Ri Withholding Tax Forms – There are numerous reasons one could fill out a form for withholding. This includes documentation requirements and withholding exemptions. It doesn’t matter what motive someone has to fill out an Application there are some things to remember.

Exemptions from withholding

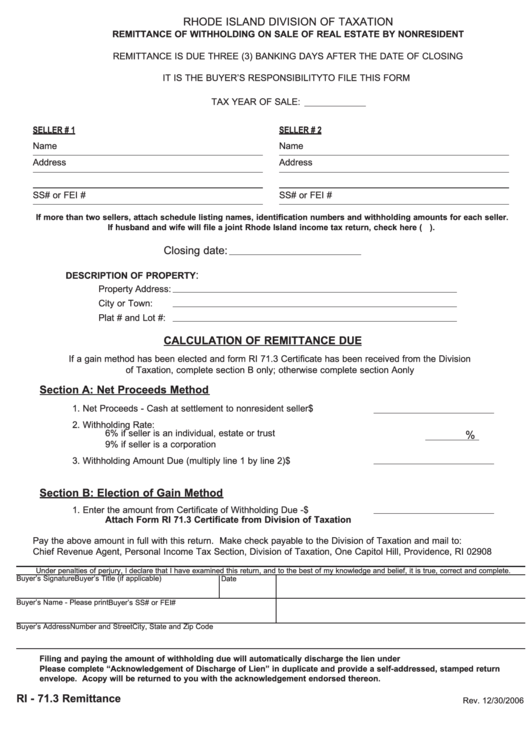

Nonresident aliens need to submit Form 1040–NR at least once per calendar year. If your requirements meet, you may be eligible to apply for an exemption from withholding. This page you will see the exemptions that are available to you.

The first step in submit Form 1040 – NR is attaching the Form 1042 S. The form contains information on the withholding process carried out by the withholding agency for federal tax reporting for tax reporting purposes. Make sure you enter the correct information when filling out this form. This information may not be disclosed and result in one person being treated.

Non-resident aliens have to pay the 30% tax withholding rate. The tax burden of your business is not to exceed 30% to be exempt from withholding. There are many exemptions. Some of them are only available to spouses or dependents like children.

The majority of the time, a refund is accessible for Chapter 4 withholding. Refunds are permitted under Sections 1471-1474. Refunds are given by the withholding agent. The withholding agent is the individual who is responsible for withholding tax at the point of origin.

Status of relationships

The marital withholding form can make your life easier and aid your spouse. The bank might be shocked by the amount you’ve deposited. It isn’t always easy to determine which one of many choices is the most attractive. There are some things you should not do. A bad decision could result in a costly loss. But, if the directions are followed and you pay attention to the rules, you shouldn’t have any problems. If you’re lucky, you might even make a few new pals on your travels. Today is your anniversary. I’m hoping you’re able to use this to get that wedding ring you’ve been looking for. For a successful approach you’ll require the assistance of a certified accountant. This small payment is well worth the lifetime of wealth. You can get a lot of information online. TaxSlayer and other reputable tax preparation companies are some of the top.

