State Withholding Tax Form 2024 – There are many reasons why someone may choose to fill out forms for withholding. These include document requirements, exclusions from withholding as well as the withholding allowances. However, if the person decides to fill out an application there are some aspects to consider.

Exemptions from withholding

Nonresident aliens are required once a year to submit Form1040-NR. If you satisfy these requirements, you may be eligible for an exemption from the form for withholding. This page lists all exclusions.

To submit Form 1040-NR The first step is to attach Form 1042S. The form provides information about the withholding done by the tax agency that handles withholding for federal tax reporting for tax reporting purposes. When filling out the form ensure that you provide the accurate details. There is a possibility for one person to be treated differently if the correct information is not provided.

The tax withholding rate for non-resident aliens is 30 percent. The tax burden of your business is not to exceed 30% in order to be eligible for exemption from withholding. There are a variety of exemptions. Certain of them are designed for spouses, whereas others are designed for use by dependents, such as children.

In general, withholding under Chapter 4 gives you the right to an amount of money back. Refunds can be made according to Sections 1400 through 1474. The refunds are made to the tax agent withholding, the person who withholds taxes from the source.

Status of the relationship

The proper marital status and withholding form will simplify your work and that of your spouse. You’ll be amazed at the amount that you can deposit at the bank. It isn’t easy to choose which of many choices is the most appealing. Certain aspects should be avoided. It’s costly to make the wrong choice. It’s not a problem if you just follow the directions and pay attention. If you’re fortunate you could even meet a few new pals on your travels. Today marks the anniversary of your wedding. I hope you will take advantage of it to find that elusive wedding ring. If you want to get it right, you will need the aid of a qualified accountant. A lifetime of wealth is worth that modest payment. You can get a lot of details online. TaxSlayer is among the most trusted and respected tax preparation companies.

