State And Local Withholding Elections Form – There are many reasons why one might decide to complete a form for withholding form. These factors include documentation requirements and withholding exemptions. No matter the reason someone chooses to file the Form, there are several points to be aware of.

Exemptions from withholding

Nonresident aliens are required once every year to file Form1040-NR. However, if you satisfy the criteria, you may be eligible to submit an exemption from withholding form. This page lists all exemptions.

The first step to submit Form 1040 – NR is attaching Form 1042 S. This form provides details about the withholding process carried out by the withholding agency to report federal income tax purposes. Please ensure you are entering the right information when filling out this form. One individual may be treated if the information is not entered.

Nonresident aliens pay a 30% withholding tax. A tax exemption may be available if you have an income tax burden of less than 30%. There are a variety of exemptions. Some are specifically for spouses, or dependents, for example, children.

In general, refunds are offered for the chapter 4 withholding. Refunds can be made in accordance with Sections 471 to 474. Refunds are given by the tax agent. This is the individual accountable for tax withholding at the source.

relational status

The marital withholding form is a good way to simplify your life and help your spouse. You’ll be amazed by the amount you can deposit to the bank. It isn’t easy to determine what option you’ll choose. There are some things you must avoid. False decisions can lead to costly consequences. But if you adhere to the guidelines and keep your eyes open to any possible pitfalls, you won’t have problems. If you’re lucky enough, you could even meet new friends while you travel. Today marks the anniversary. I’m sure you’ll use it against them to find that elusive engagement ring. You’ll need the help from a certified tax expert to complete it correctly. The small amount is well enough for a lifetime of wealth. There are numerous online resources that can provide you with details. TaxSlayer is one of the most trusted and reputable tax preparation companies.

