State Of Michigan Annual Withholding Form – There stand a digit of reasons why someone might choose to fill out a tax form. This includes documentation requirements as well as exemptions from withholding, as well as the amount of withholding allowances. There are some important things to keep in mind regardless of the reason a person files an application.

Exemptions from withholding

Nonresident aliens need to submit Form 1040–NR every calendar year. It is possible to file an exemption form for withholding tax in the event that you meet all requirements. There are exemptions that you can access on this page.

To submit Form 1040-NR, add Form 1042-S. The document lists the amount withheld by the withholding agencies for federal tax reporting to be used for reporting purposes. When you fill out the form, make sure you fill in the correct details. This information might not be provided and could result in one individual being treated.

The non-resident alien withholding tax is 30%. If the tax you pay is less than 30 percent of your withholding, you may qualify for an exemption from withholding. There are numerous exemptions. Some are specifically designed for spouses, whereas others are designed to be used by dependents such as children.

Generallyspeaking, withholding in Chapter 4 allows you to claim the right to a refund. Refunds are made in accordance with Sections 471 to 474. Refunds are to be given by the withholding agents that is, the person who withholds taxes at source.

Relational status

A marriage certificate and withholding forms will assist both of you to make the most of your time. The bank could be shocked by the amount of money you’ve deposited. The difficulty lies in selecting the best option out of the many choices. Certain issues should be avoided. It’s costly to make a wrong decision. But if you follow it and follow the directions, you shouldn’t encounter any issues. It is possible to make new acquaintances if you’re lucky. Today marks the anniversary. I’m hoping you’ll be able to utilize it in order to find the elusive diamond. It’s a complex task that requires the expertise of an expert in taxation. A modest amount of money could create a lifetime’s worth of wealth. You can get many sources of information online. TaxSlayer is a trusted tax preparation company is among the most useful.

There are a lot of withholding allowances that are being claimed

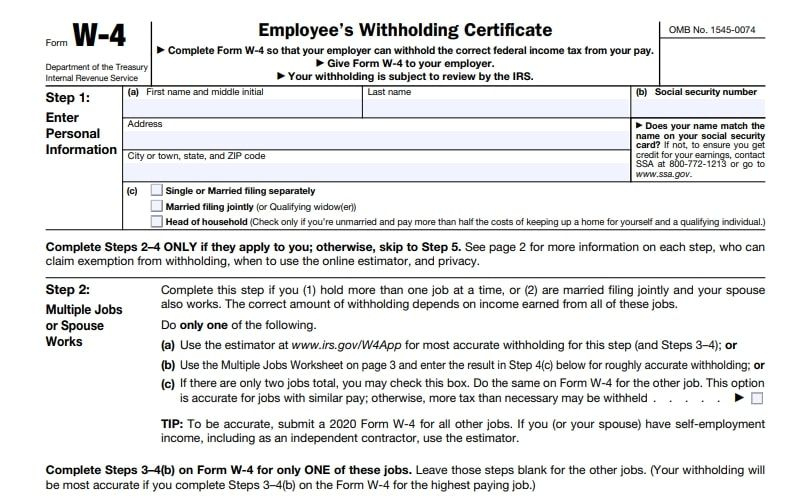

You need to indicate how many withholding allowances to claim on the form W-4 that you file. This is crucial since the tax withheld can affect the amount of tax taken from your paycheck.

You may be eligible to apply for an exemption on behalf of the head of your household if you are married. Your income will influence how many allowances your can receive. You could be eligible to claim a greater allowance if you earn a significant amount of money.

It can save you a lot of money by choosing the correct amount of tax deductions. The possibility of a refund is possible if you submit your income tax return for the year. But you need to pick the right method.

As with any other financial decision, you should do your homework. Calculators will help you determine the number of withholdings that need to be claimed. Alternate options include speaking to a specialist.

