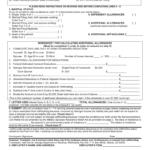

State Of Georgia Employee’s Withholding Form – There are a variety of reasons why a person may decide to submit a withholding application. These factors include the requirements for documentation, exemptions to withholding, as well as the amount of the required withholding allowances. Whatever the reasons someone is deciding to file an Application There are a few aspects to keep in mind.

Withholding exemptions

Non-resident aliens have to submit Form 1040-NR at a minimum every year. If you meet the requirements, you could be eligible for exemptions from the withholding form. This page will provide the exclusions.

When you submit Form1040-NR, attach Form 1042S. This form provides details about the withholding that is performed by the withholding agency for federal income tax reporting purposes. When filling out the form ensure that you provide the correct information. One person may be treated if this information is not supplied.

The non-resident alien tax withholding rate is 30. An exemption from withholding may be possible if you’ve got a an income tax burden of less than 30 percent. There are many exemptions. Some of them are for spouses or dependents like children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds may be granted under Sections 1400 to 1474. Refunds are provided by the withholding agent. This is the person responsible for withholding the tax at the source.

Relational status

A marriage certificate and withholding forms will assist your spouse and you both to make the most of your time. You’ll be amazed by the amount of money you can transfer to the bank. The challenge is in deciding which of the numerous options to pick. There are certain things you must avoid. Unwise decisions could lead to costly results. If you stick to the guidelines and be alert to any possible pitfalls You won’t face any issues. If you’re lucky, you may even meet new friends while traveling. Today marks the anniversary of your wedding. I’m hoping they can turn it against you in order to assist you in getting the elusive engagement ring. In order to complete the job correctly it is necessary to seek the assistance of a certified tax expert. A little amount can make a lifetime of wealth. You can find plenty of information online. Trustworthy tax preparation companies like TaxSlayer are one of the most useful.

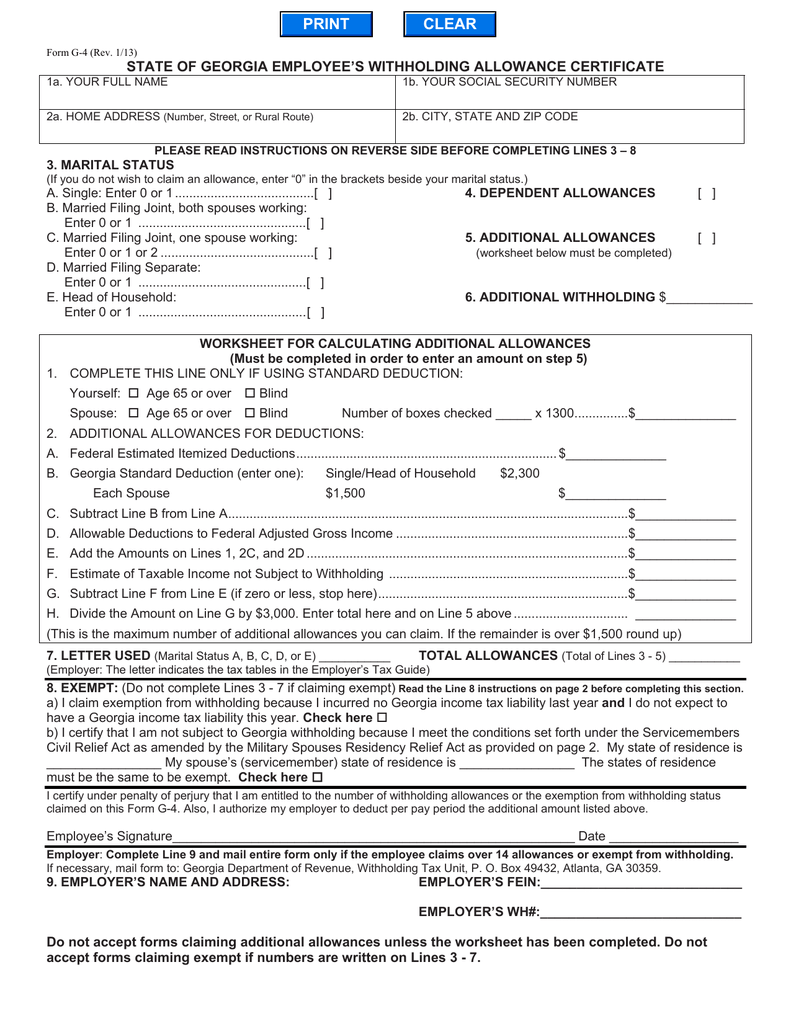

Number of claimed withholding allowances

It is crucial to indicate the amount of withholding allowances you wish to claim on the W-4 form. This is important because the amount of tax taken from your paycheck will be affected by the much you withhold.

You may be able to apply for an exemption on behalf of the head of your household when you’re married. Your income level also affects how many allowances you are qualified to receive. If you have a high income, you can request an increased allowance.

The right amount of tax deductions could help you avoid a significant tax charge. The possibility of a refund is feasible if you submit your tax return on income for the year. But, you should be careful about how you approach the tax return.

Research like you would with any financial decision. Calculators can be utilized to determine the amount of withholding allowances that need to be requested. In addition, you may speak with an expert.

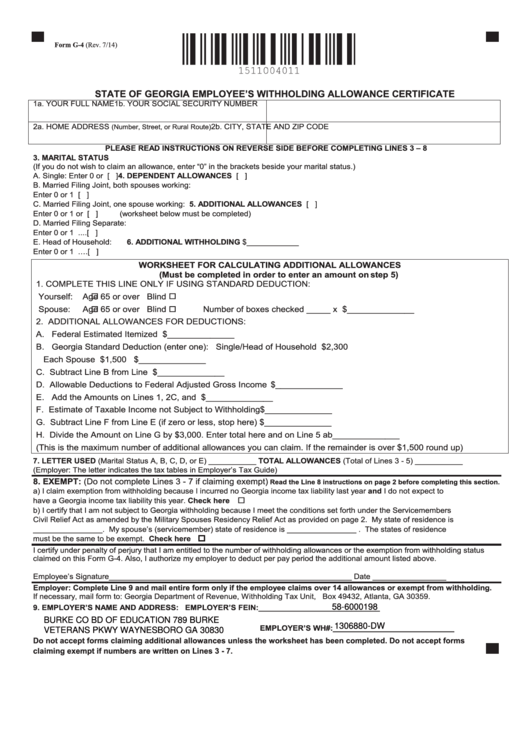

Specifications for filing

Withholding taxes on employees need to be collected and reported in the event that you’re an employer. The IRS can accept paperwork for some of these taxes. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few kinds of documentation you may require. Here’s a brief overview of the various tax forms and when they must be submitted.

Your employees may require you to submit withholding taxes returns to be eligible for their salary, bonuses and commissions. In addition, if you pay your employees on time, you could be eligible to receive reimbursement for taxes withheld. It is important to note that some of these taxes are also county taxes should be taken into consideration. There are also unique withholding methods that are applicable in specific situations.

According to IRS regulations, electronic filing of forms for withholding are required. If you are filing your national revenue tax returns make sure you provide the Federal Employee Identification Number. If you don’t, you risk facing consequences.