The amount of withholding allowances claimed

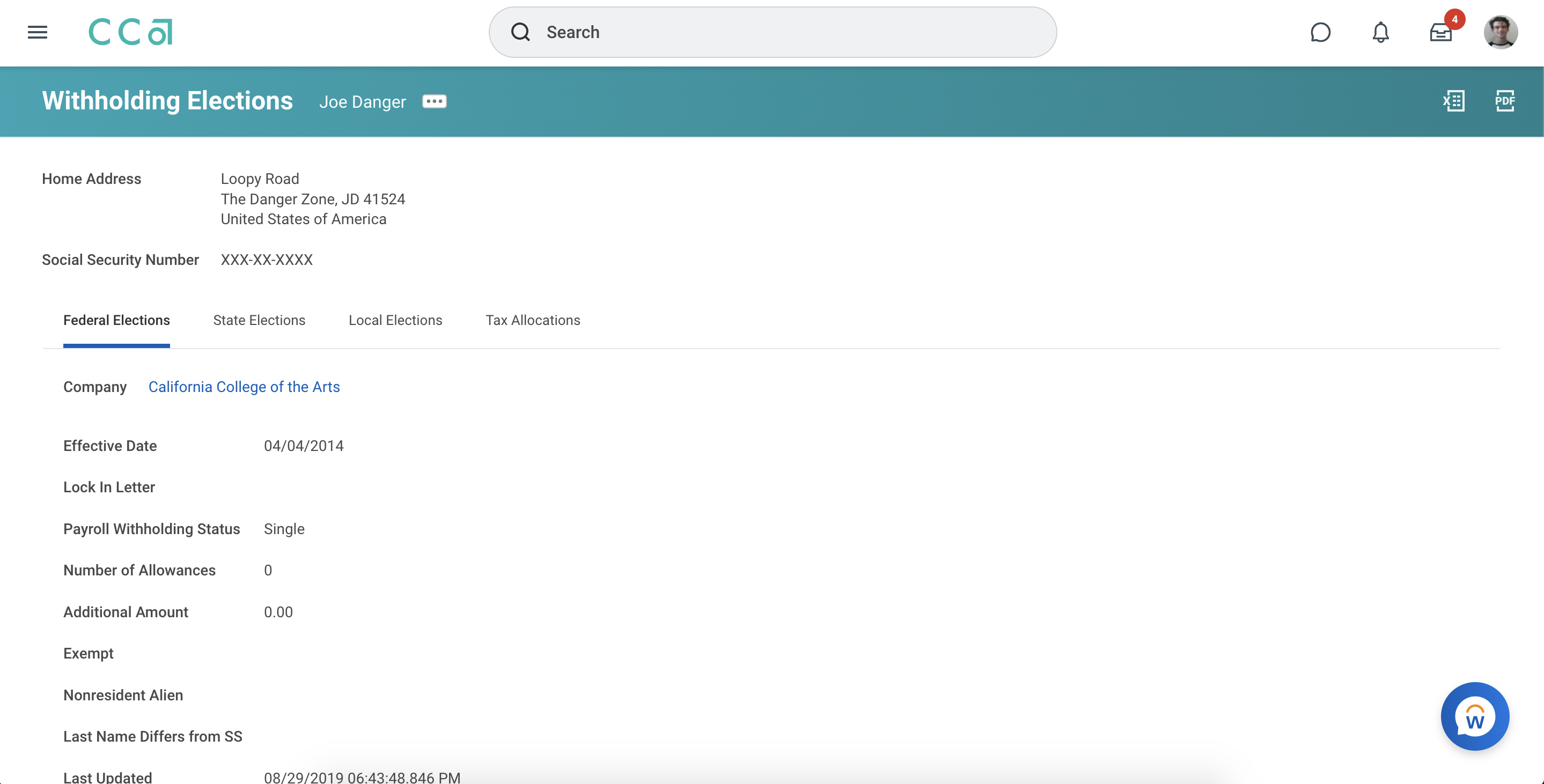

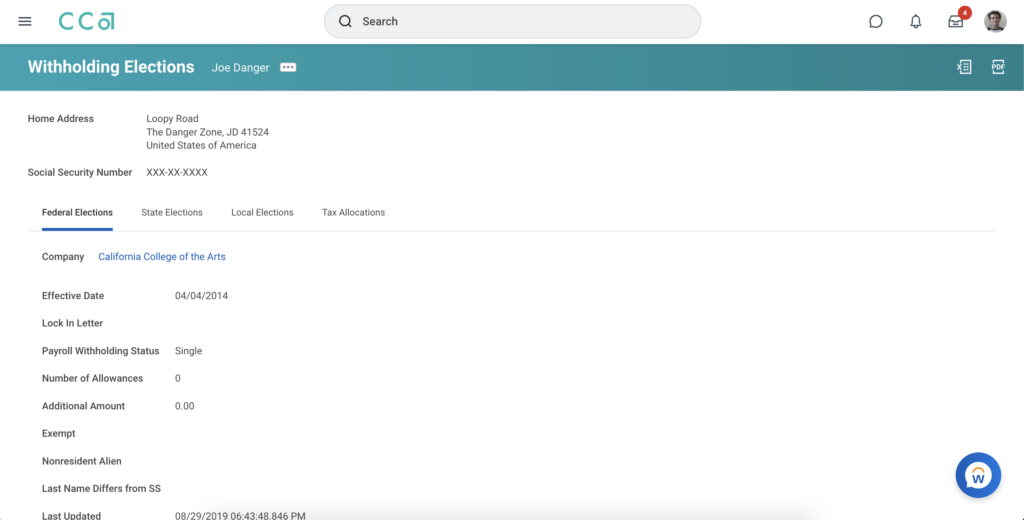

It is important to specify the amount of withholding allowances you would like to claim on the Form W-4. This is critical because your pay will be affected by the amount of tax you have to pay.

There are many factors that influence the amount of allowances that you can apply for. If you’re married, you could be qualified for an exemption for head of household. Your income also determines how much allowances you’re entitled to. If you earn a substantial income, you could be eligible to request an increase in your allowance.

It could save you lots of money by determining the right amount of tax deductions. If you submit your annual tax returns and you are entitled to a refund. However, it is crucial to choose the right approach.

It is essential to do your homework, just like you would with any other financial decision. Calculators can be used for determining the amount of withholding allowances that are required to be requested. Other options include talking to a specialist.

Formulating specifications

Withholding tax from employees need to be collected and reported when you are an employer. It is possible to submit documents to the IRS to collect a portion of these taxation. A withholding tax reconciliation and a quarterly tax return, as well as an annual tax return are examples of additional documents you could be required to submit. Here are some specifics about the various types of withholding tax forms along with the filing deadlines.

To be qualified for reimbursement of withholding taxes on the salary, bonus, commissions or other revenue that your employees receive You may be required to submit withholding tax return. Also, if your employees receive their wages punctually, you might be eligible to get tax refunds for withheld taxes. Be aware that some of these taxes could be considered to be local taxes. Additionally, you can find specific withholding rules that can be applied in particular circumstances.

You must electronically submit tax withholding forms as per IRS regulations. Your Federal Employer Identification Number needs to be included when you point your national revenue tax return. If you don’t, you risk facing consequences.