State Withholding Tax Forms 2024 – There are many reasons that an individual could submit an application for withholding. These include the need for documentation and exemptions for withholding. There are certain points to be aware of regardless of the reason a person files an application.

Exemptions from withholding

Non-resident aliens must submit Form 1040 NR once each year. If your requirements are met, you could be eligible to apply for an exemption from withholding. The exclusions you can find here are yours.

The attachment of Form 1042-S is the first step to file Form 1040-NR. This document lists the amount withheld by the withholding agencies to report federal income tax for tax reporting purposes. Complete the form in a timely manner. If the information you provide is not provided, one individual could be diagnosed with a medical condition.

The non-resident alien withholding tax is 30%. An exemption from withholding may be possible if you’ve got a an income tax burden of less than 30%. There are many exemptions offered. Some are for spouses and dependents, like children.

Generally, you are eligible for a reimbursement under chapter 4. Refunds are made according to Sections 471 through 474. The withholding agent, or the person who collects the tax at source is the one responsible for distributing these refunds.

Status of the relationship

A proper marital status withholding can help both you and your spouse to complete your tasks. You’ll be amazed at how much money you could put in the bank. The challenge is selecting the best option among the numerous options. There are certain things you must be aware of. Unwise decisions could lead to expensive results. But, if the directions are followed and you pay attention to the rules, you shouldn’t have any issues. If you’re fortunate, you might even make a few new pals when you travel. Today is the anniversary. I’m hoping that you can leverage it to get that elusive ring. For a successful completion of the task it is necessary to get the help of a certified tax expert. A lifetime of wealth is worth the modest payment. You can get a lot of details online. TaxSlayer and other trusted tax preparation firms are some of the most reliable.

The number of withholding allowances claimed

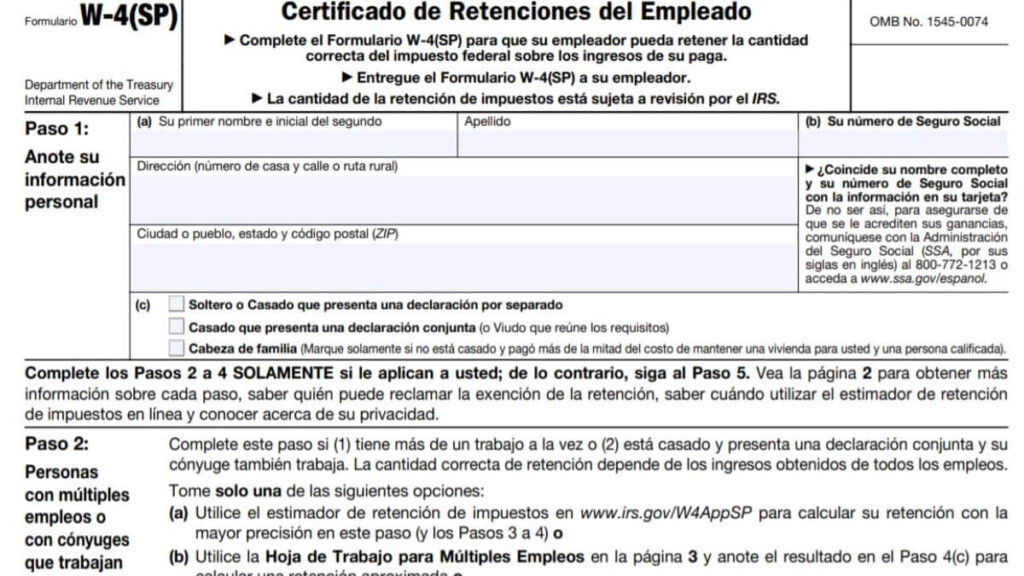

In submitting Form W-4 you must specify how many withholding allowances you want to claim. This is vital since it will affect how much tax you will receive from your wages.

You may be eligible to claim an exemption for your spouse if you are married. The amount of allowances you can claim will depend on your income. If you earn a high amount it could be possible to receive a higher allowance.

Choosing the proper amount of tax deductions could save you from a large tax payment. A refund could be possible if you file your income tax return for the previous year. But it is important to choose the right approach.

In every financial decision, it is important to be aware of the facts. Calculators are a great tool to determine how many withholding allowances are required to be claimed. An expert could be a good option.

Sending specifications

Withholding tax from your employees must be reported and collected when you are an employer. For a limited number of these taxes, you may provide documentation to the IRS. A tax return that is annually filed, quarterly tax returns or withholding tax reconciliation are all types of documents you could need. Here’s some information about the various withholding tax form categories as well as the deadlines for the submission of these forms.

Tax returns withholding may be required to prove income like bonuses, salary or commissions as well as other earnings. If you also pay your employees on-time, you might be eligible for reimbursement for any taxes withheld. It is important to remember that certain taxes might be county taxes. There are also unique withholding rules that can be utilized in certain circumstances.

According to IRS regulations Electronic submissions of withholding forms are required. When you submit your national tax return, please include the Federal Employer Identification number. If you don’t, you risk facing consequences.