Rmd Taxes Withholding On Tax Form – There are many reasons an individual might decide to fill out forms for withholding. This includes documentation requirements and withholding exemptions. It is important to be aware of these aspects regardless of the reason you decide to fill out a form.

Exemptions from withholding

Non-resident aliens must complete Form 1040-NR once a year. If you meet the criteria, you could be eligible for an exemption to withholding. This page lists all exclusions.

To complete Form 1040-NR, include Form 1042-S. This form is a record of the withholdings that the agency makes. When filling out the form make sure you fill in the correct information. It is possible that you will have to treat a specific individual if you do not provide this information.

The non-resident alien withholding tax is 30%. Exemption from withholding could be possible if you’ve got a the tax burden lower than 30%. There are a variety of exemptions. Certain of them apply to spouses, dependents, or children.

Generally, you are eligible to receive a refund in accordance with chapter 4. Refunds can be claimed according to Sections 1401, 1474 and 1475. The refunds are made to the agent who withholds tax that is the person who collects the tax from the source.

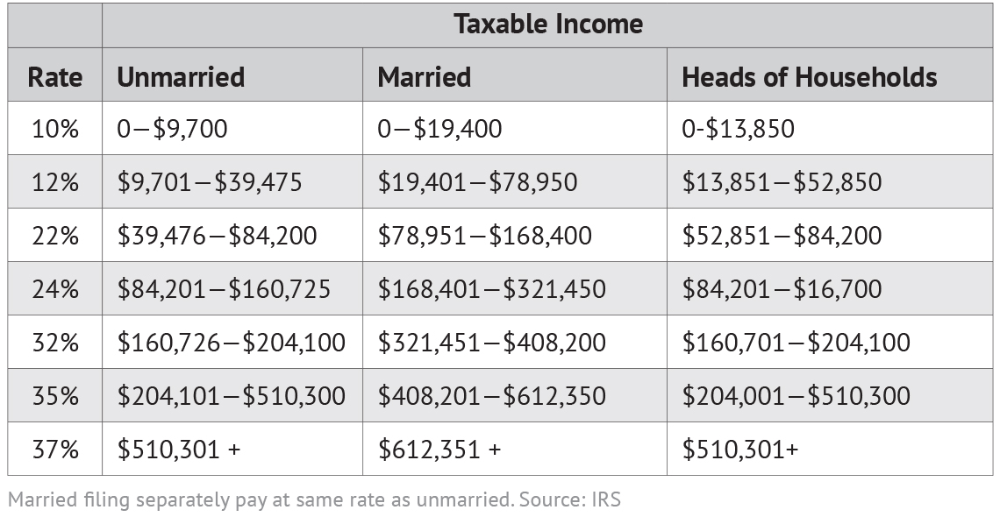

Relational status

A valid marital status withholding will make it easier for you and your spouse to do your work. Additionally, the quantity of money you may deposit at the bank could surprise you. It isn’t easy to choose which of many choices is the most appealing. Be cautious about when you make a decision. There will be a significant cost when you make a bad decision. But, if the directions are followed and you pay attention to the rules, you shouldn’t have any problems. If you’re fortunate you may even meet a few new pals when you travel. Since today is the anniversary of your wedding. I’m sure you’ll be able to use it against them to secure that dream engagement ring. It is best to seek the advice of a certified tax expert to finish it properly. A lifetime of wealth is worth the modest payment. Online information is readily available. TaxSlayer is among the most trusted and reputable tax preparation firms.

The amount of withholding allowances claimed

On the W-4 form you fill out, you need to specify the amount of withholding allowances you requesting. This is crucial since the tax amount taken from your pay will depend on how much you withhold.

Many factors affect the allowances requested.If you’re married for instance, you could be eligible for a head of household exemption. The amount of allowances you are eligible for will be contingent on your income. A larger allowance might be granted if you make an excessive amount.

A tax deduction appropriate for you could aid you in avoiding large tax bills. The possibility of a refund is feasible if you submit your income tax return for the year. But be sure to choose your method carefully.

Similar to any financial decision, you should conduct your homework. Calculators can be utilized to figure out how many allowances for withholding must be claimed. Alternative options include speaking with a specialist.

Filing specifications

Employers must take withholding tax from their employees and report the tax. If you are unable to collect these taxes, you can submit paperwork to IRS. It is possible that you will require additional documentation , like an withholding tax reconciliation or a quarterly tax return. Below are details on the different forms of withholding tax and the deadlines for filing them.

Employees may need you to submit withholding taxes returns in order to receive their salary, bonuses and commissions. If you paid your employees on time, you could be eligible for reimbursement of taxes that you withheld. It is important to note that some of these taxes are taxes imposed by the county, is important. There are also specific withholding methods that can be used in specific situations.

In accordance with IRS regulations Electronic submissions of withholding forms are required. Your Federal Employer identification number should be listed when you point to your tax return for the nation. If you don’t, you risk facing consequences.