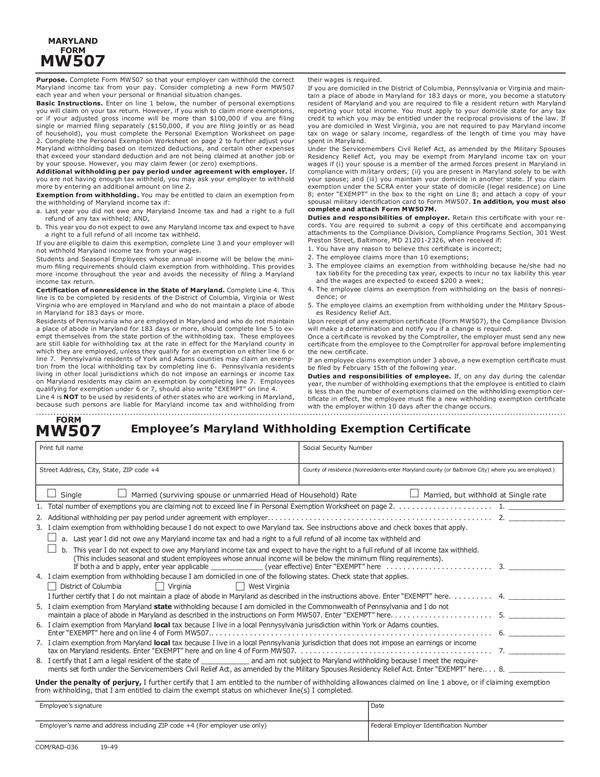

State Of Maryland Withholding Form 2024 – There are many reasons why one might decide to complete a form for withholding form. Withholding exemptions, documentation requirements and the amount of allowances for withholding demanded are all elements. There are certain important things to keep in mind, regardless of the reason that a person has to fill out a form.

Exemptions from withholding

Non-resident aliens must submit Form 1040NR once per year. If you meet the criteria, you could be eligible for an exemption to withholding. This page you’ll see the exemptions that are available to you.

The first step for filling out Form 1040-NR is to attach the Form 1042 S. The form contains information on the withholding done by the tax agency that handles withholding for federal income tax reporting to be used for reporting purposes. Be sure to enter the right information when filling in this form. This information may not be disclosed and cause one person to be treated.

The non-resident alien tax withholding rate is 30. Tax burdens is not to exceed 30% to be eligible for exemption from withholding. There are a variety of exclusions. Some are only for spouses, dependents, or children.

In general, the chapter 4 withholding entitles you to the possibility of a refund. Refunds can be claimed according to sections 1401, 1474, and 1475. The withholding agent, or the person who withholds the tax at source is the one responsible for distributing these refunds.

Status of the relationship

A marital withholding form is an excellent way to simplify your life and aid your spouse. You’ll be amazed by how much you can transfer to the bank. It can be difficult to choose what option you’ll choose. There are certain aspects you should be aware of. The wrong decision can result in a costly loss. However, if the instructions are followed and you pay attention you shouldn’t face any issues. If you’re lucky, you may even meet new friends while traveling. Today is the anniversary. I’m hoping you’re in a position to leverage this against them in order to acquire the elusive wedding ring. To do this properly, you’ll require guidance of a tax expert who is certified. The little amount is worth it for a lifetime of wealth. There is a wealth of details online. TaxSlayer is among the most trusted and respected tax preparation firms.

