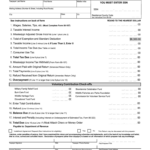

State Of Ms Withholding Tax Forms 2024 – There stand a digit of reasons why someone might choose to complete a withholding form. These factors include documentation requirements and exemptions from withholding. You should be aware of these things regardless of the reason you decide to file a request form.

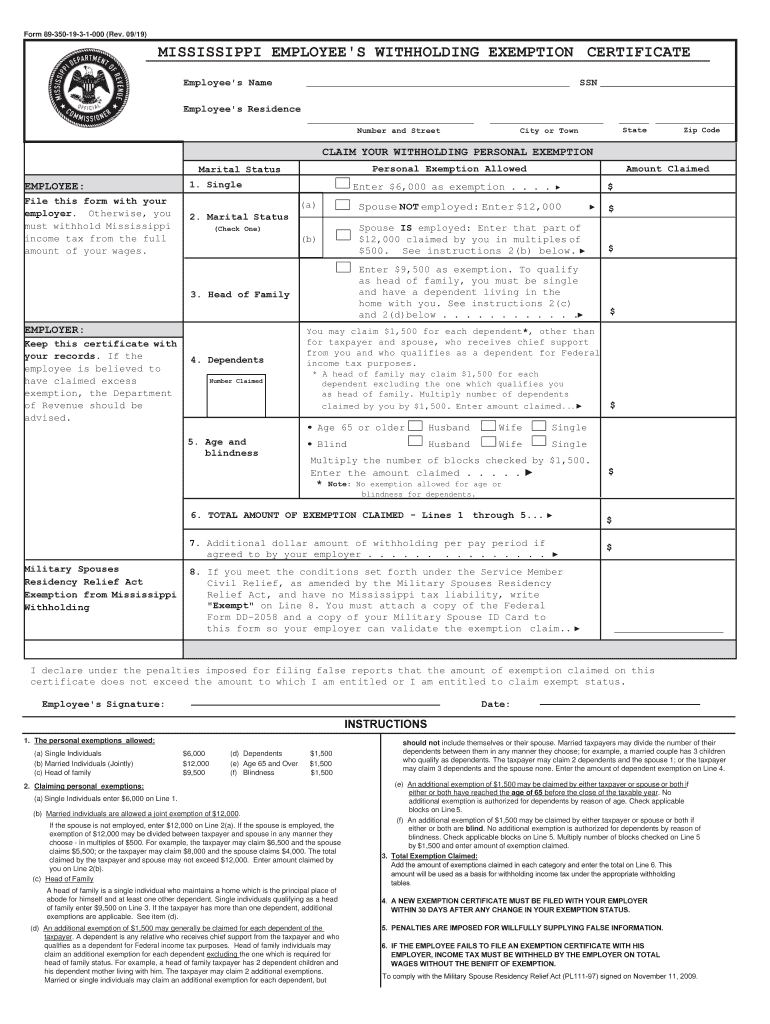

Withholding exemptions

Non-resident aliens must complete Form 1040-NR every year. If you satisfy the requirements, you may be eligible to be exempt from withholding. There are exemptions available on this page.

To file Form 1040-NR the first step is to attach Form 1042S. The form contains information on the withholding done by the tax agency that handles withholding for federal income tax reporting purposes. Be sure to enter the correct information when filling in this form. You could be required to treat a specific person for not providing the correct information.

The 30% tax withholding rate for non-resident aliens is 30. You may be eligible to be exempted from withholding if the tax burden is greater than 30%. There are numerous exemptions. Some are for spouses or dependents like children.

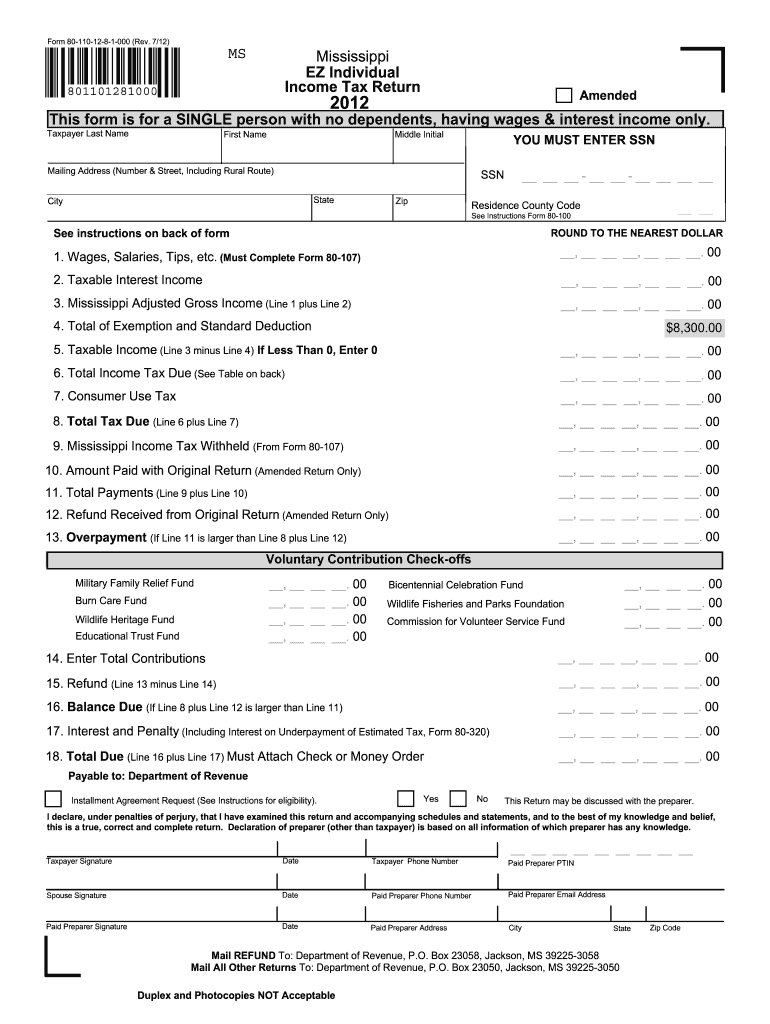

Generally, you are eligible to receive a refund in accordance with chapter 4. Refunds can be made according to Sections 1400 through 1474. Refunds are given to the agent who withholds tax, the person who withholds taxes from the source.