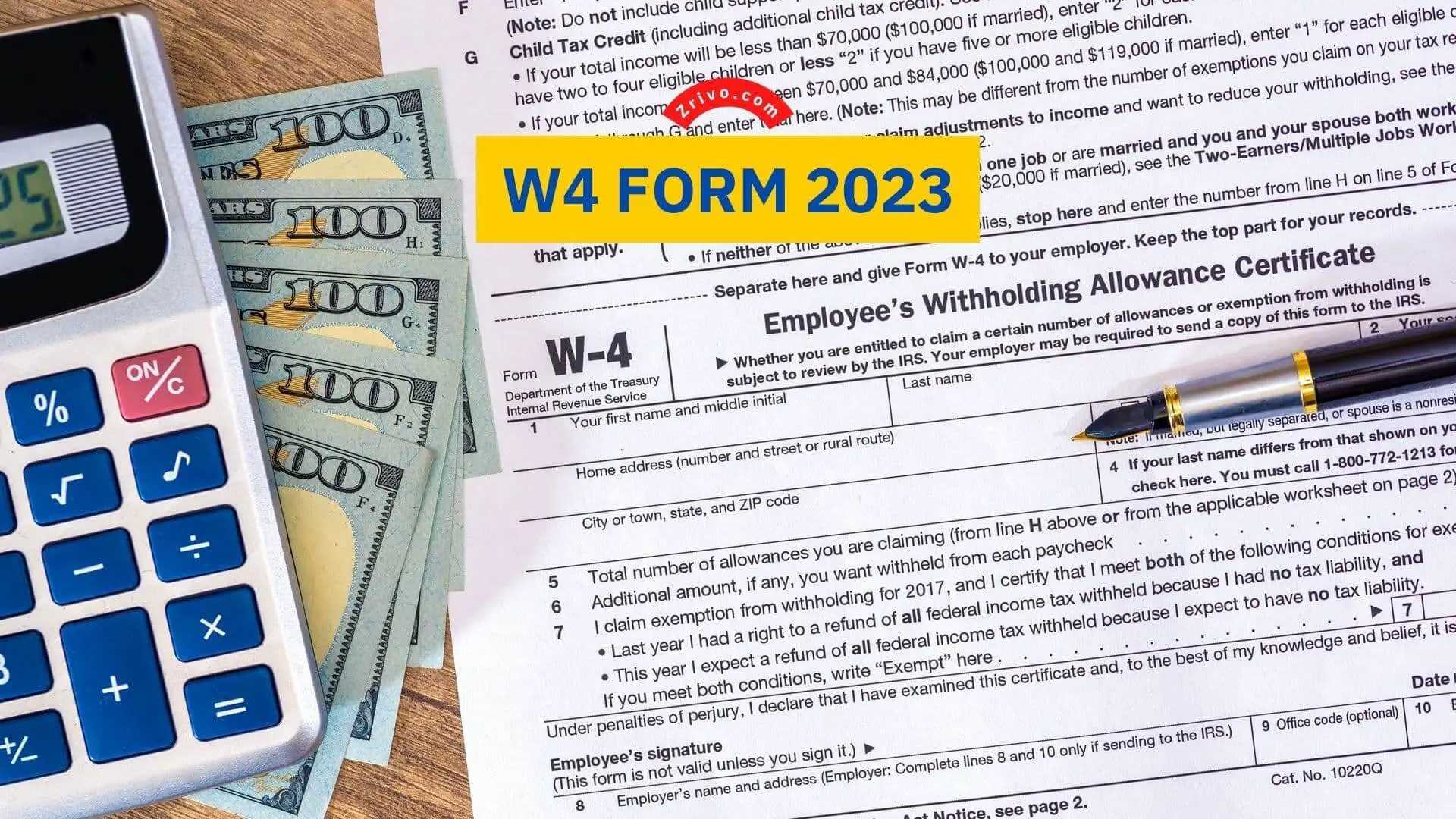

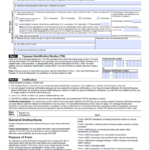

In the amount of withholding allowances claimed

The Form W-4 must be completed with the amount of withholding allowances you wish to be able to claim. This is essential because the amount of tax taken from your paycheck will be affected by the much you withhold.

There are a variety of factors that can affect the amount you are eligible for allowances. The amount you earn will also impact how much allowances you’re eligible to claim. If you earn a substantial income, you may be eligible for a higher allowance.

A tax deduction that is suitable for you can help you avoid large tax obligations. In addition, you could even receive a tax refund if your tax return for income is filed. You need to be careful about how you approach this.

As with any other financial decision, you should do your homework. Calculators can be used to determine the amount of withholding allowances are required to be claimed. Another option is to talk to a professional.

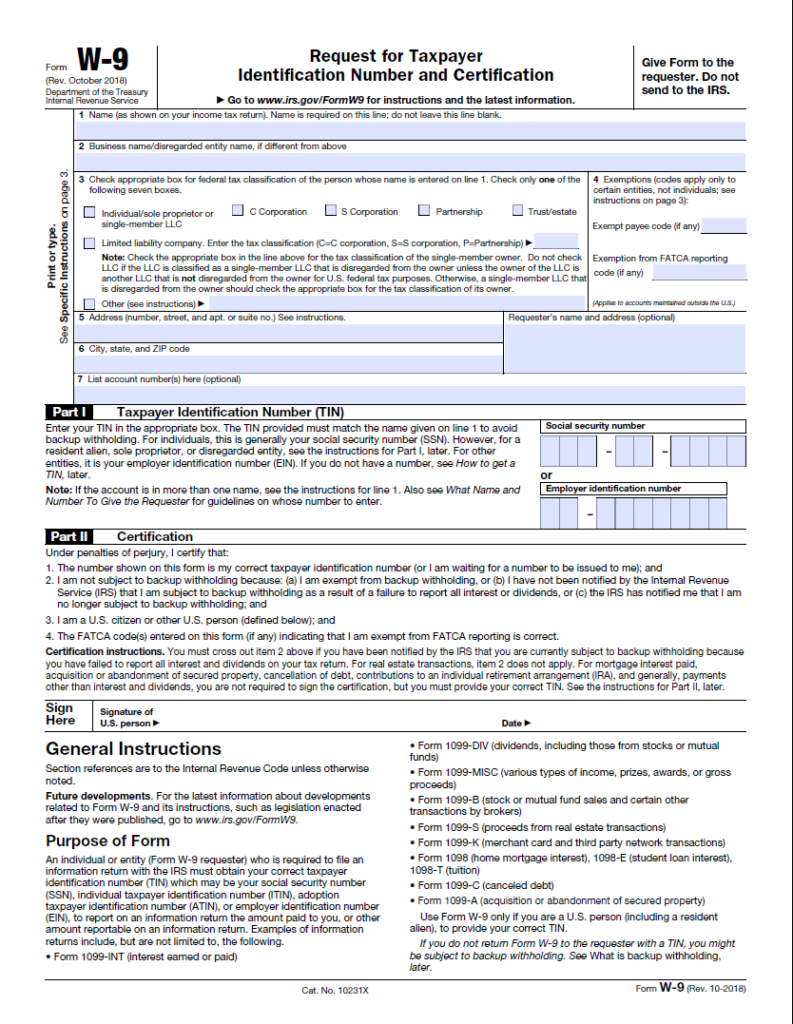

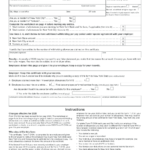

Formulating specifications

Withholding tax from your employees must be collected and reported in the event that you’re an employer. For certain taxes, you may submit paperwork to the IRS. There may be additional documentation , like the reconciliation of your withholding tax or a quarterly tax return. Here’s some information about the different tax forms and when they need to be submitted.

The bonuses, salary commissions, other income that you receive from your employees could require you to file withholding tax returns. You could also be eligible to get reimbursements for tax withholding if your employees were paid in time. Remember that these taxes can be considered as taxation by the county. There are special methods of withholding that are appropriate in particular situations.

Electronic submission of withholding forms is required under IRS regulations. If you are submitting your national tax return be sure to include your Federal Employer Identification number. If you don’t, you risk facing consequences.