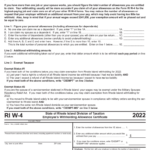

Rhode Island State Tax Withholding Form 2024 – There are a variety of reasons why someone might choose to fill out a tax form. These include document requirements, exclusions from withholding and withholding allowances. It doesn’t matter what reasons someone is deciding to file the Form There are a few aspects to keep in mind.

Exemptions from withholding

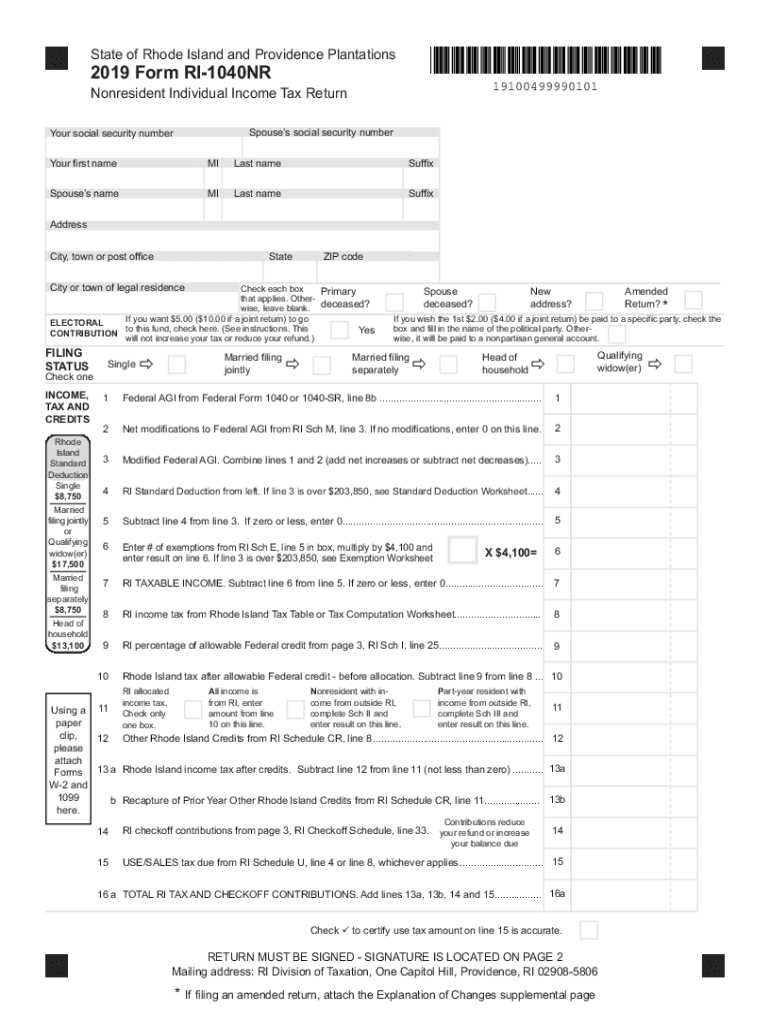

Non-resident aliens are required to submit Form 1040 NR once each year. If you meet the criteria, you could be qualified for exemption from withholding. This page will provide all exclusions.

The first step to filling out Form 1040-NR is to attach Form 1042 S. This form details the withholdings made by the agency. Complete the form in a timely manner. It is possible for a person to be treated if the information isn’t provided.

Non-resident aliens have to pay 30 percent withholding. You could be eligible to get an exemption from withholding tax if your tax burden exceeds 30%. There are numerous exemptions. Certain are only for spouses or dependents, for example, children.

In general, the chapter 4 withholding entitles you to a refund. Refunds are allowed according to Sections 1471-1474. Refunds are to be given by the agents who withhold taxes that is, the person who withholds taxes at source.

Relational status

A marriage certificate and withholding form will help you and your spouse get the most out of your time. Additionally, the quantity of money you can put in the bank will pleasantly surprise you. The challenge is in deciding which of the numerous options to choose. There are certain things you should avoid. Making the wrong decision will result in a significant cost. There’s no problem If you simply follow the directions and pay attention. If you’re lucky you could even meet a few new pals on your travels. Today marks the anniversary of your wedding. I’m hoping you’ll be able to use it against them to search for that one-of-a-kind ring. You’ll want the assistance from a certified tax expert to ensure you’re doing it right. It’s worth it to build wealth over the course of a lifetime. There is a wealth of information online. TaxSlayer is one of the most trusted and reputable tax preparation companies.