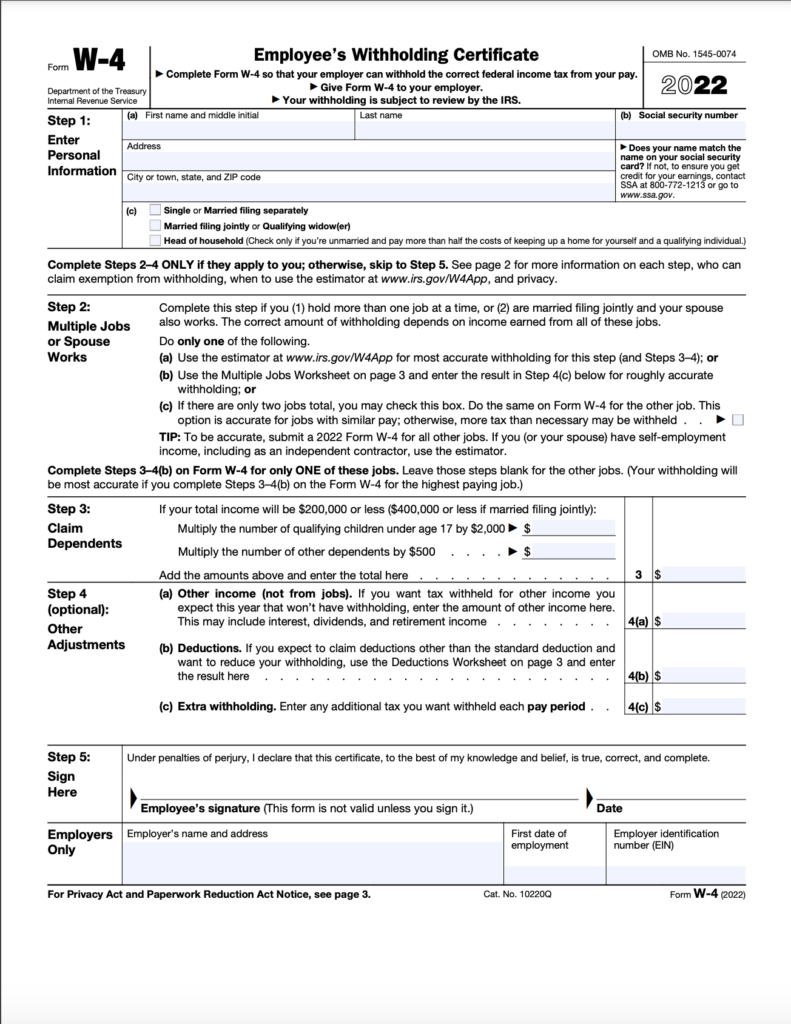

There are a lot of withholding allowances that are being requested

The W-4 form must be filled out with the number of withholding allowances you would like to take advantage of. This is important since it will affect the amount of tax you get from your wages.

You may be able to request an exemption for the head of your household when you’re married. The amount you can claim will depend on your income. If you have a high income, you may be eligible for a higher allowance.

A tax deduction appropriate for you could allow you to avoid tax obligations. You may even get a refund if you file your annual tax return. However, you must be careful about how you approach the tax return.

Similar to any other financial decision, you should conduct your homework. Calculators can be used to determine how many withholding allowances need to be made. Other options include talking to an expert.

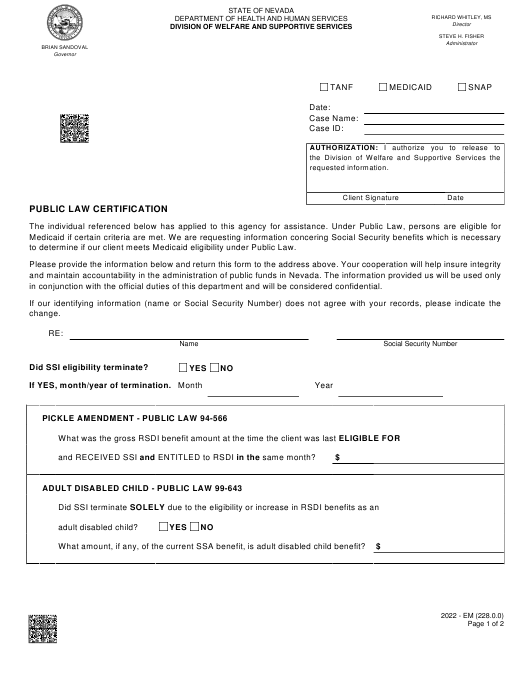

Submitting specifications

Withholding taxes on your employees have to be reported and collected when you’re an employer. A few of these taxes may be submitted to the IRS by submitting forms. A tax return that is annually filed and quarterly tax returns as well as the reconciliation of withholding tax are all examples of paperwork you might require. Here’s some details about the various tax forms and when they need to be submitted.

Employees may need you to file withholding tax returns in order to receive their wages, bonuses and commissions. If you paid your employees promptly, you could be eligible to receive reimbursement for taxes that were withheld. It is important to remember that certain taxes may be county taxes. There are special methods of withholding that are appropriate in particular situations.

According to IRS rules, you are required to electronically submit withholding forms. Your Federal Employer Identification Number should be listed when you submit your tax return for national revenue. If you don’t, you risk facing consequences.