State Of Michigan Income Tax Change Withholding Form – There are many reasons that someone could complete the form to request withholding. These factors include the requirements for documentation, exemptions to withholding and the amount of required withholding allowances. There are some points to be aware of, regardless of the reason that a person has to fill out a form.

Exemptions from withholding

Nonresident aliens are required at least once each year to fill out Form1040-NR. If you meet the criteria, you may be eligible to be exempt from withholding. This page will list the exclusions.

The attachment of Form 1042-S is the first step to submit Form 1040-NR. For federal income tax reporting reasons, this form outlines the withholding made by the agency responsible for withholding. Fill out the form correctly. This information may not be given and cause one person to be treated.

Nonresident aliens have the option of paying a 30% tax on withholding. Your tax burden should not exceed 30% in order to be exempt from withholding. There are a variety of exemptions. Some of them are only for spouses or dependents like children.

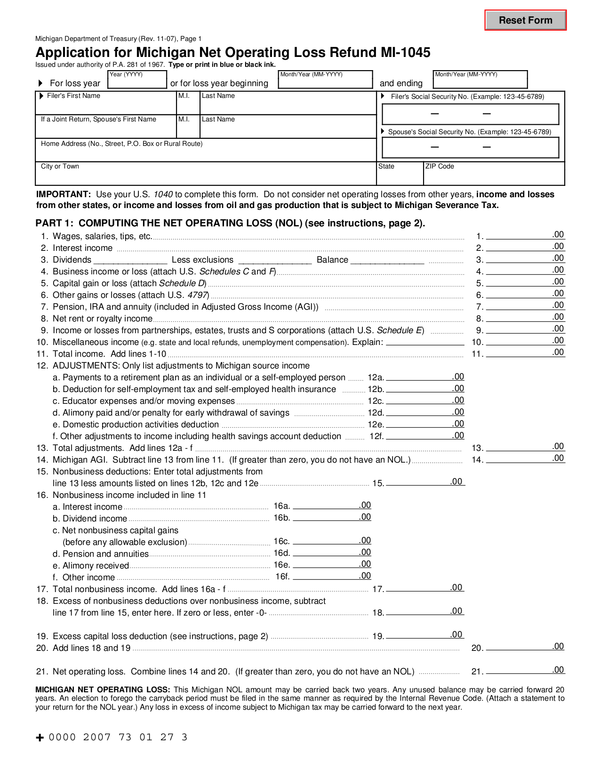

Generally, withholding under Chapter 4 entitles you for the right to a refund. Refunds are granted according to Sections 1471-1474. Refunds will be made to the withholding agent, the person who withholds the tax from the source.

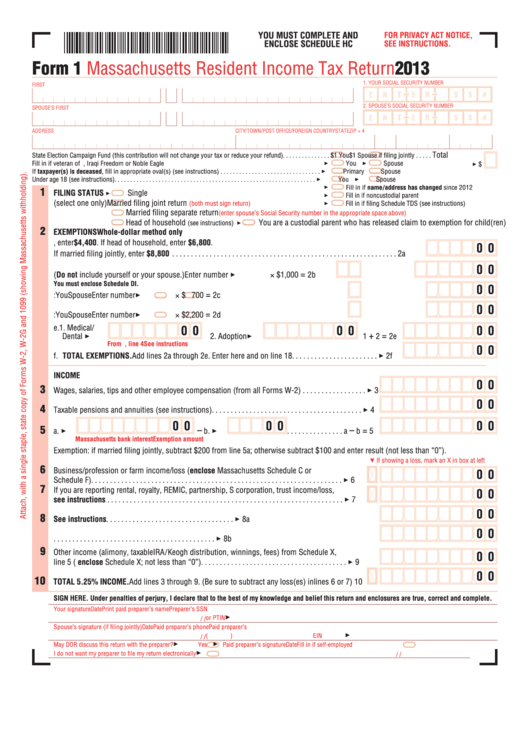

Status of relationships

The work of your spouse and you is made simpler with a valid marriage status withholding form. The bank might be shocked by the amount of money that you have to deposit. It isn’t always easy to determine which one of many choices is the most attractive. Certain issues should be avoided. It will be costly to make the wrong decision. There’s no problem when you follow the directions and pay attention. If you’re lucky you might make new acquaintances on your journey. Today is the anniversary day of your wedding. I’m hoping that you can make use of it to get that elusive engagement ring. In order to complete the job correctly it is necessary to get the help of a tax professional who is certified. This tiny amount is worth the lifetime of wealth. It is a good thing that you can access a ton of information online. TaxSlayer is one of the most trusted and respected tax preparation companies.

There are many withholding allowances being made available

It is important to specify the number of withholding allowances to be able to claim on the Form W-4 that you file. This is crucial since the tax withheld will impact the amount of tax taken from your pay check.

There are a variety of factors that can influence the amount you qualify for allowances. The amount you earn will also impact how much allowances you’re eligible to claim. If you earn a substantial income, you may be eligible for a higher allowance.

You might be able to reduce the amount of your tax bill by selecting the right amount of tax deductions. A refund could be possible if you submit your tax return on income for the previous year. However, you must be careful about how you approach the tax return.

As with any financial decision, you should be aware of the facts. Calculators are readily available to help you determine how much withholding allowances are required to be claimed. You may also talk to a specialist.

Filing requirements

Employers should report the employer who withholds taxes from employees. For certain taxes you might need to submit documentation to IRS. There are other forms you may require for example, an annual tax return, or a withholding reconciliation. Here’s a brief overview of the various tax forms and when they need to be filed.

In order to be eligible for reimbursement of withholding taxes on the compensation, bonuses, salary or other revenue received from your employees You may be required to submit withholding tax return. If you pay your employees on time, then you may be eligible to receive the refund of taxes that you withheld. Be aware that certain taxes are county taxes, is also vital. There are specific methods of withholding that are suitable in certain situations.

The IRS regulations require you to electronically submit your withholding documentation. The Federal Employer Identification number must be noted when you file to your tax return for the nation. If you don’t, you risk facing consequences.