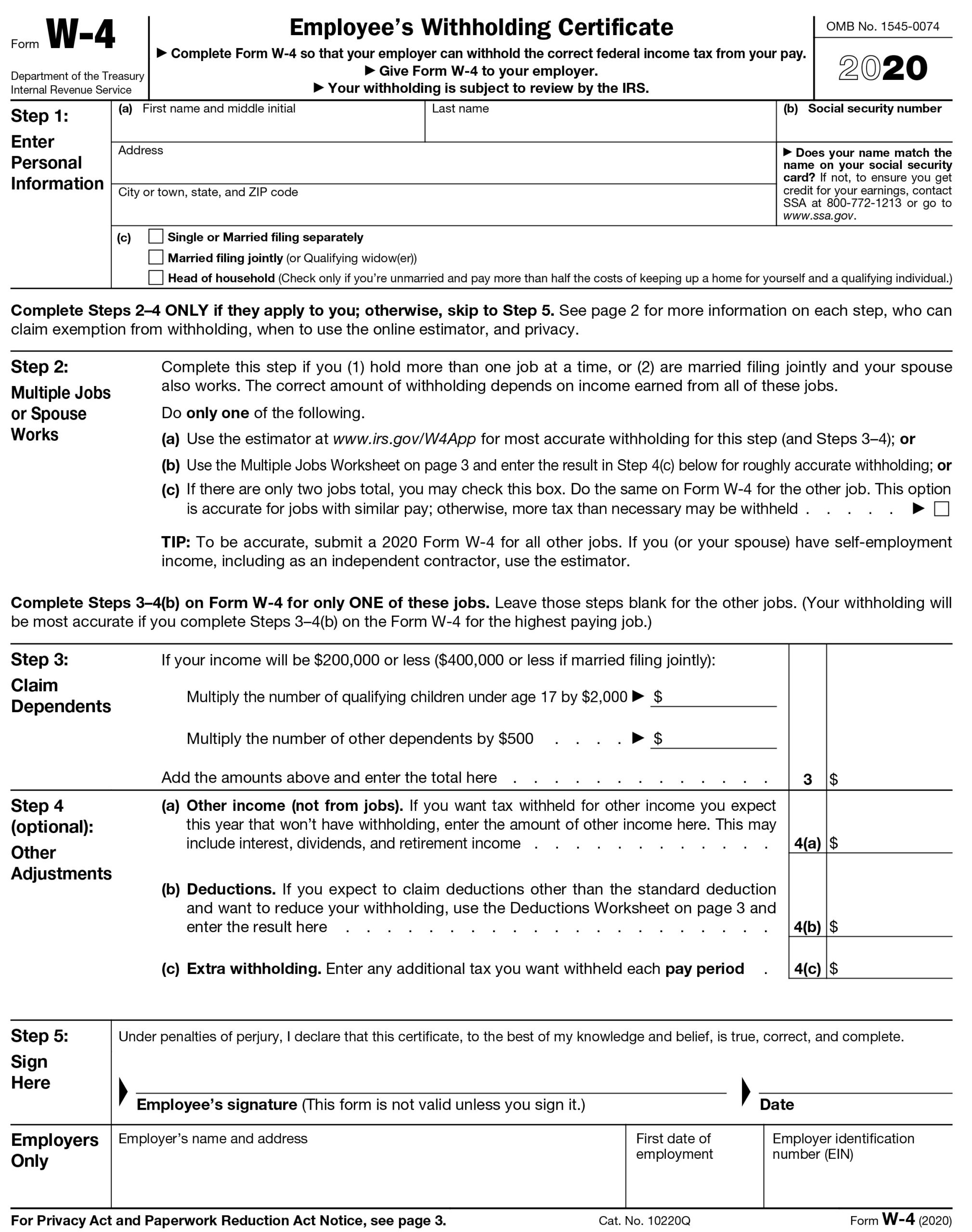

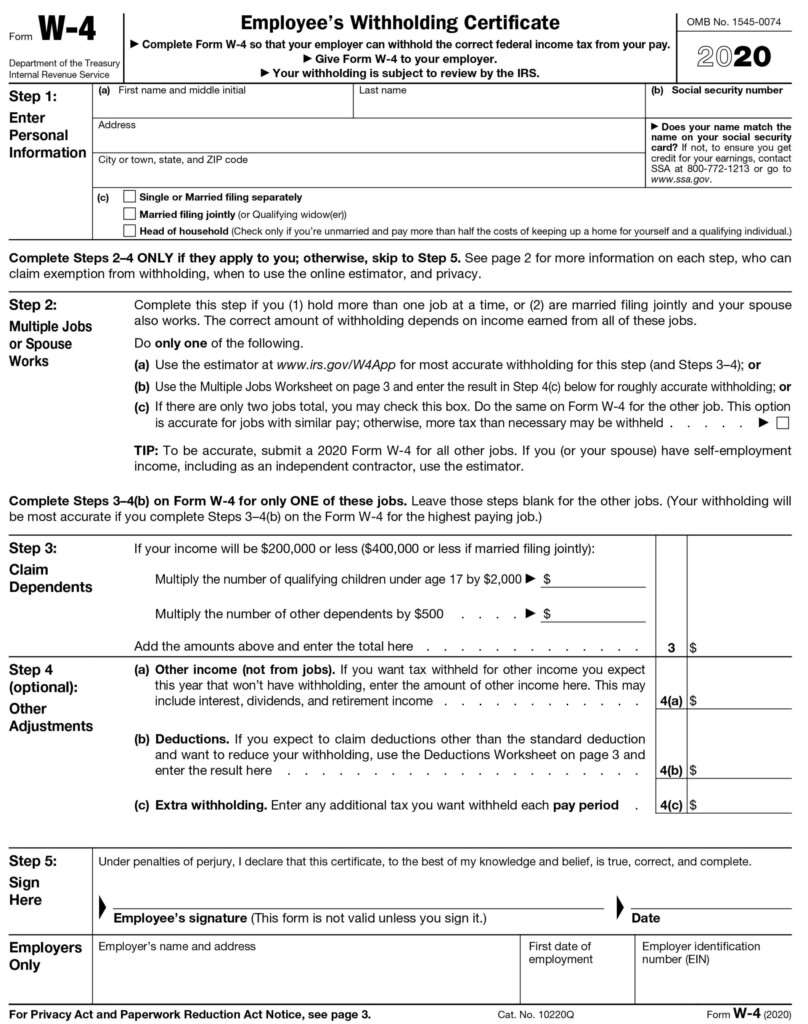

The amount of withholding allowances that were claimed

It is crucial to indicate the amount of withholding allowances which you wish to claim on the Form W-4. This is important since the amount of tax withdrawn from your paychecks will depend on how much you withhold.

A variety of factors influence the amount of allowances requested.If you’re married for instance, you may be able to apply for a head of household exemption. Your income level can also affect the number of allowances available to you. A higher allowance may be available if you earn an excessive amount.

A proper amount of tax deductions could save you from a large tax cost. If you submit the annual tax return for income and you are qualified for a tax refund. However, you must choose your approach wisely.

Like any financial decision, it is important to be aware of the facts. Calculators are readily available to aid you in determining the amount of withholding allowances must be claimed. A better option is to consult to a professional.

