State Of Pennsylvania Income Tax Withholding Form – There are numerous reasons one could fill out the form to request withholding. These include the need for documentation and withholding exemptions. It doesn’t matter what reasons someone is deciding to file the Form there are some aspects to keep in mind.

Exemptions from withholding

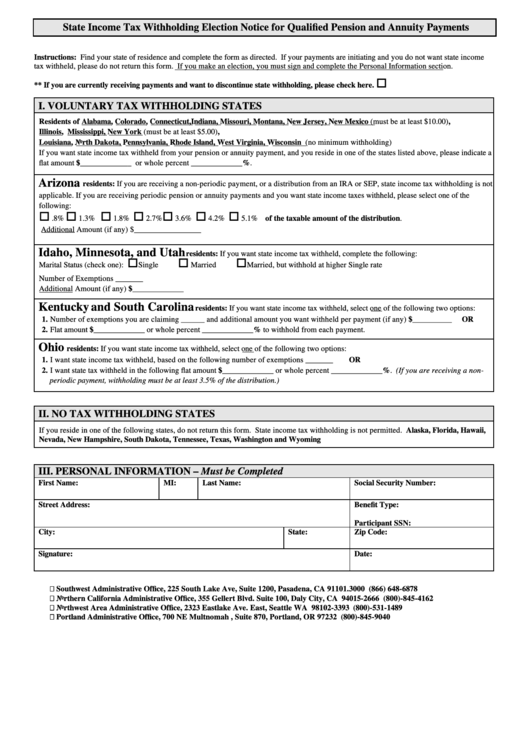

Non-resident aliens must submit Form 1040 NR at least once each year. However, if you meet the criteria, you may be able to submit an exemption from withholding form. There are exemptions that you can access on this page.

The attachment of Form 1042-S is the first step in submitting Form 1040-NR. For federal income tax reporting purposes, this form provides the withholding process of the agency responsible for withholding. Fill out the form correctly. If the information you provide is not supplied, one person may be diagnosed with a medical condition.

Nonresident aliens have a 30% withholding tax. If the tax you pay is less than 30 percent of your withholding, you may qualify to be exempt from withholding. There are many exclusions. Some are specifically designed for spouses, whereas others are meant for use by dependents, such as children.

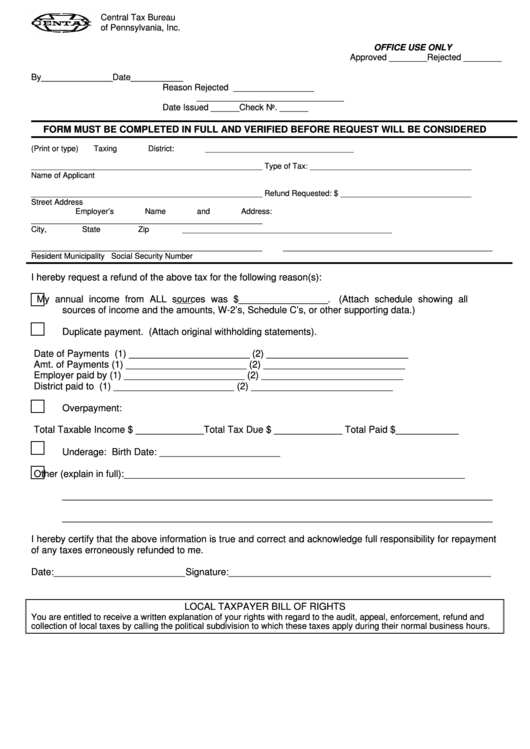

Generally, a refund is offered for the chapter 4 withholding. Refunds can be claimed according to sections 1401, 1474 and 1475. The agent who withholds the tax or the individual who withholds the tax at source is the one responsible for distributing these refunds.

Relational status

A proper marital status withholding will make it easier for both of you to accomplish your job. It will also surprise you how much you can deposit at the bank. It isn’t easy to decide which of the many options is the most appealing. Certain aspects should be avoided. False decisions can lead to costly consequences. There’s no problem if you just follow the directions and pay attention. If you’re lucky, you could meet some new friends on your journey. Today is your anniversary. I’m hoping that you can use it against them to secure that dream ring. If you want to get it right, you will need the help of a certified accountant. A modest amount of money could create a lifetime’s worth of wealth. Online information is easy to find. TaxSlayer is a reputable tax preparation company.

