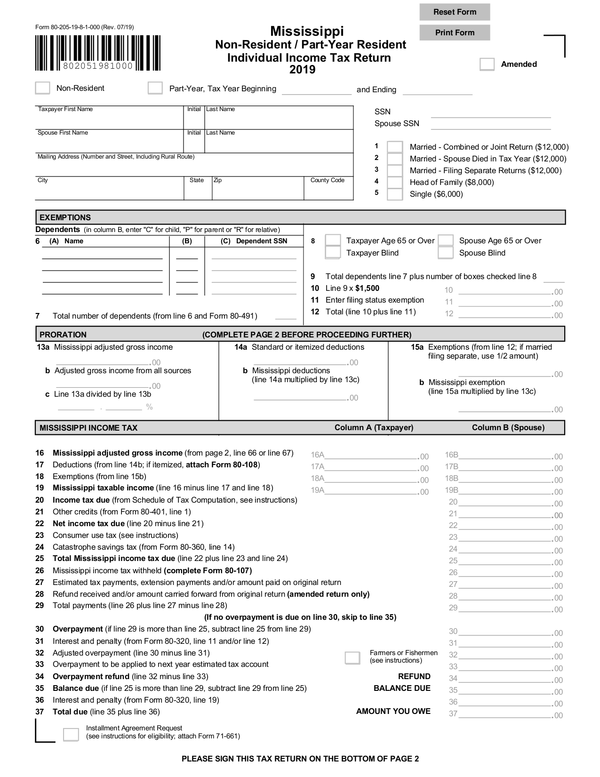

State Withholding Form 2024 Mississippi – There are many reasons why someone might choose to fill out a tax form. This is due to the requirement for documentation, withholding exemptions and also the amount of the required withholding allowances. Whatever the reason behind the filing of an application, there are certain things you must keep in mind.

Withholding exemptions

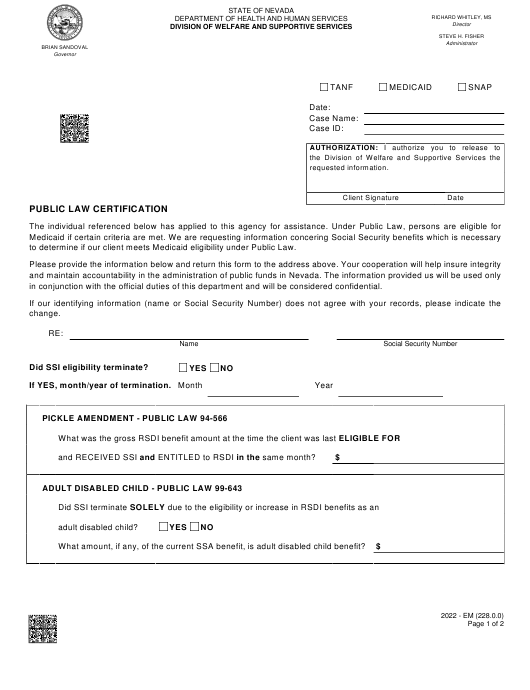

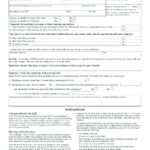

Non-resident aliens must submit Form 1040-NR once a year. If you meet these requirements, you could be eligible to receive exemptions from the withholding form. This page will provide the exclusions.

For Form 1040-NR submission The first step is attaching Form 1042S. This form is used to record federal income tax. It outlines the withholding of the withholding agent. Make sure you enter the right information when filling out this form. One individual may be treated differently if this information is not provided.

The non-resident alien withholding rate is 30 percent. It is possible to be exempted from withholding if the tax burden is greater than 30 percent. There are many exclusions. Certain exclusions are only available to spouses or dependents like children.

You can claim an amount of money if you do not follow the terms of chapter 4. In accordance with Section 1471 through 1474, refunds are given. The refunds are made to the withholding agent, the person who withholds the tax at the source.

