State And City Tax Withholding Form – There are a variety of reasons someone might choose to fill out a form for withholding form. This includes documentation requirements as well as exemptions from withholding, as well as the quantity of requested withholding allowances. There are a few important things to keep in mind regardless of the reason that a person has to fill out the form.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR at least once every year. If the requirements meet, you may be eligible to apply for an exemption from withholding. On this page, you’ll see the exemptions that are available to you.

For Form 1040-NR submission The first step is to attach Form 1042S. This form details the withholdings made by the agency. Be sure to enter the right information when filling in this form. There is a possibility for one person to be treated if the correct information is not provided.

Non-resident aliens are subject to 30 percent withholding. If the tax you pay is lower than 30% of your withholding, you may qualify for an exemption from withholding. There are many exemptions. Certain of them apply to spouses, dependents, or children.

Generally, withholding under Chapter 4 allows you to claim a return. Refunds can be claimed under Sections 1401, 1474, and 1475. Refunds are given to the withholding agent, the person who withholds taxes from the source.

Relational status

A proper marital status withholding will make it easier for both of you to do your work. You’ll be amazed at the amount you can deposit at the bank. The challenge is picking the right bank out of the many choices. There are certain things you should avoid doing. Making the wrong decision will result in a significant cost. There’s no problem when you follow the directions and pay attention. If you’re lucky enough you’ll make new acquaintances while driving. Since today is the date of your wedding anniversary. I’m hoping you can make use of it to find that perfect wedding ring. For a successful approach you’ll need the aid of a qualified accountant. It’s worthwhile to create wealth over the course of your life. You can find tons of information online. TaxSlayer and other trusted tax preparation firms are some of the best.

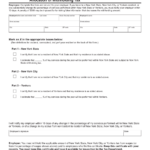

There are many withholding allowances being claimed

The form W-4 should be filled in with the amount of withholding allowances that you would like to be able to claim. This is important as your paychecks may be affected by the amount of tax you pay.

There are many factors that affect the allowance amount you are able to claim. If you’re married, you may be eligible for a head-of-household exemption. Additionally, you can claim additional allowances based on the amount you earn. If you earn a high amount, you might be eligible to receive a higher allowance.

A tax deduction that is appropriate for you could aid you in avoiding large tax payments. Refunds could be feasible if you submit your tax return on income for the previous year. However, you must be careful about how you approach the tax return.

Similar to any financial decision, it is important that you should do your homework. Calculators can be utilized to figure out how many withholding allowances must be claimed. Other options include talking to an expert.