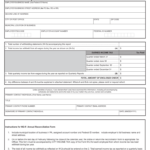

The number of withholding allowances that were requested

It is important to specify the number of withholding allowances you wish to claim on the form W-4 you submit. This is critical as your paychecks may be affected by the amount of tax you have to pay.

The amount of allowances that you get will be contingent on the various aspects. For instance If you’re married, you could be qualified for a head or household exemption. The amount of allowances you are eligible for will be contingent on the income you earn. If you earn a high amount, you might be eligible to receive a higher allowance.

Choosing the proper amount of tax deductions might save you from a large tax payment. In reality, if you complete your yearly income tax return, you could even receive a refund. But , you have to choose the right method.

Research as you would in any other financial decision. Calculators can be utilized to determine how many withholding allowances need to be claimed. A specialist could be a good alternative.

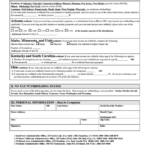

Filing requirements

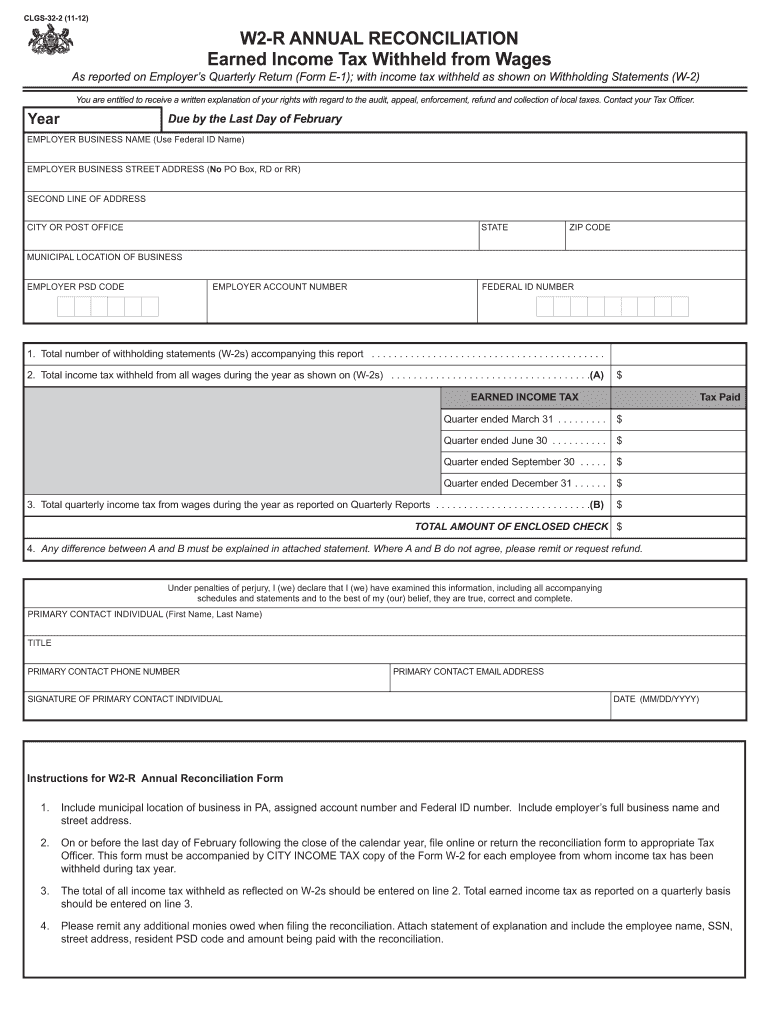

Employers must pay withholding taxes to their employees and then report the tax. Certain of these taxes can be submitted to the IRS through the submission of paperwork. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few kinds of documentation you may require. Here are some information regarding the various forms of withholding tax forms along with the deadlines for filing.

Employees may need you to submit withholding taxes return forms to get their bonuses, salary and commissions. You may also be eligible to be reimbursed of taxes withheld if you’re employees were paid on time. Noting that certain of these taxes are taxes imposed by the county, is vital. You may also find unique withholding methods that are utilized in certain situations.

In accordance with IRS regulations, electronic filing of forms for withholding are required. The Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.