There are numerous withholding allowances being made available

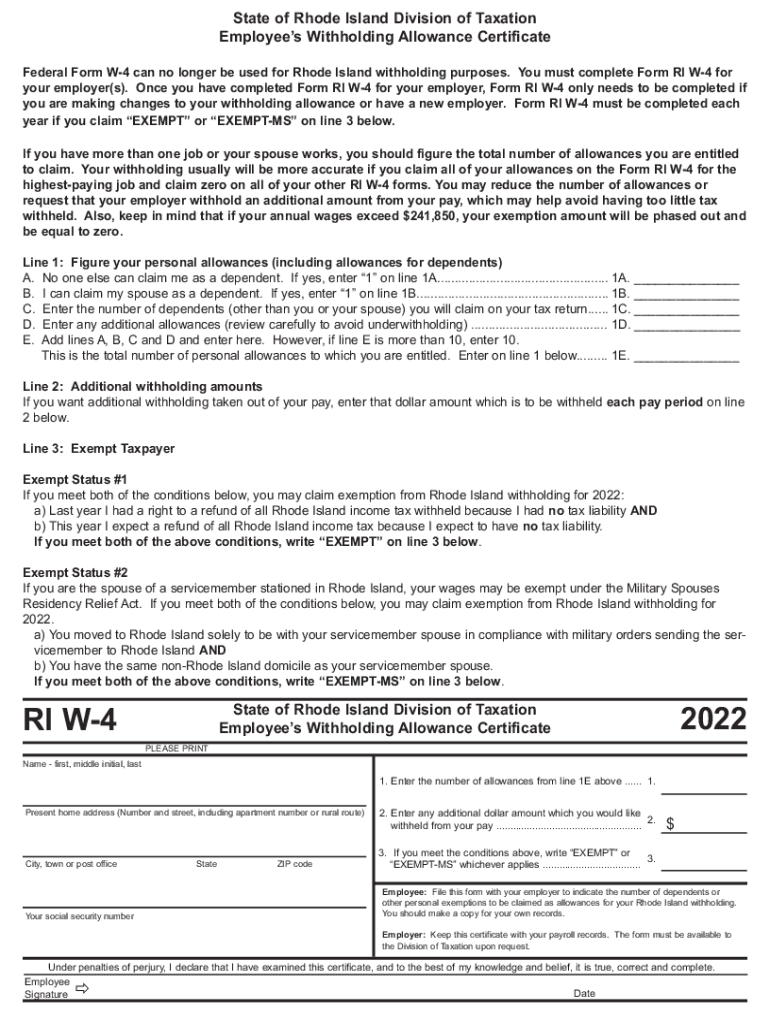

It is essential to state the amount of the withholding allowance you want to claim in the Form W-4. This is crucial since the amount of tax you are able to deduct from your paychecks will depend on how much you withhold.

A variety of factors influence the amount of allowances requested.If you’re married as an example, you might be eligible for an exemption for head of household. The amount you earn can impact how many allowances are accessible to you. If you earn a significant amount of income, you may be eligible for a higher allowance.

The right amount of tax deductions could save you from a large tax bill. A refund could be feasible if you submit your tax return on income for the current year. Be sure to select your approach carefully.

Conduct your own research, just as you would in any other financial decision. Calculators can assist you in determining the amount of withholding that should be claimed. Another option is to talk with a professional.

Formulating specifications

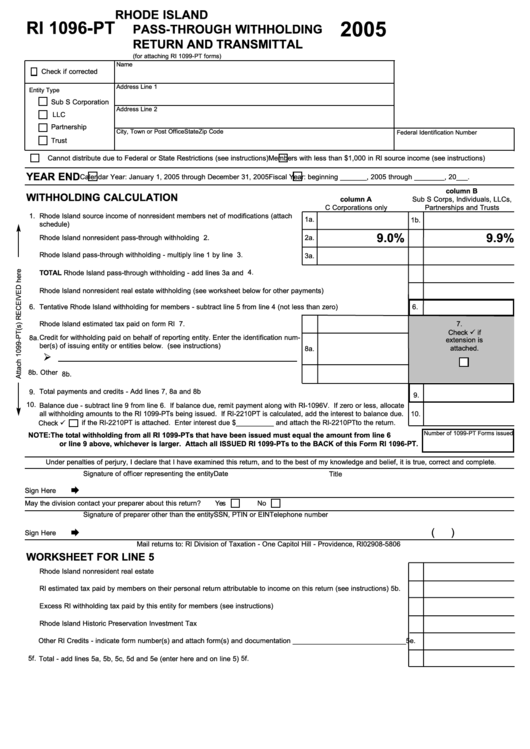

If you’re an employer, you have to be able to collect and report withholding taxes from your employees. You may submit documentation to the IRS for some of these taxes. Other documents you might be required to file include an withholding tax reconciliation, quarterly tax returns, and an annual tax return. Here are some information about the various types of withholding tax forms and the deadlines for filing.

Withholding tax returns may be required for certain incomes such as bonuses, salary, commissions and other income. If you also pay your employees on time, you might be eligible for reimbursement for any taxes not withheld. Be aware that certain taxes are taxes imposed by the county, is crucial. There are also unique withholding rules that can be utilized in certain circumstances.

According to IRS regulations, electronic submissions of withholding forms are required. It is mandatory to include your Federal Employer Identification Number when you point your national income tax return. If you don’t, you risk facing consequences.