Specifications for filing

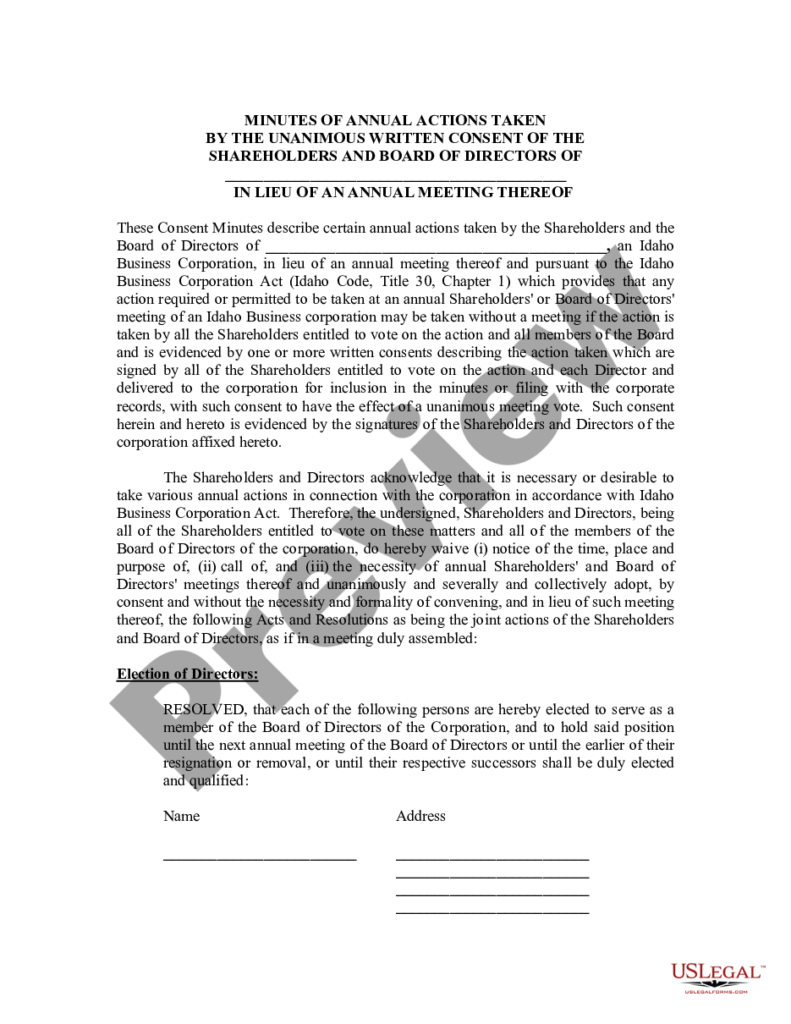

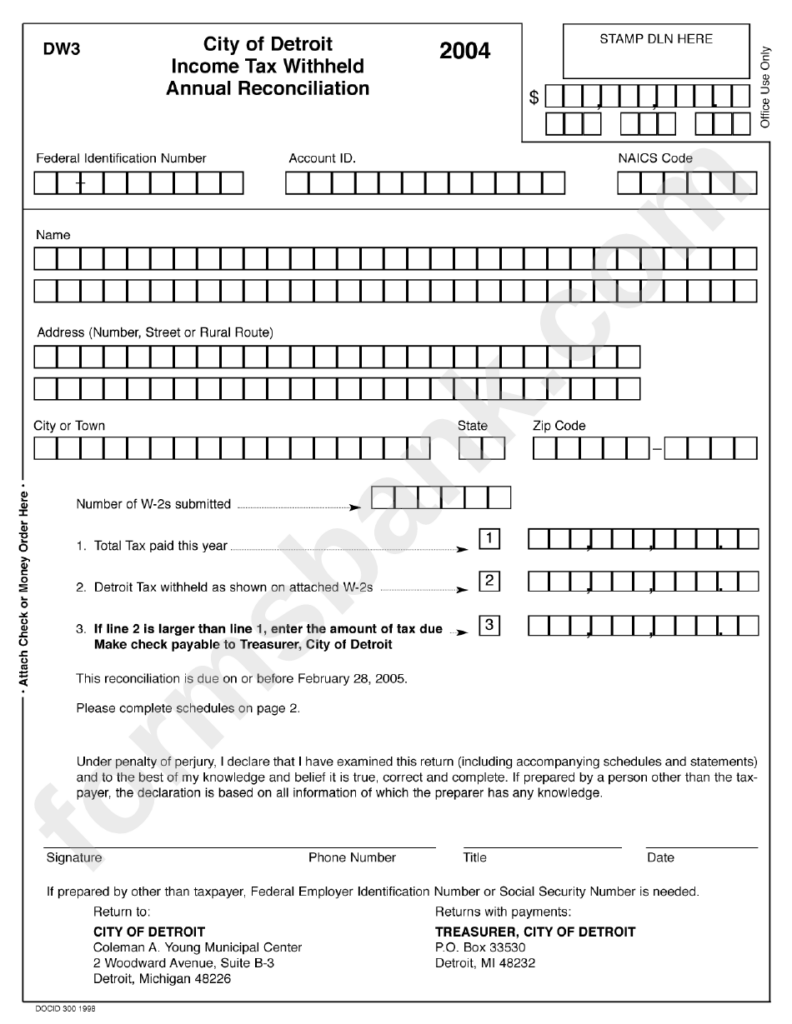

Employers are required to report any withholding taxes that are being taken from employees. It is possible to submit documents to the IRS to collect a portion of these taxation. There are additional forms you might need for example, an annual tax return, or a withholding reconciliation. Below are details on the different types of withholding tax and the deadlines to file them.

You may have to file tax returns withholding for the income you receive from employees, such as bonuses and commissions or salaries. You could also be eligible to be reimbursed for taxes withheld if your employees were paid in time. It is important to note that some of these taxes are also county taxes ought to be taken into consideration. In some situations there are rules regarding withholding that can be different.

Electronic submission of forms for withholding is required according to IRS regulations. The Federal Employer Identification Number needs to be included when you point to your national tax return. If you don’t, you risk facing consequences.