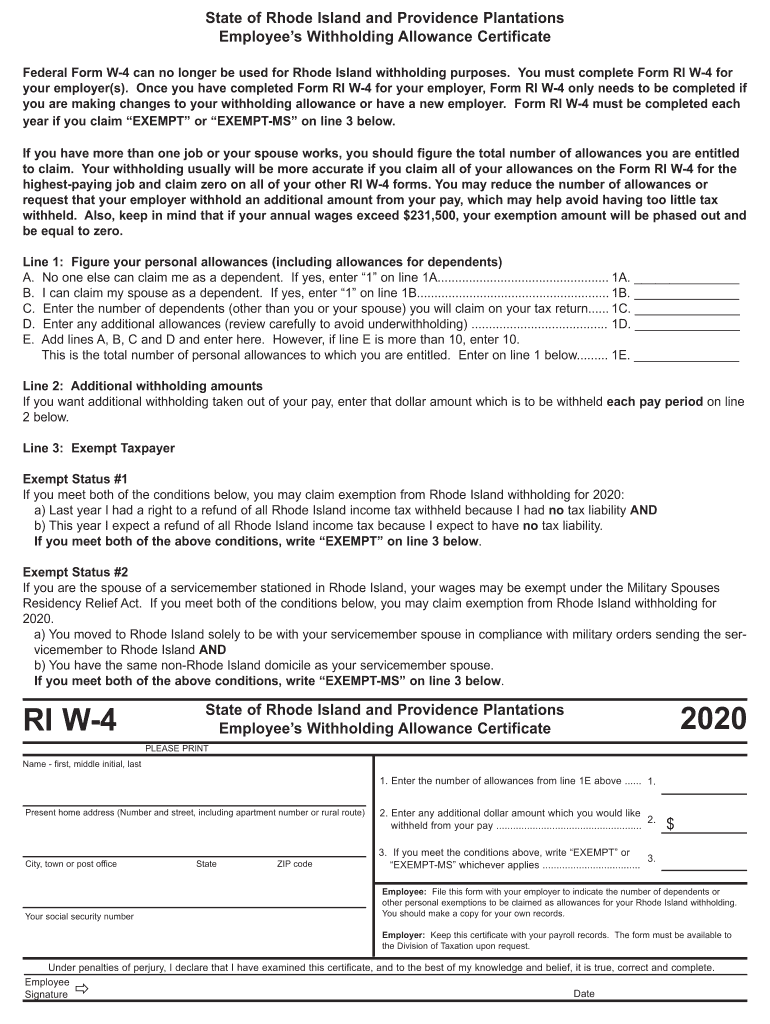

the number of claims for withholding allowances

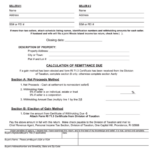

It is important to specify the amount of withholding allowances you would like to claim on the form W-4. This is vital since it will affect how much tax you receive from your wages.

A number of factors can determine the amount that you can claim for allowances. Your income can affect the number of allowances available to you. If you earn a higher income, you may be eligible for an increased allowance.

Choosing the proper amount of tax deductions could help you avoid a hefty tax payment. If you file the annual tax return for income, you may even be qualified for a tax refund. But it is important to choose the right approach.

Just like with any financial decision you make, it is important to research the subject thoroughly. To determine the amount of withholding allowances to be claimed, make use of calculators. An expert might be a viable option.

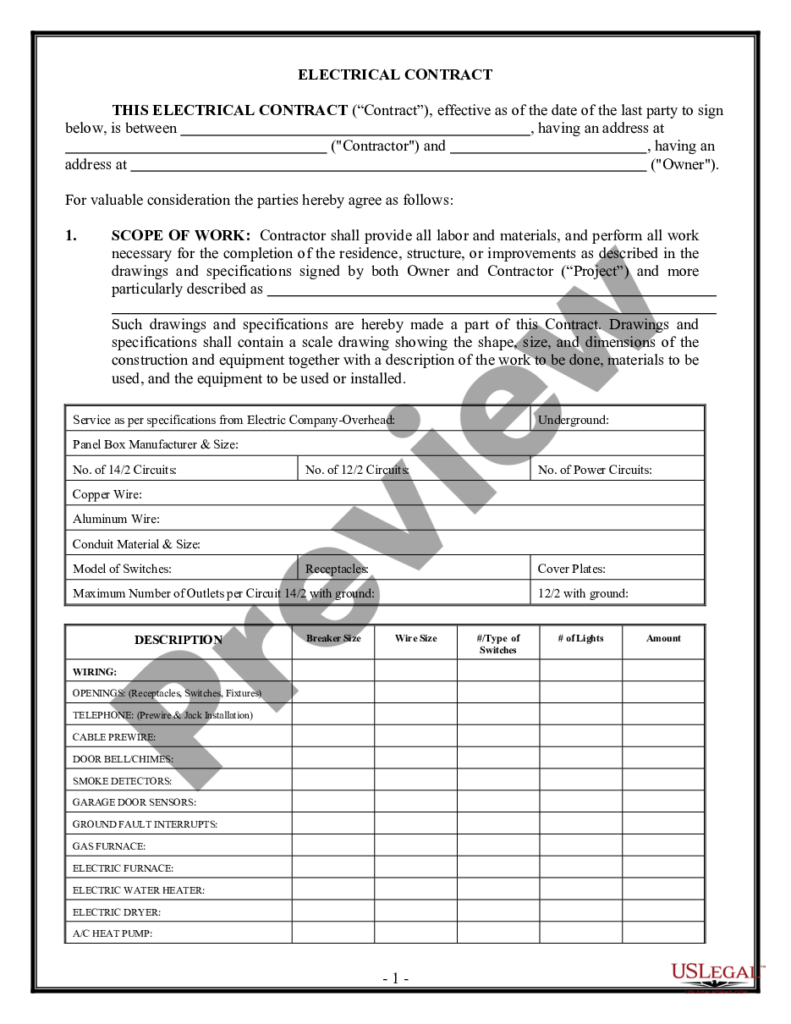

Specifications that must be filed

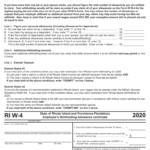

Employers are required to pay withholding taxes to their employees and then report the amount. The IRS will accept documents to pay certain taxes. An annual tax return, quarterly tax returns or withholding tax reconciliation are all kinds of documentation you may need. Here are some details about the various types of tax forms for withholding as well as the filing deadlines.

Your employees may require you to file withholding tax returns to be eligible for their bonuses, salary and commissions. If you make sure that your employees are paid on time, you could be eligible for the reimbursement of taxes withheld. Be aware that some of these taxes could be considered to be local taxes. You may also find unique withholding procedures that can be applied in particular situations.

According to IRS rules, you have to electronically file withholding forms. When you file your tax returns for national revenue ensure that you include the Federal Employee Identification Number. If you don’t, you risk facing consequences.