Status of relationships

An official marriage status withholding form can help your spouse and you both to make the most of your time. In addition, the amount of money that you can deposit in the bank will pleasantly be awestruck. The difficulty lies in choosing the right option out of the many options. You must be cautious in with what you choose to do. Making a mistake can have costly negative consequences. If you stick to the instructions and be alert for any pitfalls You won’t face any issues. If you’re lucky to meet some new friends while on the road. Today marks the anniversary. I hope you are in a position to leverage this to get the elusive wedding ring. You’ll want the assistance of a certified tax expert to finish it properly. A little amount can create a lifetime of wealth. Online information is easy to find. TaxSlayer as well as other reliable tax preparation firms are a few of the top.

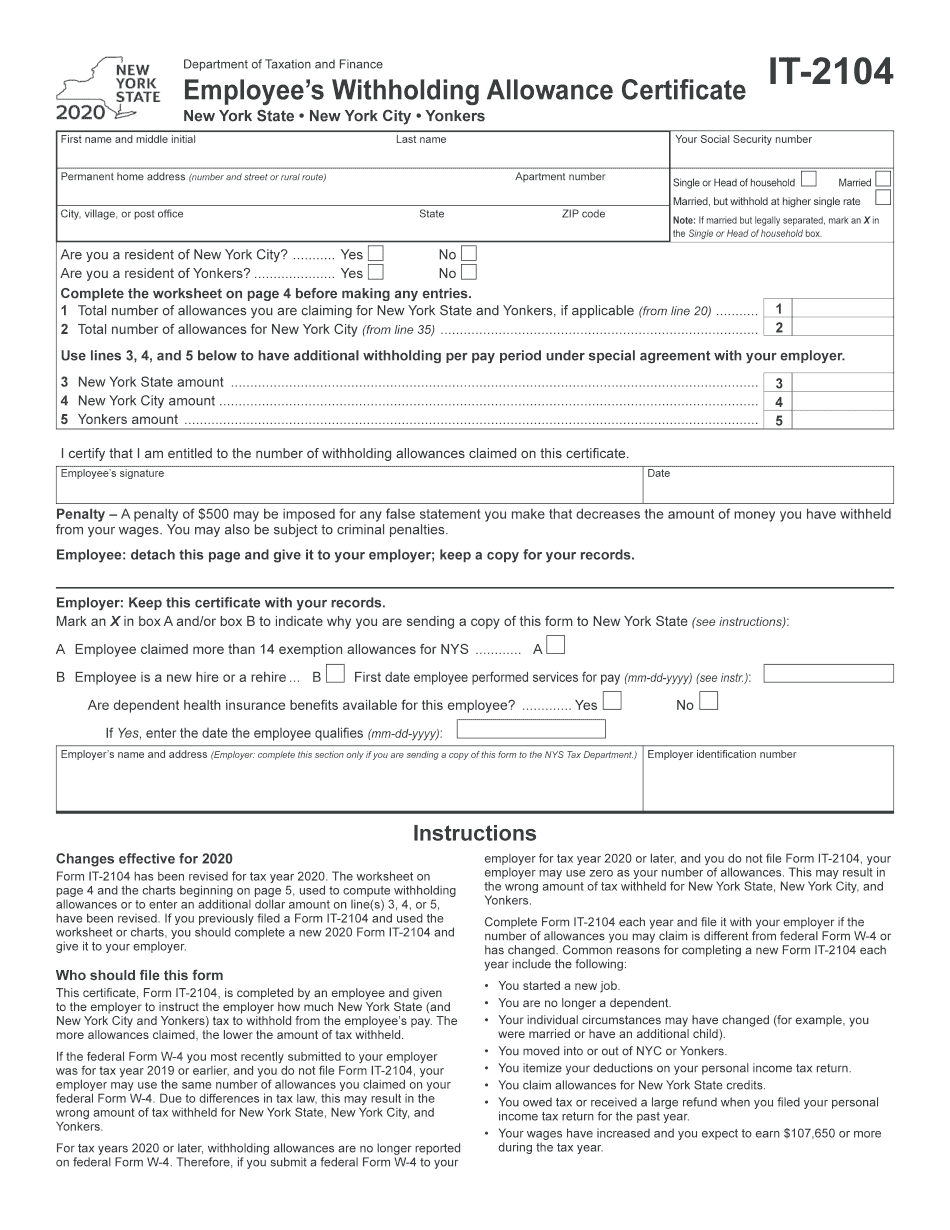

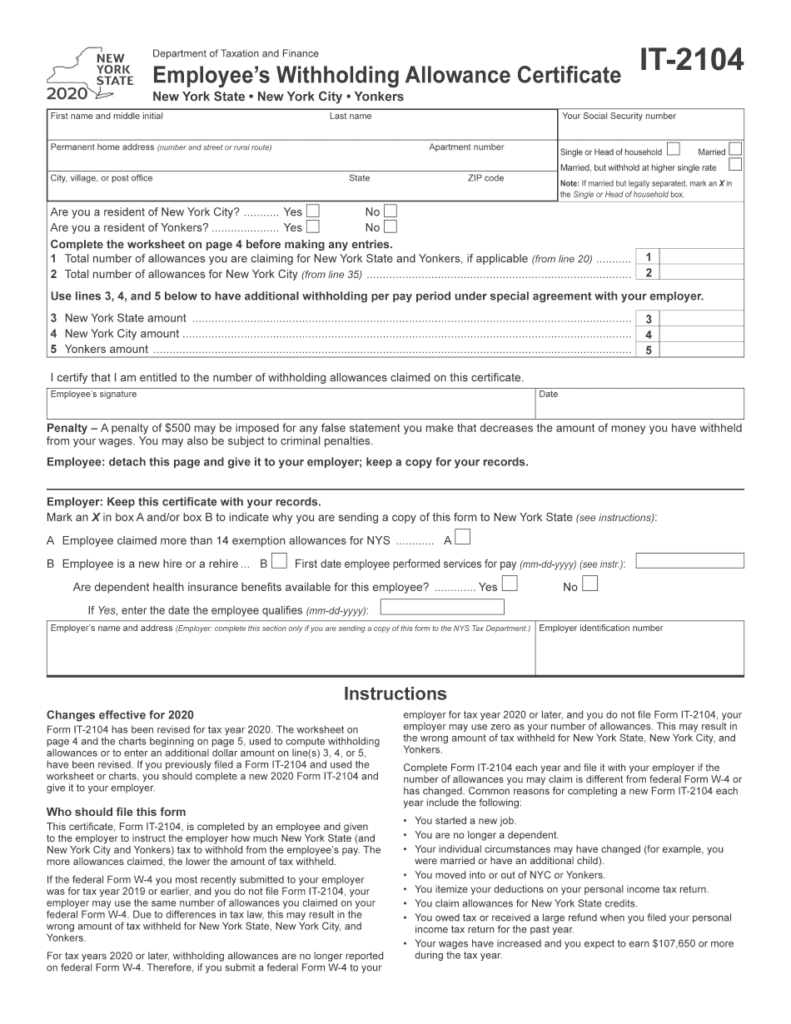

There are numerous withholding allowances being requested

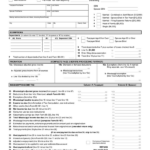

The Form W-4 must be completed with the amount of withholding allowances that you wish to claim. This is important since the tax amount withdrawn from your pay will depend on how much you withhold.

There are many factors that influence the allowance amount you are able to request. If you’re married, you may be eligible for a head-of-household exemption. The amount you earn will determine how many allowances you are eligible for. You could be eligible to claim more allowances if earn a significant amount of money.

A tax deduction that is suitable for you can help you avoid large tax payments. Even better, you might be eligible for a refund when your annual income tax return has been completed. But be sure to choose your approach carefully.

Similar to any other financial decision, you should do your homework. Calculators can assist you in determining the amount of withholding that should be requested. You may also talk to a specialist.

Specifications to be filed

Employers are required to report any withholding tax that is being taken from employees. If you are taxed on a specific amount, you may submit paperwork to the IRS. It is possible that you will require additional documentation , like a withholding tax reconciliation or a quarterly return. Below are details on the different forms of withholding tax and the deadlines for filing them.

In order to be eligible for reimbursement of withholding tax on the compensation, bonuses, salary or other income earned by your employees, you may need to file a tax return for withholding. If your employees receive their wages punctually, you might be eligible to get the tax deductions you withheld. It is important to note that some of these taxes are also county taxes should also be noted. You may also find unique withholding procedures that can be utilized in certain circumstances.

In accordance with IRS regulations, electronic submissions of withholding forms are required. You must provide your Federal Employer ID Number when you file at your income tax return from the national tax system. If you don’t, you risk facing consequences.