Sc Withholding Form 2024 – There are many reasons that an individual could submit an application for withholding. This includes documentation requirements and exemptions for withholding. There are a few important things to keep in mind, regardless of the reason that a person has to fill out the form.

Exemptions from withholding

Non-resident aliens have to file Form 1040 NR at least once each year. If you fulfill the minimum requirements, you could be eligible to submit an exemption from withholding form. You will discover the exclusions that you can access on this page.

To file Form 1040-NR, the first step is to attach Form 1042S. The form contains information on the withholding that is performed by the tax agency that handles withholding for federal tax reporting for tax reporting purposes. Be sure to enter the correct information as you complete the form. If the correct information isn’t supplied, one person may be treated.

The non-resident alien tax withholding rate is 30 percent. A nonresident alien may be qualified for an exemption. This applies if your tax burden is lower than 30 percent. There are many exemptions. Some are specifically designed for spouses, whereas others are intended for use by dependents like children.

In general, refunds are offered for the chapter 4 withholding. Refunds are granted according to Sections 1471-1474. Refunds are given to the agent who withholds tax the person who withholds taxes from the source.

relational status

A marital withholding form is a good way to simplify your life and help your spouse. You’ll be amazed at the amount that you can deposit at the bank. The difficulty lies in selecting the best option out of the many choices. There are some things you must avoid. It can be costly to make a wrong decision. If you adhere to the rules and pay attention to instructions, you won’t run into any problems. If you’re lucky, you might even make new acquaintances while traveling. Today is the day you celebrate your wedding. I’m hoping you’ll utilize it in order to find that elusive diamond. It’s a difficult task that requires the expertise of a tax professional. It’s worthwhile to accumulate wealth over a lifetime. There is a wealth of information online. Tax preparation firms that are reputable, such as TaxSlayer are among the most helpful.