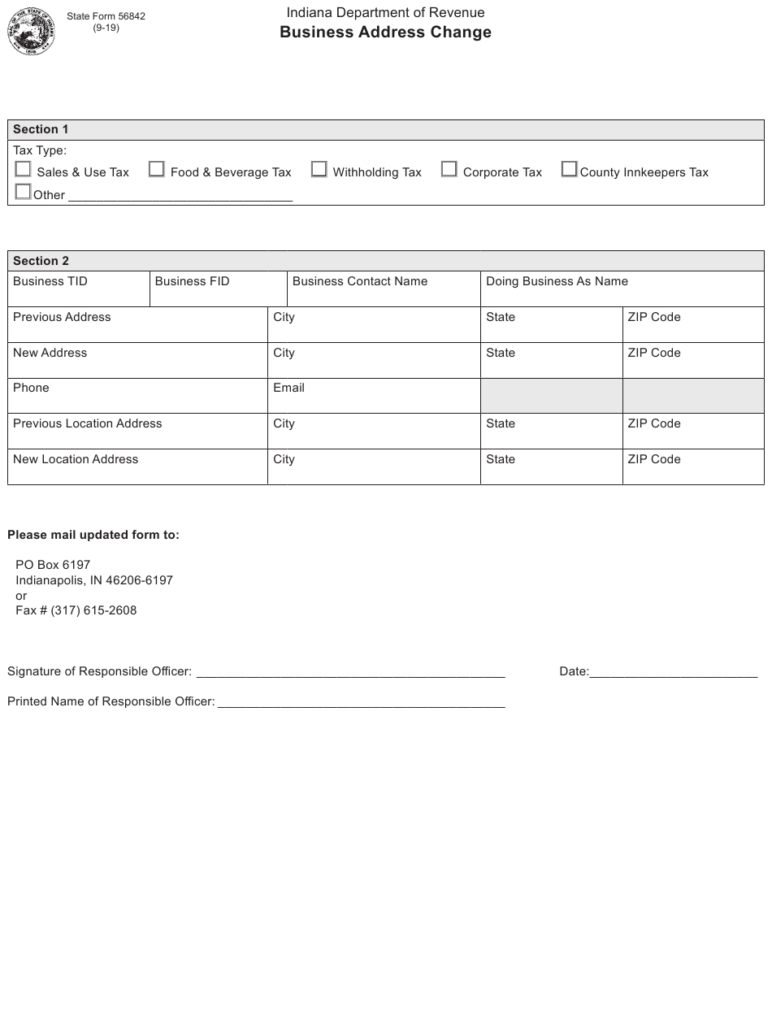

Formulating specifications

Employers must inform the IRS of any withholding taxes that are being collected from employees. For a limited number of these taxes, you may provide documentation to the IRS. Other documents you might be required to file include an withholding tax reconciliation and quarterly tax returns as well as the annual tax return. Here’s some information about the different forms of withholding tax categories and the deadlines for filling them out.

The bonuses, salary commissions, other earnings you earn from your employees may necessitate you to file tax returns withholding. If your employees are paid in time, you could be eligible for tax refunds for withheld taxes. It is important to keep in mind that some of these taxes are local taxes. There are special tax withholding strategies that could be appropriate in particular situations.

As per IRS regulations, electronic filings of tax withholding forms are required. The Federal Employer Identification number must be listed when you point at your national tax return. If you don’t, you risk facing consequences.