State Of Mi Withholding Form – There are a variety of reasons why one could fill out an application for withholding. These factors include documentation requirements and exemptions from withholding. There are some points to be aware of, regardless of the reason a person files the form.

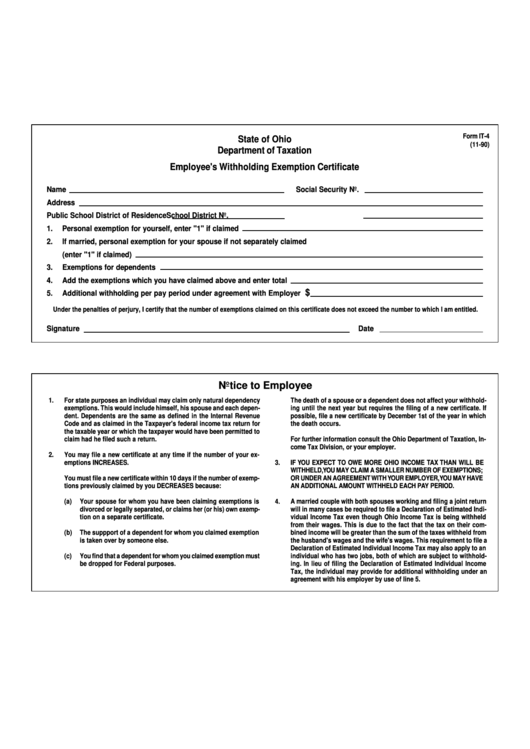

Exemptions from withholding

Non-resident aliens have to file Form 1040NR once per year. It is possible to apply for an exemption for withholding tax when you meet the conditions. This page lists all exemptions.

Attaching Form 1042-S is the first step to submit Form 1040-NR. This form provides details about the withholding that is performed by the agency responsible for withholding for federal tax reporting for tax reporting purposes. It is crucial to enter correct information when you complete the form. If this information is not given, a person could be taken into custody.

The non-resident alien withholding rate is 30%. Non-resident aliens may be eligible for an exemption. This is the case if your tax burden less than 30%. There are numerous exemptions. Some of them apply to spouses or dependents, like children.

In general, the chapter 4 withholding gives you the right to an amount of money. In accordance with Section 1471 through 1474, refunds are granted. Refunds are to be given by the withholding agents who is the person who is responsible for withholding taxes at the source.

Status of relationships

You and your spouse’s work is made simpler by a proper marriage status withholding form. Furthermore, the amount of money you can put at the bank could delight you. Knowing which of the many possibilities you’re most likely to decide is the biggest challenge. There are certain actions you should avoid doing. The wrong decision can cause you to pay a steep price. But if you adhere to the instructions and keep your eyes open to any possible pitfalls You won’t face any issues. If you’re lucky enough, you could even make new acquaintances while traveling. Today is the anniversary day of your wedding. I’m hoping you’ll be able to utilize it against them to locate that perfect engagement ring. It will be a complicated job that requires the knowledge of an accountant. The little amount is worth it for a life-long wealth. There is a wealth of information on the internet. TaxSlayer is a trusted tax preparation business, is one of the most useful.

There are a lot of withholding allowances being claimed

It is essential to state the amount of withholding allowances you would like to claim on the W-4 form. This is crucial since the withholdings will effect on the amount of tax is deducted from your paycheck.

There are a variety of factors that affect the amount of allowances you are able to apply for. If you’re married you may be qualified for an exemption for head of household. Your income level will also determine how many allowances you are entitled to. You may be eligible for an increase in allowances if you make a lot of money.

It can save you thousands of dollars by determining the right amount of tax deductions. A refund could be possible if you file your tax return on income for the current year. It is essential to pick the right method.

Like every financial decision, you must be aware of the facts. Calculators are useful for determining the amount of withholding allowances that need to be made. You can also speak to an expert.