The amount of withholding allowances claimed

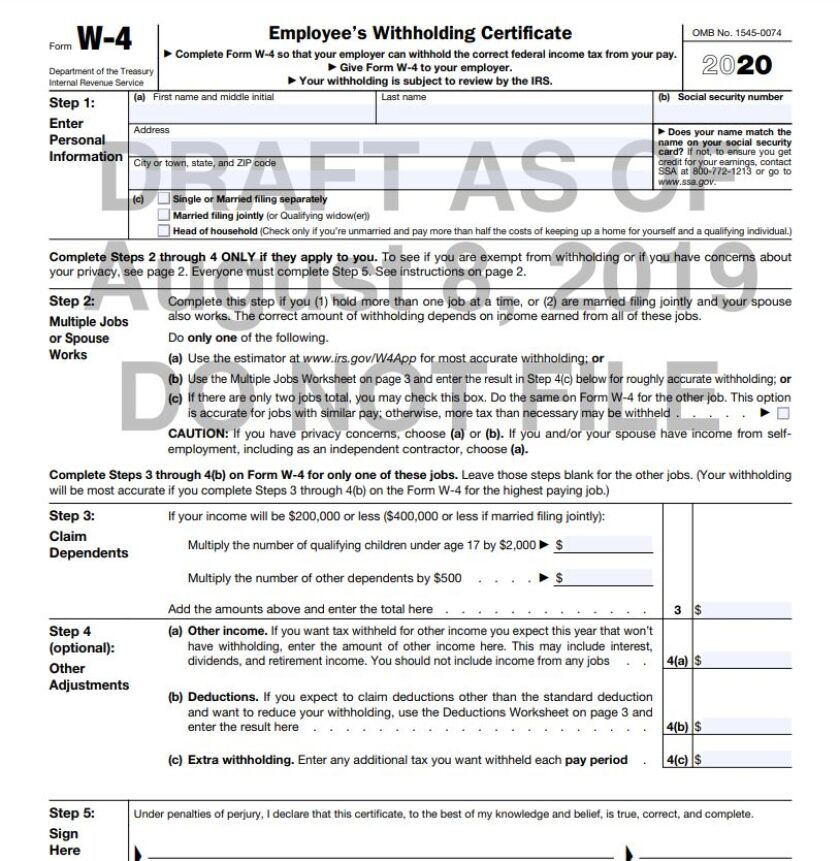

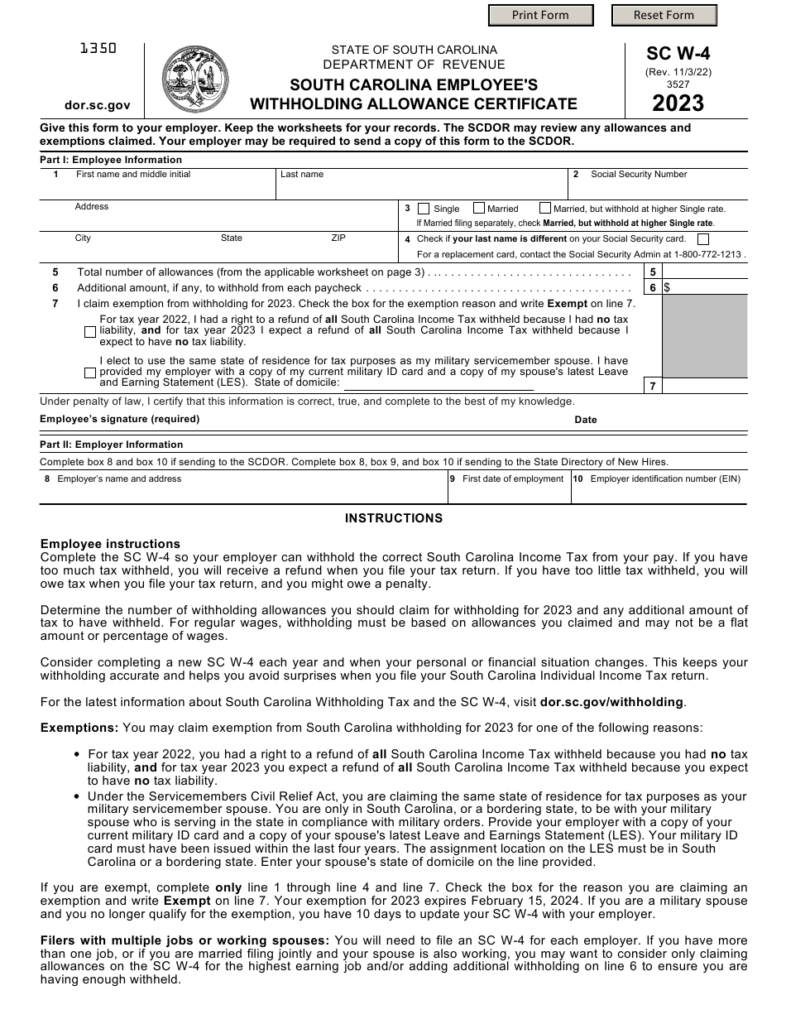

On the Form W-4 that you file, you should specify the amount of withholding allowances you seeking. This is crucial since the withholdings can have an effect on the amount of tax that is deducted from your pay checks.

The amount of allowances that you are entitled to will be determined by a variety of factors. For example If you’re married, you could be qualified for an exemption for your household or head. The amount you earn will determine how many allowances you are eligible for. If you earn a substantial income, you could be eligible to request an increased allowance.

A tax deduction that is appropriate for you could allow you to avoid tax payments. You could actually receive the amount you owe if you submit the annual tax return. However, be cautious about your approach.

Conduct your own research, just like you would with any financial decision. To figure out the amount of tax withholding allowances that need to be claimed, utilize calculators. You can also speak to a specialist.

Filing requirements

Employers must collect withholding taxes from their employees and report it. In the case of a small amount of these taxes, you can submit paperwork to IRS. A tax return for the year, quarterly tax returns or tax withholding reconciliations are just a few types of documents you could require. Here are the details on various tax forms for withholding and the deadlines for each.

It is possible that you will need to file tax returns for withholding for the income you receive from employees, like bonuses or commissions. You may also have to file for salary. If you also pay your employees on-time you may be eligible for reimbursement for any taxes that were taken out of your paycheck. It is important to remember that certain taxes could be considered to be local taxes. In certain situations the rules for withholding can be different.

Electronic filing of withholding forms is mandatory according to IRS regulations. You must include your Federal Employer Identification Number when you submit your national income tax return. If you don’t, you risk facing consequences.