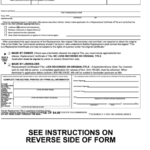

filing specifications

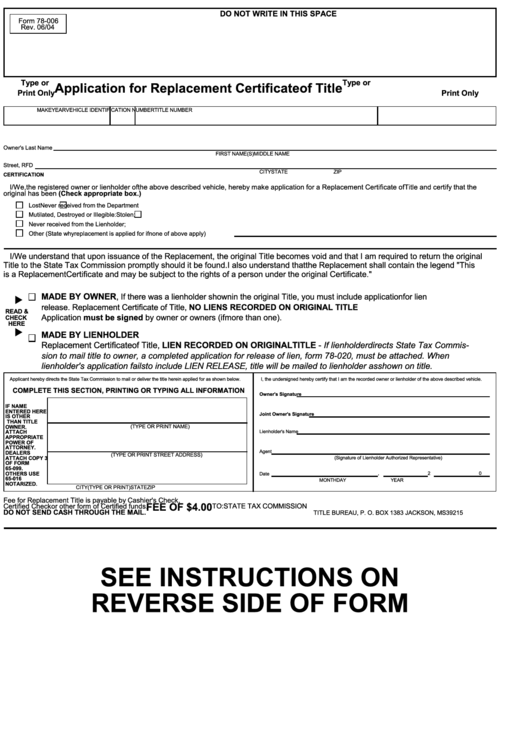

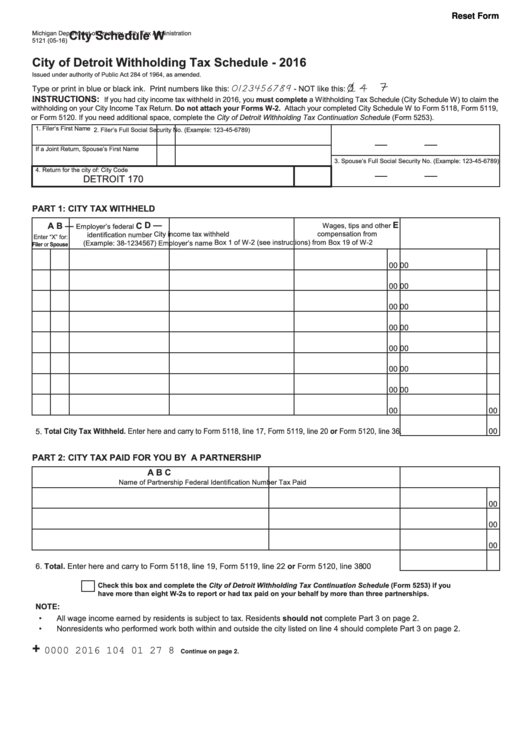

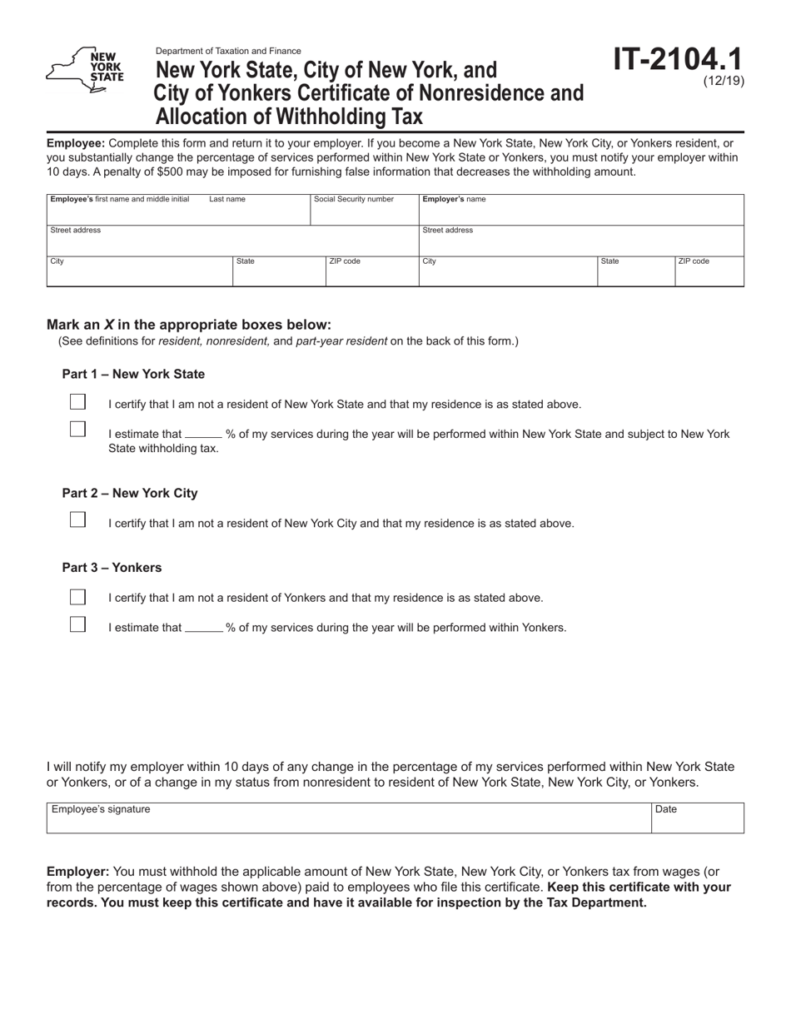

If you are an employer, you must collect and report withholding taxes on your employees. If you are taxed on a specific amount, you may submit paperwork to the IRS. There may be additional documentation , like the reconciliation of your withholding tax or a quarterly return. Here’s some details about the different tax forms, and when they must be filed.

To be qualified for reimbursement of withholding taxes on the salary, bonus, commissions or other revenue received from your employees You may be required to submit withholding tax return. Also, if employees are paid in time, you could be eligible to get the tax deductions you withheld. Remember that these taxes could be considered as county taxes. There are certain methods of withholding that are appropriate in particular situations.

You have to submit electronically tax withholding forms as per IRS regulations. When you submit your tax return for national revenue be sure to include the Federal Employer Identification number. If you don’t, you risk facing consequences.