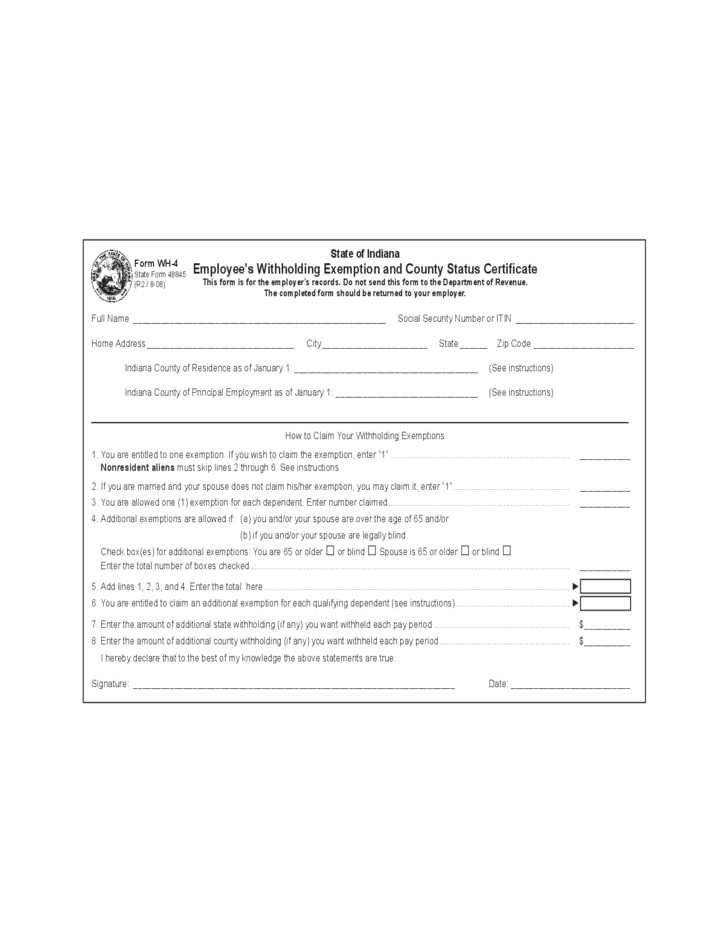

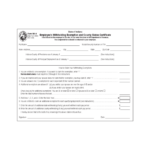

State Withholding Form Indiana – There are a variety of reasons an individual might want to fill out a form for withholding form. Documentation requirements, withholding exemptions and the amount of withholding allowances requested are all factors. Whatever the reason behind a person to file a document there are certain aspects that you need to remember.

Withholding exemptions

Nonresident aliens are required once a year to submit Form1040-NR. If you meet these requirements, you may be eligible to receive exemptions from the form for withholding. This page will list all exemptions.

The first step in submit Form 1040 – NR is attaching Form 1042 S. The document is required to declare the federal income tax. It outlines the withholding of the withholding agent. It is important to enter the correct information when filling out the form. You could be required to treat a specific person for not providing this information.

Nonresident aliens pay a 30% withholding tax. If your tax burden is less than 30% of your withholding, you may be eligible for an exemption from withholding. There are many exemptions. Some are specifically designed for spouses, whereas others are designed for use by dependents such as children.

In general, withholding under Chapter 4 entitles you for a return. Refunds are allowed according to Sections 1471-1474. The refunds are given by the tax agent (the person who collects tax at source).

Relational status

A proper marital status withholding will make it easier for both you and your spouse to do your work. You’ll be amazed at how much money you could make a deposit to the bank. It can be difficult to choose which one of the options you’ll choose. There are some things to avoid. It’s expensive to make the wrong choice. If you follow the instructions and adhere to them, there won’t be any problems. If you’re lucky enough, you could even meet new friends while traveling. In the end, today is the anniversary of your wedding. I’m hoping they can turn it against you in order to assist you in getting the elusive engagement ring. If you want to get it right, you will need the assistance of a certified accountant. This small payment is well enough to last the life of your wealth. Information on the internet is readily available. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

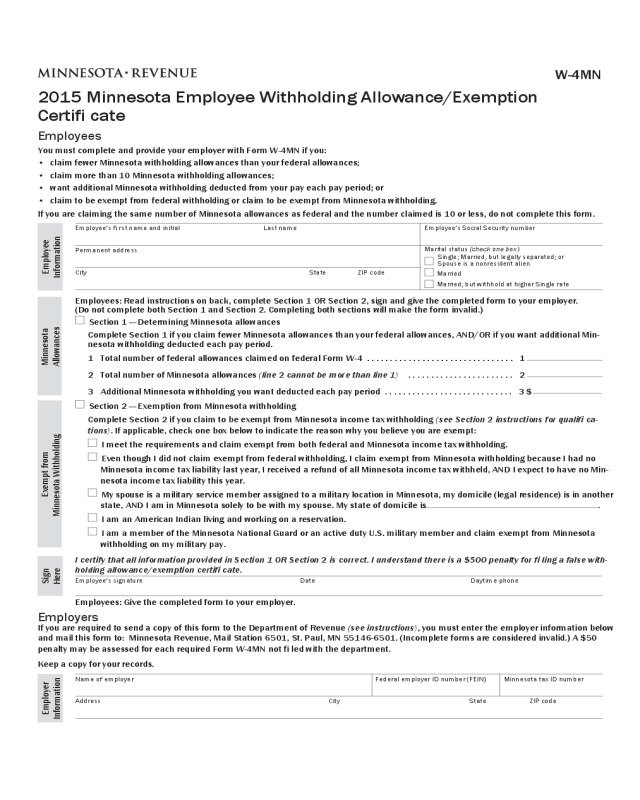

Number of claimed withholding allowances

It is important to specify the amount of the withholding allowance you wish to claim on the Form W-4. This is important because the tax withheld will impact the amount taken out of your paychecks.

There are a variety of factors that affect the allowances requested.If you’re married, for instance, you could be eligible to claim an exemption for the head of household. The amount you earn will influence how many allowances your can receive. If you have a higher income you may be eligible to receive more allowances.

Tax deductions that are appropriate for your situation could aid you in avoiding large tax payments. You could actually receive a refund if you file your annual income tax return. However, you must be cautious about your approach.

Just like with any financial decision you make, it is important to do your homework. Calculators are a great tool to determine the amount of withholding allowances you should claim. A professional might be a viable alternative.

Formulating specifications

Employers must report any withholding taxes that are being collected from employees. If you are taxed on a specific amount you might need to submit documentation to IRS. There are other forms you might need for example, an annual tax return, or a withholding reconciliation. Here are some specifics regarding the various forms of tax withholding forms and the deadlines for filing.

In order to be eligible for reimbursement of withholding taxes on the compensation, bonuses, salary or other revenue received from your employees it is possible to file a tax return for withholding. Additionally, if your employees are paid punctually, you might be eligible to get reimbursement of withheld taxes. Be aware that certain taxes could be considered to be taxes imposed by the county, is vital. Furthermore, there are special withholding practices that can be applied under particular circumstances.

Electronic submission of forms for withholding is required under IRS regulations. When you file your tax returns for national revenue make sure you include your Federal Employee Identification Number. If you don’t, you risk facing consequences.