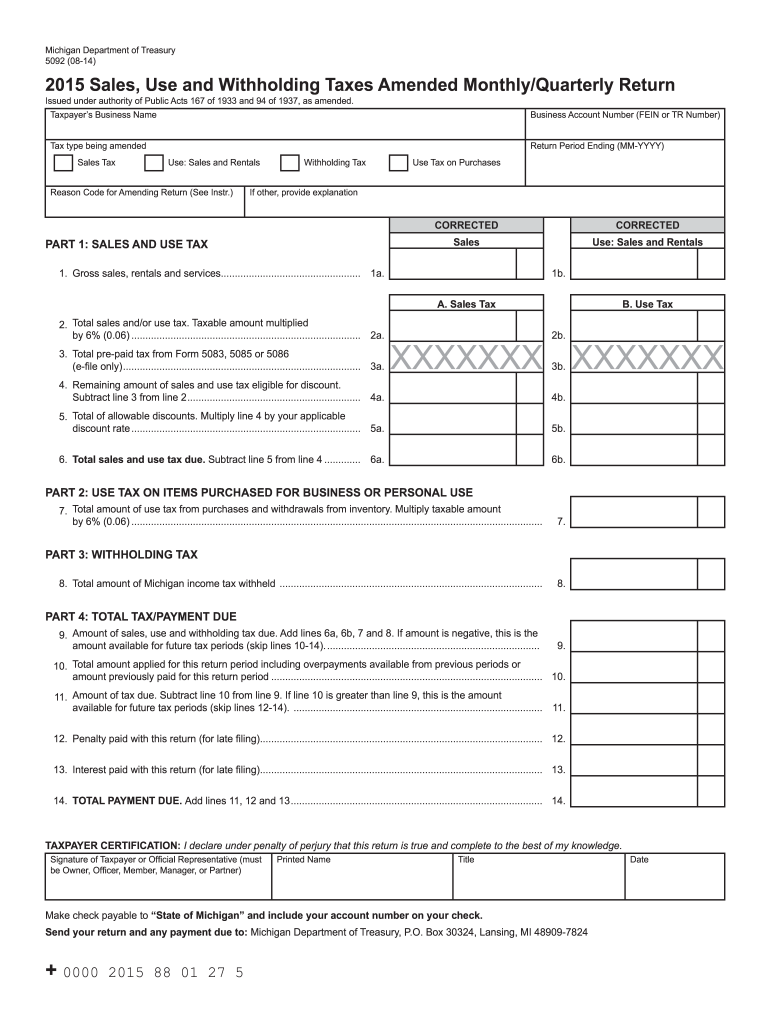

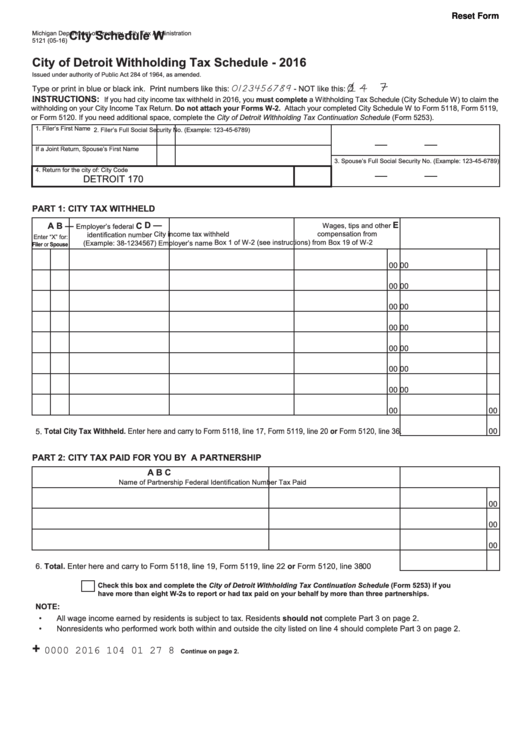

Filing requirements

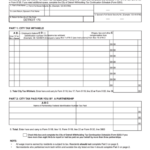

If you’re an employer, you must collect and report withholding taxes on your employees. You may submit documentation to the IRS for a few of these taxes. An annual tax return and quarterly tax returns, or tax withholding reconciliations are just a few kinds of documentation you may need. Here’s some information about the different tax forms for withholding categories, as well as the deadlines to filing them.

Your employees might require you to submit withholding taxes return forms to get their wages, bonuses and commissions. Additionally, if you pay your employees on time it could be possible to qualify to be reimbursed for any taxes taken out of your paycheck. The fact that certain taxes are county taxes should also be noted. Additionally, you can find specific withholding methods that are used in specific situations.

In accordance with IRS rules, you must electronically file withholding forms. You must provide your Federal Employer ID Number when you file your national income tax return. If you don’t, you risk facing consequences.