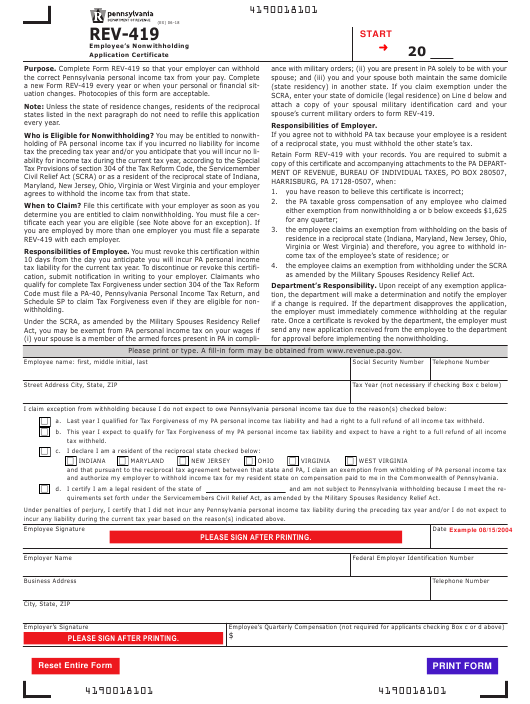

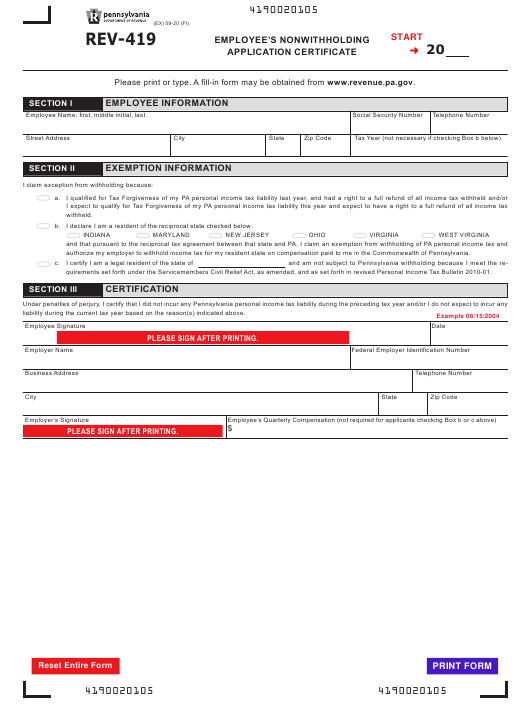

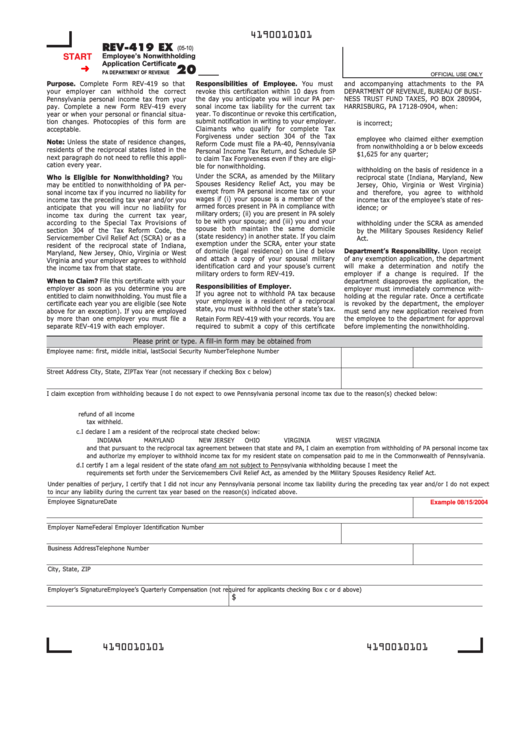

Pennsylvania State Withholding Form Rev 419 – There are a variety of reasons one might decide to fill out a withholding form. This includes the documentation requirements, withholding exclusions and withholding allowances. It doesn’t matter what reasons someone is deciding to file the Form, there are several things to remember.

Withholding exemptions

Non-resident aliens are required to submit Form 1040 NR once each year. However, if you meet the requirements, you might be eligible to submit an exemption from the withholding form. The exemptions listed here are yours.

The first step to submitting Form 1040 – NR is attaching the Form 1042 S. The form contains information on the withholding done by the agency responsible for withholding for federal income tax reporting purposes. Fill out the form correctly. The information you provide may not be disclosed and cause one person to be treated differently.

Nonresident aliens pay a 30% withholding tax. If your tax burden is less than 30% of your withholding, you may qualify to receive an exemption from withholding. There are many exemptions. Some are specifically for spouses, or dependents, for example, children.

Generallyspeaking, withholding in Chapter 4 entitles you for an amount of money back. Refunds can be made according to Sections 1400 through 1474. Refunds will be made to the tax agent withholding, the person who withholds the tax from the source.

Status of the relationship

A valid marital status withholding can make it simpler for both of you to do your work. In addition, the amount of money that you can deposit in the bank will pleasantly be awestruck. The challenge is picking the right bank from the multitude of options. Certain things are best avoided. Unwise decisions could lead to costly consequences. But if you follow it and follow the directions, you shouldn’t have any issues. If you’re lucky, you may make new acquaintances on your trip. Today marks the anniversary. I’m hoping you’ll use it against them in order to get the elusive diamond. It’s a difficult task that requires the expertise of an expert in taxation. A modest amount of money can make a lifetime of wealth. There is a wealth of details online. TaxSlayer is a trusted tax preparation firm.

There are a lot of withholding allowances being claimed

It is important to specify the number of withholding allowances you want to claim on the form W-4 you fill out. This is critical because your pay will be affected by the amount of tax that you pay.

There are many variables which affect the amount of allowances that you can request. If you’re married you might be qualified for an exemption for head of household. The amount you earn can determine the amount of allowances accessible to you. If you have a high income, you could be eligible to request an increased allowance.

You may be able to reduce the amount of your tax bill by deciding on the appropriate amount of tax deductions. The possibility of a refund is possible if you submit your tax return on income for the year. But, you should be cautious about your approach.

Conduct your own research, just like you would with any other financial decision. Calculators can be utilized to figure out how many withholding allowances you should claim. You can also speak to a specialist.

Specifications to be filed

Employers must report any withholding taxes that are being paid by employees. The IRS will accept documents to pay certain taxes. You might also need additional documentation such as an withholding tax reconciliation or a quarterly tax return. Here is more information on the various forms of withholding tax and the deadlines for filing them.

In order to be eligible to receive reimbursement for tax withholding on compensation, bonuses, salary or other income received from your employees, you may need to file a tax return for withholding. If your employees receive their wages punctually, you might be eligible for tax refunds for withheld taxes. It is crucial to remember that some of these taxes are local taxes. There are also unique withholding methods which can be utilized in specific situations.

According to IRS regulations the IRS regulations, electronic filing of forms for withholding are required. Your Federal Employer Identification Number must be listed on your national revenue tax return. If you don’t, you risk facing consequences.