Relational status

A marital withholding form is an excellent way to make your life easier and help your spouse. You’ll be surprised at how much money you can transfer to the bank. It isn’t easy to choose which of many choices is the most attractive. There are certain things that you should avoid doing. There will be a significant cost if you make a wrong choice. However, if the instructions are followed and you pay attention, you should not have any issues. If you’re lucky enough, you could even meet new friends while you travel. Since today is the anniversary of your wedding. I’m hoping that you can leverage it to get that elusive ring. In order to complete the job correctly it is necessary to obtain the assistance of a tax professional who is certified. A modest amount of money can make a lifetime of wealth. You can find tons of information on the internet. Trustworthy tax preparation companies like TaxSlayer are among the most helpful.

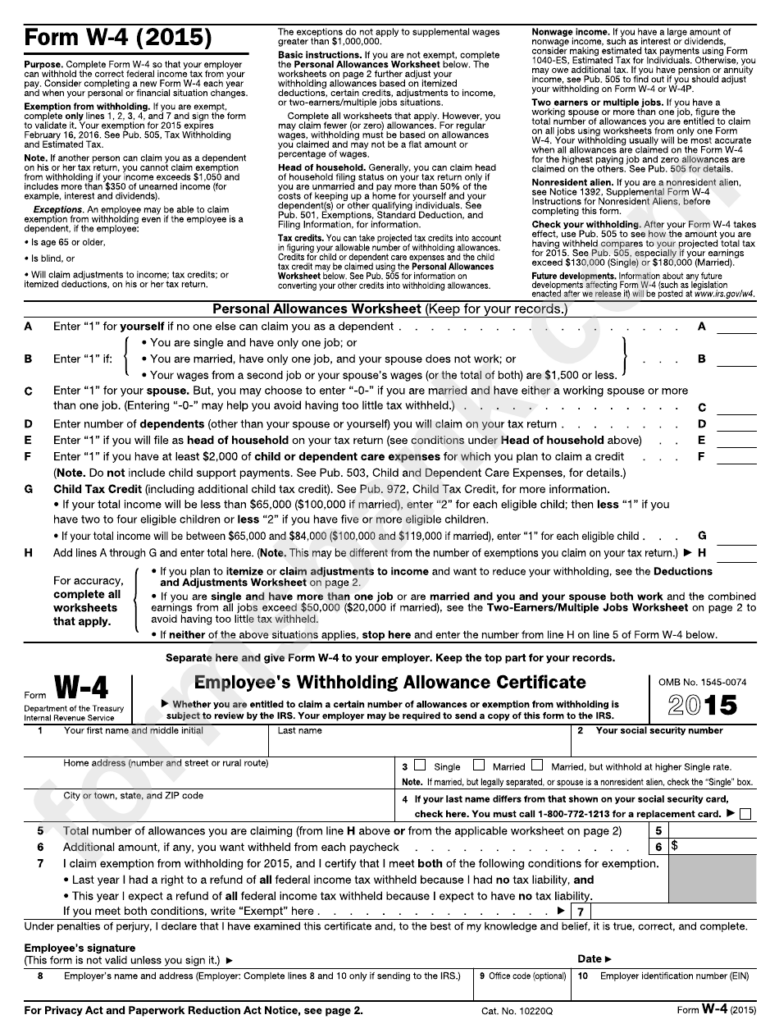

Number of withholding allowances claimed

It is essential to state the amount of withholding allowances you wish to claim on the form W-4. This is crucial as your paychecks may be affected by the amount of tax you have to pay.

There are a variety of factors that can affect the amount you are eligible for allowances. The amount you earn can impact how many allowances are offered to you. A larger allowance might be granted if you make lots of money.

Tax deductions that are appropriate for your situation could help you avoid large tax obligations. A refund could be possible if you file your income tax return for the current year. However, you must be cautious about your approach.

It is essential to do your homework the same way you would for any financial choice. Calculators are readily available to aid you in determining the amount of withholding allowances are required to be claimed. An expert could be a good alternative.

Filing specifications

Withholding tax from your employees must be collected and reported in the event that you are an employer. For a limited number of these taxes, you can send paperwork to IRS. You might also need additional documentation such as the reconciliation of your withholding tax or a quarterly tax return. Below are details about the different withholding tax forms and the deadlines for each.

The compensation, bonuses commissions, other income you get from employees might necessitate you to file withholding tax returns. Additionally, if you paid your employees on time, you could be eligible to receive reimbursement for taxes withheld. Be aware that these taxes may also be considered local taxes. Additionally, there are unique methods of withholding that are applied under particular circumstances.

Electronic submission of forms for withholding is required according to IRS regulations. It is mandatory to provide your Federal Employer Identification Number when you submit to your tax return for national income. If you don’t, you risk facing consequences.